Pennsylvania Paycheck Calculator for Accurate Paychecks

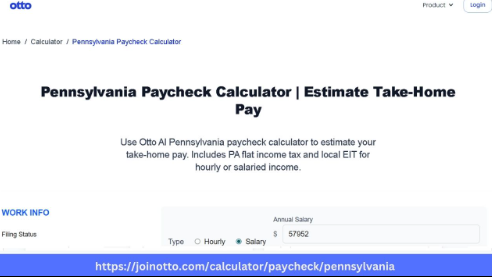

Calculating your paycheck in Pennsylvania can be a challenging task if you are unsure about taxes, deductions, and other withholdings. A Pennsylvania Paycheck Calculator is a useful tool that simplifies this process and ensures that you know exactly what your take-home pay will be. Whether you are a small business owner managing your own payroll or a self-employed entrepreneur figuring out your earnings, understanding paycheck calculations can save time, reduce errors, and give you a clear picture of your finances.

In Pennsylvania, paycheck calculations are affected by multiple factors, including federal taxes, state taxes, local taxes, Social Security, and Medicare contributions. Each of these deductions impacts your net income, so it is important to have a reliable method for estimating your take-home pay. Using a Pennsylvania Paycheck Calculator allows you to input your salary, hourly wage, or annual income and automatically calculate the deductions according to state and federal guidelines.

One of the key elements of calculating your paycheck in Pennsylvania is understanding the difference between gross pay and net pay. Gross pay refers to your total earnings before any deductions, including regular wages, overtime, bonuses, and commissions. Net pay, on the other hand, is the amount you receive after all taxes and deductions have been subtracted. This is the figure that goes directly into your bank account and represents the money you can spend or save. Using a paycheck calculator Pennsylvania residents trust can provide an accurate estimate of this amount in just a few clicks.

Federal taxes are a significant part of paycheck deductions. These include income tax, Social Security tax, and Medicare tax. The amount withheld depends on your income level, filing status, and any allowances you have claimed on your W-4 form. Social Security tax is calculated at a flat rate for most employees, while Medicare has a fixed percentage that applies to all earnings. A Pennsylvania Paycheck Calculator automatically factors in these federal deductions, ensuring that your calculations are precise and up-to-date with current tax laws.

State taxes are also an important consideration. Pennsylvania has a flat state income tax rate that applies to most residents, and it is deducted directly from your paycheck. Additionally, many municipalities in Pennsylvania have local taxes that are withheld from your earnings. The exact rate varies depending on where you live, and failing to account for these local taxes can lead to discrepancies between your expected and actual take-home pay. A reliable paycheck calculator Pennsylvania tool includes both state and local taxes in its calculations, giving you a realistic estimate of your net pay.

Another important factor that influences your paycheck is other deductions. These can include contributions to retirement plans, health insurance premiums, and other voluntary or mandatory deductions. Employers typically provide information about these deductions, but it can be difficult to manually calculate the total impact on your paycheck. With a Pennsylvania Paycheck Calculator, you can enter these amounts and see the effect on your take-home pay immediately. This feature is especially useful for small business owners managing multiple deductions for themselves or their employees.

Many small business owners and self-employed entrepreneurs find it challenging to calculate take-home pay accurately. Payroll errors can lead to compliance issues, unhappy employees, and even fines. Using a calculator to estimate paycheck amounts before issuing payments helps prevent mistakes and ensures that you are withholding the correct amounts for taxes and other deductions. Moreover, it saves time and reduces the stress of manual calculations, allowing you to focus on growing your business rather than worrying about payroll errors.

For those who work hourly or receive irregular income, a Pennsylvania Paycheck Calculator can provide flexible and accurate estimates. You can input different hours worked, adjust for overtime, or include bonuses to see how your paycheck will change. This is particularly valuable for freelancers, contractors, and small business owners who may not have a fixed salary. Understanding your earnings in advance helps with budgeting, planning for taxes, and managing personal or business finances effectively.

Some Pennsylvania Paycheck Calculators also allow you to compare multiple scenarios. For example, you can see how different filing statuses, withholding allowances, or additional deductions will impact your take-home pay. This functionality is helpful when making financial decisions, such as adjusting retirement contributions or choosing between different health insurance plans. By using a reliable tool, you can make informed choices and optimize your income according to your personal and business needs.

In addition to accuracy, convenience is another reason to use a Pennsylvania Paycheck Calculator. Instead of manually looking up tax tables and performing complex calculations, you can quickly enter your information and receive an instant estimate. Many calculators are accessible online and mobile-friendly, making them convenient for entrepreneurs who are always on the go. Whether you are checking payroll for yourself or your employees, a calculator saves both time and effort while providing reliable results.

For small business owners, a Pennsylvania Paycheck Calculator also supports compliance with labor laws. By ensuring that taxes and deductions are calculated correctly, you reduce the risk of penalties for incorrect withholdings. It also helps maintain transparency and trust with your employees, as you can provide clear explanations of their paycheck amounts. This level of accuracy is essential for managing payroll efficiently and protecting your business from legal complications.

In conclusion, a Pennsylvania Paycheck Calculator is an essential tool for anyone looking to calculate take-home pay Pennsylvania accurately and efficiently. It simplifies the process of understanding deductions, taxes, and net income while providing convenience and reliability. Small business owners and self-employed entrepreneurs can benefit from using a calculator to ensure accuracy, maintain compliance, and make informed financial decisions. By relying on a trusted tool, such as those offered by Otto AI, you can save time, reduce errors, and gain a clear understanding of your earnings. A Pennsylvania Paycheck Calculator is more than just a calculator; it is a practical solution for managing payroll with confidence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness