B2B2C Insurance Market Report: Unlocking Growth Potential and Addressing Challenges

United States of America – August 12, 2025 – The Insight Partners is proud to announce its newest market report, "B2B2C Insurance Market: An In-depth Analysis of the Global B2B2C Insurance Industry". The report provides a holistic view of the B2B2C Insurance market, outlining the current landscape as well as growth forecasts through 2031.

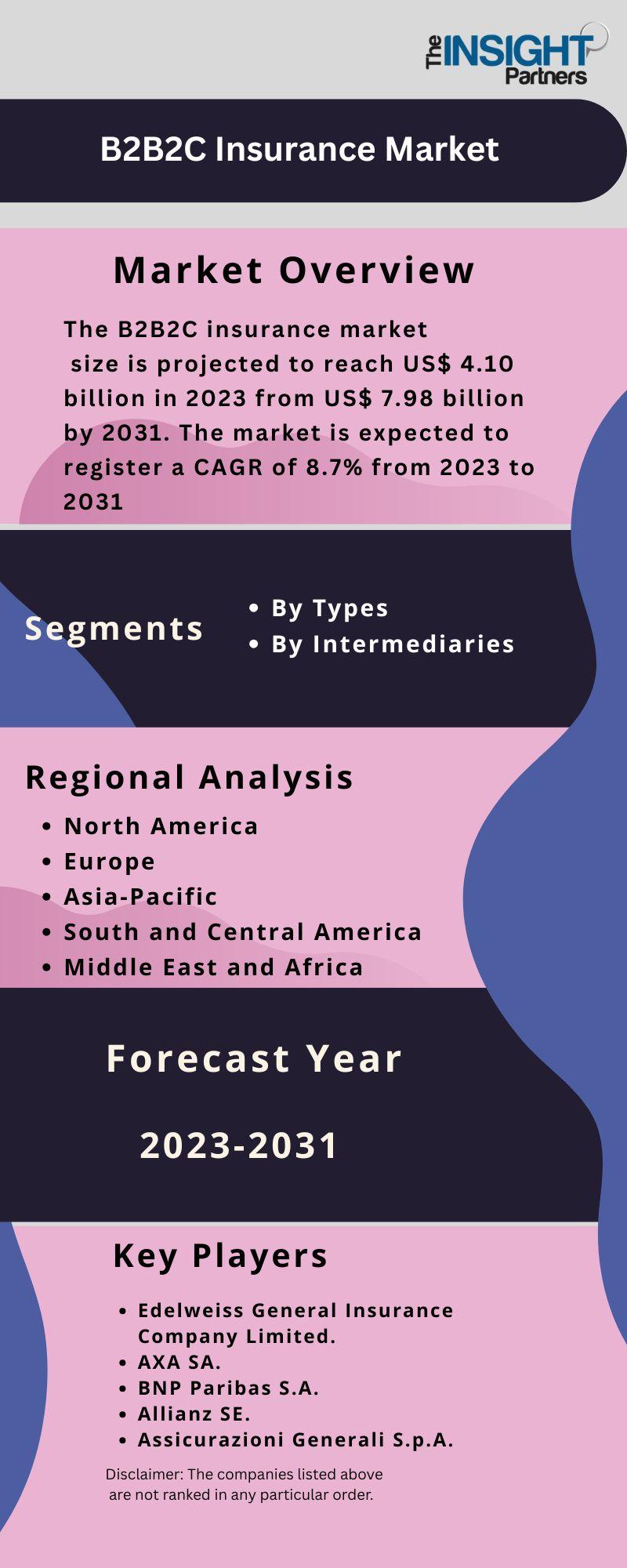

Overview of B2B2C Insurance Market

The B2B2C Insurance market is evolving rapidly, driven by the integration of digital platforms, changing consumer expectations, and strategic collaborations between insurers, intermediaries, and non-insurance brands. The model’s ability to reach customers through trusted partners is fueling adoption across multiple sectors.

Key Findings and Insights

Market Size and Growth

-

Historical Data: The B2B2C Insurance market was valued at US$ 4.10 billion in 2023 and is projected to reach US$ 7.98 billion by 2031, growing at a CAGR of 8.7% during the forecast period.

-

Key Factors Affecting the Market:

-

Increasing demand for personalized and embedded insurance offerings.

-

Growth of partnerships between insurers and digital platforms, retailers, and banks.

-

Rising customer trust in purchasing insurance via familiar B2B2C channels.

-

Expanding use of AI and analytics for tailored product recommendations.

-

Market Segmentation

By Types

-

Life Insurance

-

Health Insurance

-

Property and Casualty Insurance

By Intermediaries

-

Banks

-

Wealth Managers

-

Retailers

Spotting Emerging Trends

-

Technological Advancements:

-

AI-driven underwriting and claims processing.

-

API-based integration for seamless embedded insurance sales.

-

Blockchain for secure policy management and fraud prevention.

-

-

Changing Consumer Preferences:

-

Preference for insurance bundled with products or services they already use.

-

Increased demand for flexible, on-demand coverage options.

-

Shift toward mobile-first policy management.

-

-

Regulatory Changes:

-

Stricter compliance requirements in data privacy and customer consent.

-

Regulatory push toward transparency in policy terms and pricing.

-

Growth Opportunities

-

Expansion of embedded insurance in e-commerce and fintech platforms.

-

Leveraging big data to enhance product customization.

-

Targeting underserved markets through retail and banking partnerships.

-

Adoption of micro-insurance models to tap into emerging economies.

Conclusion

The B2B2C Insurance market: Global Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2023-2031 report provides much-needed insight for a company willing to set up its operations in the B2B2C Insurance market. Since an in-depth analysis of competitive dynamics, the environment, and probable growth path are given in the report, a stakeholder can move ahead with fact-based decision-making in favor of market achievements and enhancement of business opportunities.

About The Insight Partners

The Insight Partners is among the leading market research and consulting firms in the world. We take pride in delivering exclusive reports along with sophisticated strategic and tactical insights into the industry. Reports are generated through a combination of primary and secondary research, solely aimed at giving our clientele a knowledge-based insight into the market and domain. This is done to assist clients in making wiser business decisions. A holistic perspective in every study undertaken forms an integral part of our research methodology and makes the report unique and reliable.

for reference: -https://shorturl.at/uAXUc

To know more and get access to Sample reports.

https://www.theinsightpartners.com/sample/TIPRE00039087

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness