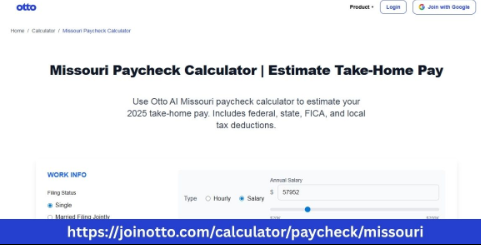

Missouri Paycheck Calculator for Accurate Take-Home Pay

Understanding your paycheck is important whether you are running your own business, working for someone else, or managing employees. A Missouri paycheck calculator helps you figure out how much of your earnings you will actually take home after taxes and other deductions. For many small business owners and self-employed professionals, knowing this amount in advance makes budgeting and planning much easier.

A Missouri paycheck calculator can give you a clear picture of your finances before payday. It takes into account state taxes, federal taxes, Social Security, Medicare, and sometimes additional deductions like retirement contributions or health insurance premiums. With the right calculator, you can quickly see the difference between your gross pay and your net pay.

Why Understanding Take-Home Pay Matters

Your gross pay is the total amount you earn before any deductions. Your net pay, or take-home pay, is what you actually receive after all required deductions. Knowing your net pay helps you:

-

Plan your monthly budget

-

Save for taxes if you are self-employed

-

Make decisions about benefits and contributions

-

Prepare for changes in income

If you are an employer, it is equally important to know how much your employees will take home. This transparency helps build trust and makes payroll discussions easier.

What a Missouri Paycheck Calculator Does

A Missouri paycheck calculator is designed to calculate take home pay Missouri workers can expect. It factors in both state and federal tax rules specific to Missouri. This includes:

-

Missouri state income tax rates

-

Federal income tax withholding

-

Social Security contributions

-

Medicare contributions

-

Optional deductions such as retirement or health plans

By entering details like your gross pay, pay frequency, filing status, and any pre-tax or post-tax deductions, the calculator provides an estimated net pay.

Missouri State Income Tax

Missouri uses a progressive income tax system, which means the tax rate increases as your income goes up. The rate ranges from low percentages for smaller incomes to higher rates for larger incomes. The Missouri paycheck calculator automatically applies the correct rate based on your earnings.

In addition to income tax, local taxes may apply depending on your city or county. While not all areas have local income taxes, it’s important to check if they apply to your situation.

Federal Taxes and Withholding

Every paycheck in Missouri also includes federal taxes. These are determined by the IRS and are based on your filing status, number of dependents, and income level. The main components are:

-

Federal Income Tax – Withholding based on IRS tax tables

-

Social Security Tax – A percentage of your wages up to a set limit

-

Medicare Tax – A smaller percentage of all your wages, with no limit

The Missouri paycheck calculator takes these into account automatically so you can see the full impact of federal taxes.

Pre-Tax and Post-Tax Deductions

Your take-home pay is also affected by any deductions you choose or are required to make. Pre-tax deductions, like retirement plan contributions or certain health insurance premiums, reduce your taxable income before taxes are calculated. This can lower the amount of taxes you pay.

Post-tax deductions happen after taxes are calculated. Examples include certain insurance premiums, wage garnishments, or charitable contributions. The calculator can factor these in if you provide the amounts.

Benefits for Self-Employed and Small Business Owners

If you are self-employed, calculating your own paycheck may seem unnecessary because you pay yourself from your business earnings. However, using a Missouri paycheck calculator can help you estimate the correct amount to set aside for taxes. This prevents surprises at tax time.

Small business owners can also use it to prepare accurate payroll for employees. This helps avoid under-withholding or over-withholding taxes, which can cause financial strain later.

Otto AI, for example, integrates payroll planning tools that can complement a Missouri paycheck calculator. By combining automation with accurate tax calculations, you can save time and reduce payroll errors.

Steps to Use a Missouri Paycheck Calculator

Using the tool is simple and can be done in minutes:

-

Enter your gross pay (annual or per pay period).

-

Select your pay frequency (weekly, bi-weekly, monthly).

-

Choose your filing status and number of allowances or dependents.

-

Add any pre-tax and post-tax deductions.

-

Let the calculator compute your estimated take-home pay.

Once you have the results, you can adjust your withholding or deductions to better match your financial goals.

Common Situations Where It Helps

Budget Planning – Knowing exactly how much will be in your bank account after payday makes it easier to plan for bills, savings, and expenses.

Job Offers – If you are considering a new job, using the Missouri paycheck calculator helps you compare offers based on net pay instead of just gross salary.

Tax Season Preparation – By tracking your net pay throughout the year, you can avoid under-paying or over-paying taxes.

Side Income Estimates – Freelancers and gig workers can use the calculator to estimate take-home pay from additional income sources.

Adjusting for Life Changes

Major life events can change your take-home pay. Marriage, having children, buying a home, or changing jobs all affect your tax situation. The Missouri paycheck calculator lets you test different scenarios so you can see how these changes impact your net pay.

This is also useful if you decide to increase retirement contributions, enroll in a new health plan, or take advantage of other workplace benefits.

Tips for Accurate Results

While the Missouri paycheck calculator gives good estimates, the accuracy depends on the details you provide. To get the best results:

-

Use your actual gross pay from your pay stub or contract.

-

Include all deductions accurately.

-

Update the information if your income or deductions change.

-

Check the calculator regularly to reflect the most recent tax rates.

Planning Ahead with Paycheck Estimates

When you know your take-home pay in advance, you can make better decisions about saving, spending, and investing. It reduces the risk of running short before your next paycheck and allows you to build a more stable financial plan.

Whether you are an employee, a small business owner, or self-employed, the Missouri paycheck calculator is a simple tool that can make a big difference in how you manage money.

Conclusion

A Missouri paycheck calculator is one of the easiest ways to calculate take home pay Missouri residents can expect. It accounts for state taxes, federal taxes, and other deductions to show a clear estimate of your net pay. For small business owners, employees, and the self-employed, it’s a valuable tool for budgeting, tax planning, and financial decision-making. By using a trusted platform like Otto AI alongside your paycheck calculations, you can simplify payroll and keep your finances on track.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness