Effortless Idaho Sales Tax Calculation with Otto AI

Calculating sales tax accurately is essential for any business operating in Idaho. Mistakes can lead to penalties, frustrated customers, and extra administrative work. An Idaho Sales Tax Calculator can simplify this task by helping entrepreneurs determine the exact amount of tax to charge on each transaction. Using such a tool can save time, reduce errors, and make managing your business finances much smoother.

Idaho Sales Tax applies to most goods and services sold within the state, with a general rate of 6%. Some local areas may impose additional taxes, making it important to stay updated on the rates that apply to your specific location. A Sales Tax Calculator Idaho makes this process straightforward by calculating the total tax automatically, including both state and local rates where applicable.

One of the main advantages of using a calculator is accuracy. Manual calculations often lead to mistakes, especially when local taxes vary or exemptions apply. Undercharging customers can hurt your business, while overcharging can lead to complaints and lost trust. An Idaho Sales Tax Calculator ensures that the correct tax is applied every time, reducing stress and improving efficiency.

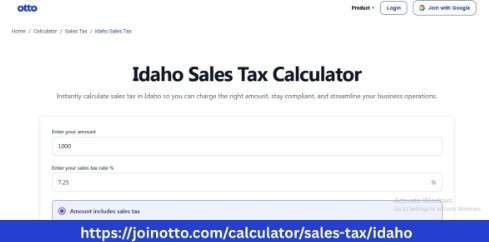

Small business owners and self-employed entrepreneurs often handle many aspects of their business on their own. Spending hours calculating sales tax manually can take time away from core business activities like marketing, customer service, or product development. By using Otto AI’s Idaho Sales Tax Calculator, you can streamline your workflow and focus on growing your business while maintaining accurate tax compliance.

Understanding what Idaho Sales Tax covers is also important. Tax generally applies to tangible personal property and some services, while certain items like groceries, prescription medications, and medical supplies may be exempt. Using a Sales Tax Calculator Idaho helps you apply these rules correctly, ensuring that only taxable items are charged. Otto AI’s calculator is designed to take these exemptions into account, reducing the chances of errors.

Idaho businesses must also consider filing frequency. Depending on your sales volume, you may need to report sales tax monthly, quarterly, or annually. Keeping accurate records of collected taxes is crucial to avoid late fees and penalties. A reliable sales tax calculator makes it easier to track taxes collected, simplifying the filing process and keeping your records organized.

Staying compliant with changing tax regulations can be challenging. Tax rates and rules can change, and keeping up with updates is essential. A Sales Tax Calculator Idaho ensures that you always use current rates for your calculations. Otto AI’s tools are regularly updated to reflect the latest changes in Idaho Sales Tax, helping you maintain compliance effortlessly.

Pricing decisions can also benefit from an accurate sales tax calculation. Knowing the exact tax amount to include in the final price helps you set competitive prices while protecting your profit margins. Using an Idaho Sales Tax Calculator allows you to plan effectively and ensures that your pricing covers taxes appropriately.

Many businesses also integrate sales tax calculators into their invoicing systems. Modern accounting software often allows automatic calculation of taxes for each invoice. Otto AI’s calculator can be used alongside these systems to verify accuracy, ensuring that your customers are charged the correct amount and that your financial records remain precise.

For e-commerce businesses, charging sales tax correctly is especially critical. Online businesses must collect Idaho Sales Tax for orders shipped to customers within the state. A Sales Tax Calculator Idaho simplifies this process by calculating the correct tax based on the shipping location, reducing the risk of compliance issues and making online operations more efficient.

Some business owners may attempt to calculate sales tax manually, but the risk of error is high. Mistakes can result in audits, penalties, and extra administrative work. Using a dedicated Idaho Sales Tax Calculator eliminates this risk by automating complex calculations, including state and local taxes. This makes it a valuable tool for any entrepreneur seeking accuracy and efficiency.

In addition to improving compliance, an Idaho Sales Tax Calculator enhances overall business operations. It allows business owners to focus on customer satisfaction, product quality, and growth rather than worrying about calculations and filing. Otto AI’s calculator provides a reliable, easy-to-use solution for managing sales tax, saving both time and effort.

In summary, managing Idaho Sales Tax does not need to be complicated. The Idaho Sales Tax Calculator simplifies the process by providing accurate calculations, accounting for exemptions, and keeping up with changing rates. Small business owners and self-employed entrepreneurs can benefit significantly by using Otto AI’s tools to ensure their tax obligations are met efficiently.

Using a Sales Tax Calculator Idaho improves accuracy, saves time, and supports better decision-making. From determining the correct tax for each sale to simplifying filing and record-keeping, it is an indispensable resource for businesses of all sizes. Incorporating Otto AI’s Idaho Sales Tax Calculator into your workflow can reduce stress, minimize errors, and help your business run smoothly.

In conclusion, the Idaho Sales Tax Calculator is an essential tool for business owners looking for simplicity and reliability. By automating calculations, accounting for exemptions, and staying updated with current rates, this tool ensures accurate tax management. Otto AI provides a user-friendly solution that supports small business and self-employed entrepreneurs in Idaho. Using the Idaho Sales Tax Calculator allows you to focus on growing your business while ensuring compliance and efficiency in your operations.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness