Track Earnings with New Hampshire Paycheck Calculator

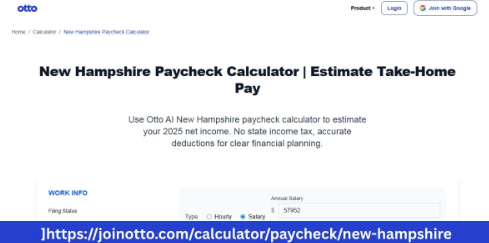

Understanding your paycheck is a crucial step toward financial stability. For residents of New Hampshire, the New Hampshire Paycheck Calculator provides an easy way to see exactly how much money you will take home after deductions. By using this tool, you can gain clarity on your earnings, plan your budget efficiently, and make informed financial decisions. Otto AI has developed resources to make calculating your income simple, accurate, and stress-free.

The New Hampshire Paycheck Calculator focuses on helping you determine your net pay, which is the money left after deductions. Your gross pay shows the total amount you earn, but the deductions for taxes, Social Security, Medicare, and benefits reduce this number. By entering your income and deduction details into the calculator, you can quickly find out your take-home pay. This knowledge is essential for budgeting, saving, and planning day-to-day expenses.

Using a paycheck calculator in New Hampshire provides transparency that is especially useful for small business owners and self-employed entrepreneurs. Managing finances can be challenging when income varies or when deductions are not fully understood. The calculator allows you to input all relevant information and see exactly how each deduction affects your net pay. This helps avoid confusion, ensures accurate planning, and prevents financial surprises.

The calculator is flexible and allows you to test different scenarios. For instance, if you expect a raise, bonus, or change in benefits, the tool can show how these adjustments will impact your take-home pay. Entrepreneurs and freelancers often deal with fluctuating incomes, and being able to forecast paychecks accurately is vital for managing both personal and business finances. This foresight helps in making timely decisions about spending, saving, and investing.

Deductions play a significant role in calculating net pay. Federal taxes are based on your income bracket, filing status, and allowances. Social Security and Medicare taxes are also deducted automatically. If you contribute to retirement accounts or participate in health insurance plans, those deductions are included too. Using the New Hampshire Paycheck Calculator gives you a clear breakdown of all these factors, helping you understand where your money is going.

Self-employed individuals face additional complexity because they are responsible for both employee and employer portions of Social Security and Medicare taxes. The New Hampshire Paycheck Calculator simplifies these calculations, providing an accurate estimate of net income after taxes. This information is valuable for managing quarterly tax payments, planning business expenses, and avoiding surprises during tax season.

Planning for life changes is another advantage of using a paycheck calculator. Major life events such as marriage, having children, or changing healthcare coverage can affect your deductions and take-home pay. By inputting these changes into the calculator, you can understand their financial impact and adjust your budget accordingly. This proactive approach helps maintain financial stability and reduces stress.

Otto AI makes using the New Hampshire Paycheck Calculator easy. Its intuitive interface guides you step by step, allowing you to enter your gross income, filing status, and other relevant details. Within seconds, the calculator provides an accurate estimate of your net pay. Its simplicity ensures that anyone can use it, even without prior experience with financial tools.

Budgeting becomes much easier once you know your net pay. With the results from the paycheck calculator, you can allocate money for bills, savings, and other expenses. Entrepreneurs and freelancers benefit from knowing their exact income, as it helps separate personal and business finances. Understanding your net pay allows you to make informed decisions about spending, saving, and planning for emergencies.

The paycheck calculator is also a powerful tool for long-term financial planning. Whether you are saving for a major purchase, planning a vacation, or preparing for retirement, knowing your take-home pay is the foundation for setting realistic goals. By regularly using the calculator, you can monitor changes in your income, evaluate the effects of deductions, and adjust your strategies accordingly. This consistency ensures better control over your finances.

The calculator can handle various payment scenarios, including overtime, commissions, and bonuses. This ensures that your estimates remain accurate even when your income fluctuates. Small business owners and self-employed professionals benefit from this functionality, as it provides a reliable picture of earnings regardless of variability in pay.

Another benefit is that the calculator supports better tax planning. By knowing your net pay, you can estimate federal tax liabilities and plan for quarterly payments if necessary. Adjusting your withholdings based on accurate calculations helps you avoid overpaying or underpaying taxes. This awareness empowers you to manage finances more effectively and prevents end-of-year surprises.

Using a paycheck calculator also promotes financial literacy. Many people do not fully understand how deductions impact their income. By exploring your paycheck in detail, you learn about taxes, benefits, and contributions. For self-employed entrepreneurs, this knowledge is crucial for managing both personal and business finances and ensuring long-term stability.

Even if your income is consistent, the New Hampshire Paycheck Calculator serves as a helpful reference. Comparing your estimates with actual deposits ensures that deductions are applied correctly. Monitoring your paycheck regularly can help identify errors early and safeguard your income, giving you confidence in your financial planning.

In conclusion, the New Hampshire Paycheck Calculator is an essential tool for anyone who wants clarity about their income. It provides a clear estimate of net pay, helps with budgeting and tax planning, and supports informed financial decisions. Whether you are an employee, self-employed, or running a small business, using this tool allows you to manage your finances effectively. Otto AI ensures that accessing and using the calculator is simple and reliable, making it easier than ever to calculate take-home pay in New Hampshire. With this knowledge, you can budget wisely, save strategically, and plan for a financially secure future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness