Master Chicago Sales Tax with Easy Calculator

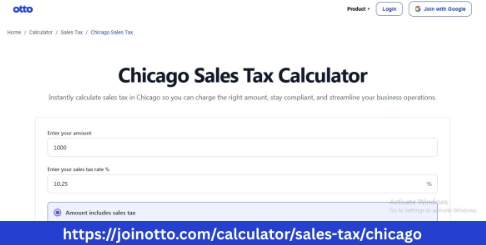

Running a business in Chicago comes with its fair share of responsibilities, and one of the most important is managing sales tax. A reliable tool that simplifies this process is the Chicago Sales Tax Calculator. This tool allows business owners, retailers, and self-employed entrepreneurs to calculate the exact amount of sales tax to charge their customers. With multiple tax components and periodic changes in rates, using a calculator ensures accuracy and compliance.

Chicago sales tax is made up of several layers, including the state tax, city tax, and other applicable local taxes. Calculating the total manually can be confusing, especially for new business owners. A Chicago Sales Tax Calculator helps by automatically combining all relevant taxes, giving a clear and accurate result. This eliminates the risk of errors and saves valuable time.

Accuracy is one of the main advantages of using a sales tax calculator. Errors in tax collection can lead to penalties, interest, and complications with tax authorities. By entering your sales amount and selecting the location, the calculator provides the exact tax owed. This ensures that your business remains compliant and reduces stress during tax season.

For small businesses, understanding the breakdown of taxes is essential. Sales Tax Chicago includes the Illinois state tax of 6.25%, the Chicago city tax of 1.25%, and other possible district taxes. Knowing these details helps you maintain transparency with customers and manage your financial records efficiently. The Sales Tax Calculator Chicago streamlines this process, so you do not have to manually research or memorize tax rates.

Beyond compliance, using a calculator helps with pricing and planning. Including sales tax in product prices allows you to present a final cost to customers without confusion. It also helps you evaluate how taxes affect revenue, which is crucial for budgeting and strategic decisions. The Chicago Sales Tax Calculator ensures you can make these decisions confidently.

Many entrepreneurs face the challenge of administrative tasks related to tax filing. Proper reporting, record-keeping, and timely submission are critical to avoid fines. A sales tax calculator supports this process by giving accurate figures to report, reducing the likelihood of mistakes and saving time during filing periods.

Sales tax rates in Chicago can change due to legislative updates or adjustments in special districts. Staying up-to-date is essential for compliance. Tools like the Chicago Sales Tax Calculator are updated regularly to reflect current rates. This is particularly useful for businesses selling in multiple Chicago locations or online, where tax obligations may vary.

Ease of use is another benefit. You do not need an accounting degree to use a sales tax calculator effectively. By entering basic details like product price and location, you can quickly calculate the correct tax. This accessibility makes it suitable for small shops, online stores, or service-based businesses where sales tax applies.

Regular use of a Sales Tax Calculator Chicago also helps business owners understand how taxes work. Over time, entrepreneurs gain knowledge about the different tax components, which supports better financial planning, forecasting, and decision-making. This understanding can reduce confusion and help anticipate the impact of future tax changes.

Many businesses integrate sales tax calculators with accounting or point-of-sale systems. This integration ensures that sales tax is automatically applied to invoices, receipts, and reports, further simplifying operations. Tools like Otto AI can help integrate tax calculations into business workflows, streamlining processes and maintaining accuracy without extra effort.

A Chicago Sales Tax Calculator is versatile, supporting single transactions and bulk sales. Whether calculating tax for one item or hundreds, the calculator provides accurate results, making it suitable for businesses of all sizes. This flexibility ensures consistent tax management regardless of transaction volume.

Using a calculator also prevents mistakes in charging customers. Overcharging can upset customers, while undercharging may lead to lost revenue or legal complications. A trusted tool ensures accurate tax collection, protecting your business reputation and helping maintain customer trust.

In conclusion, the Chicago Sales Tax Calculator is an essential tool for any business in the city. It simplifies calculations, ensures accuracy, and saves time, allowing entrepreneurs to focus on growing their business. Understanding Sales Tax Chicago and leveraging tools like Otto AI makes it easier to manage tax obligations efficiently. Incorporating a sales tax calculator into daily operations is a smart step for smooth financial management and compliance in Chicago’s dynamic business environment.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness