New Jersey Paycheck Calculator Guide for Accurate Pay

Understanding your paycheck is an essential part of managing your finances, whether you are an employee, freelancer, or entrepreneur. The New Jersey Paycheck Calculator is a valuable tool that can help you estimate your take-home pay accurately. With taxes, deductions, and benefits often making paychecks confusing, using a reliable calculator ensures you have a clear picture of your earnings.

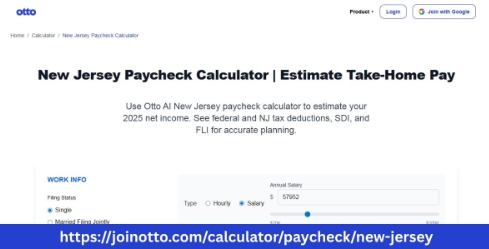

The New Jersey Paycheck Calculator allows you to calculate your net pay based on your gross income, filing status, and other relevant factors. Net pay, also known as take-home pay, is the amount you receive after all deductions are subtracted from your total earnings. By entering your salary or hourly wage into the calculator, you can quickly determine what to expect in your paycheck.

One of the major components affecting your paycheck is taxes. New Jersey imposes state income tax, Social Security, and Medicare deductions. Additionally, depending on your city or municipality, there may be local taxes that further reduce your take-home pay. The calculator takes all these factors into account, providing a realistic estimate. For small business owners and self-employed individuals, understanding these deductions is critical for budgeting and planning purposes.

Deductions are not limited to taxes alone. Many employees and contractors may have other deductions, such as retirement contributions, health insurance premiums, or other benefits. The New Jersey Paycheck Calculator can accommodate these entries, giving you a more accurate representation of what will actually appear in your bank account. Knowing your net income helps you make informed financial decisions, such as saving for emergencies, investing, or planning major expenses.

Using a paycheck calculator in New Jersey is straightforward. Start by entering your gross pay, which is the total amount earned before any deductions. Then select your pay frequency—weekly, biweekly, or monthly. Next, input your filing status and any additional information about exemptions or allowances. The calculator will process this data and display your estimated net pay. Some calculators, like those offered by Otto AI, also provide a breakdown of deductions, making it easier to see where your money goes.

Understanding your paycheck is particularly useful for freelancers and self-employed individuals. Unlike traditional employees, self-employed workers are responsible for paying their own taxes, including federal, state, and self-employment taxes. The New Jersey Paycheck Calculator can help you estimate the portion of your income that will go toward these obligations. This allows you to set aside the correct amount of money each month, avoiding surprises during tax season.

Another benefit of using a paycheck calculator is comparing different income scenarios. For example, if you are considering a new job or a raise, you can input the new salary into the calculator to see how much you will take home after taxes and deductions. This helps in evaluating the true financial benefit of a change in your compensation. It also helps small business owners understand the cost of hiring employees, factoring in payroll taxes and other contributions.

In addition to regular paychecks, the calculator can assist in planning for bonuses or overtime pay. By inputting additional income into the system, you can see how taxes and deductions affect these earnings. This feature is especially helpful in New Jersey, where tax rates and deductions can vary based on total income. Having this information ensures you are not caught off guard when extra payments are added to your paycheck.

Calculating take-home pay is not just about understanding deductions—it also helps with budgeting and financial planning. When you know exactly how much money will be available each month, you can allocate funds more efficiently. Expenses like rent, utilities, groceries, and savings can be planned with confidence. The New Jersey Paycheck Calculator provides this clarity, making financial management simpler and more effective.

For small business owners, using a paycheck calculator can also improve employee satisfaction. When employees understand how their pay is calculated and receive accurate estimates, it reduces confusion and builds trust. It also ensures that payroll is processed correctly, avoiding errors that can lead to frustration or legal issues. Otto AI provides tools that make payroll calculations faster and more accurate, benefiting both employers and employees alike.

Many online calculators, including the New Jersey Paycheck Calculator, are regularly updated to reflect current tax rates and laws. This is important because tax regulations change over time, affecting deductions and net pay. By using an updated calculator, you can be confident that your estimates are accurate and compliant with the latest rules. This is especially important for self-employed entrepreneurs who must navigate both federal and state requirements.

While calculators provide excellent estimates, it is also important to review your pay stubs regularly. Pay stubs show the actual amounts deducted from your salary and any contributions made to benefits or retirement accounts. Comparing these figures to the estimates from the New Jersey Paycheck Calculator helps identify any discrepancies and ensures that your payroll is accurate. Regular monitoring of your pay also supports better financial decision-making.

In addition to taxes and deductions, other factors can influence your take-home pay. Changes in filing status, additional exemptions, or changes in benefits can all affect the net amount. Using a paycheck calculator allows you to simulate different scenarios, giving you a clear understanding of how these changes impact your income. This flexibility makes the New Jersey Paycheck Calculator a valuable tool for ongoing financial planning.

Small business owners can also benefit from understanding payroll expenses through a calculator. Knowing how much of each paycheck goes to taxes and benefits helps in budgeting for business operations. It also allows you to plan for growth, hire new employees, or adjust compensation packages effectively. Using reliable tools like Otto AI for payroll calculations simplifies these processes and reduces the risk of errors.

In conclusion, the New Jersey Paycheck Calculator is an essential tool for anyone looking to calculate take-home pay in New Jersey. It provides clarity on taxes, deductions, and net income, making financial planning more manageable. Whether you are an employee, freelancer, or small business owner, understanding your paycheck helps you make informed decisions about budgeting, saving, and investing. By using tools like Otto AI, you can ensure accurate payroll calculations and gain a better understanding of your earnings, ultimately leading to improved financial stability and confidence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness