South Carolina Paycheck Calculator Guide for Easy Use

Managing payroll can be one of the most important yet challenging tasks for business owners and self-employed professionals in South Carolina. Understanding how much money you or your employees will actually take home after taxes and deductions is crucial for budgeting and financial planning. The South Carolina Paycheck Calculator is a helpful online tool that can make this process easier. By using it, you can quickly estimate net pay, avoid surprises, and make smarter decisions about expenses and savings. Otto AI offers insights into how such tools can help streamline this process for individuals and businesses alike.

When running a business or working for yourself, it is important to know the difference between gross pay and net pay. Gross pay is the total amount earned before taxes and deductions. Net pay is the amount you receive in your bank account after taxes, insurance, retirement contributions, and any other deductions. The South Carolina Paycheck Calculator helps you bridge this gap by giving a clear estimate of your take-home pay.

This calculator takes into account multiple factors, including federal income tax, South Carolina state income tax, Social Security, and Medicare contributions. You can also include deductions such as health insurance premiums, retirement plan contributions, or other withholdings to get a more accurate result. By entering this information into the paycheck calculator South Carolina employees and employers can avoid overestimating or underestimating their pay.

For self-employed entrepreneurs, the tool can be especially valuable. Self-employment means you are responsible for both the employer and employee portions of Social Security and Medicare taxes, as well as quarterly estimated tax payments. The South Carolina Paycheck Calculator can help you plan for these expenses so that you are not caught off guard when tax season arrives.

One key advantage is the ability to adjust for different scenarios. For example, if you are considering increasing your hours, changing your pay rate, or adding benefits for employees, you can use the calculator to see the impact on take-home pay before making any commitments. This helps you make decisions with confidence and ensures your payroll expenses align with your budget.

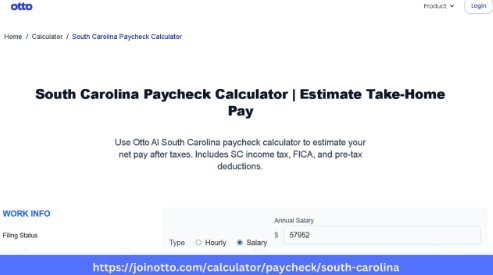

The process of using the calculator is straightforward. You simply input your gross wages, pay frequency, and any additional information like tax filing status or deductions. In just a few moments, you will see an estimate of your net pay. This quick calculation can save hours of manual work and reduce the risk of making mistakes in your payroll records.

Small business owners also benefit from having a reliable estimate for payroll costs. Knowing exactly what each employee will take home after deductions can help with employee satisfaction, as there are fewer disputes over paycheck amounts. It also makes it easier to communicate clearly about salary offers and benefits packages.

For employees, the South Carolina Paycheck Calculator offers peace of mind. It allows them to verify that they are receiving the correct pay and helps with personal budgeting. Whether it’s planning for bills, setting savings goals, or managing debt, understanding your true income is a critical step toward financial stability.

Another important point is that state and federal tax rates can change over time. The calculator is often updated to reflect the latest tax laws, so you can be sure that your calculations are based on current information. This means you do not have to manually research tax tables or guess about how changes in the law will affect your paycheck.

For self-employed individuals who often deal with irregular income, the calculator can help plan for months with higher or lower earnings. This flexibility is useful for freelancers, contractors, and gig workers whose income is not always consistent. By projecting your take-home pay, you can set aside the right amount for taxes and make sure you have enough left over for living expenses.

It is also worth noting that this tool is not only for income from wages. If you have additional income sources, such as bonuses or commissions, you can include them in your calculations. This gives a more complete picture of your financial situation and helps you avoid surprises at tax time.

Otto AI recognizes that in today’s fast-moving business environment, quick and accurate payroll calculations are essential. Having access to a South Carolina Paycheck Calculator means you can spend less time crunching numbers and more time focusing on growing your business or advancing your career.

While the calculator provides a helpful estimate, it should not replace professional tax advice. Complex financial situations, such as owning multiple businesses, having significant investment income, or dealing with special deductions, may require guidance from an accountant or tax advisor. However, for everyday use, this tool is an excellent resource.

The more familiar you are with your paycheck and the factors that influence it, the better prepared you will be to manage your money. Whether you are an employer making payroll decisions or an employee planning your budget, knowing your true income helps reduce stress and build confidence in your financial planning.

In summary, the South Carolina Paycheck Calculator is a practical and user-friendly resource for anyone wanting to calculate take home pay South Carolina residents can rely on. It saves time, reduces errors, and provides clarity for both employers and employees. By using this tool, you can make informed financial decisions and ensure your payroll processes are smooth and accurate.

With a tool like this, you can plan ahead, set realistic financial goals, and take control of your income. Otto AI believes that understanding your pay is one of the most important steps toward financial success. For individuals and businesses in the state, the South Carolina Paycheck Calculator is an essential part of that journey.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness