Europe Electric Scooter Market by Power Output Segment

Europe's Electric Scooter Market Accelerating Toward a $60.6 Billion Future

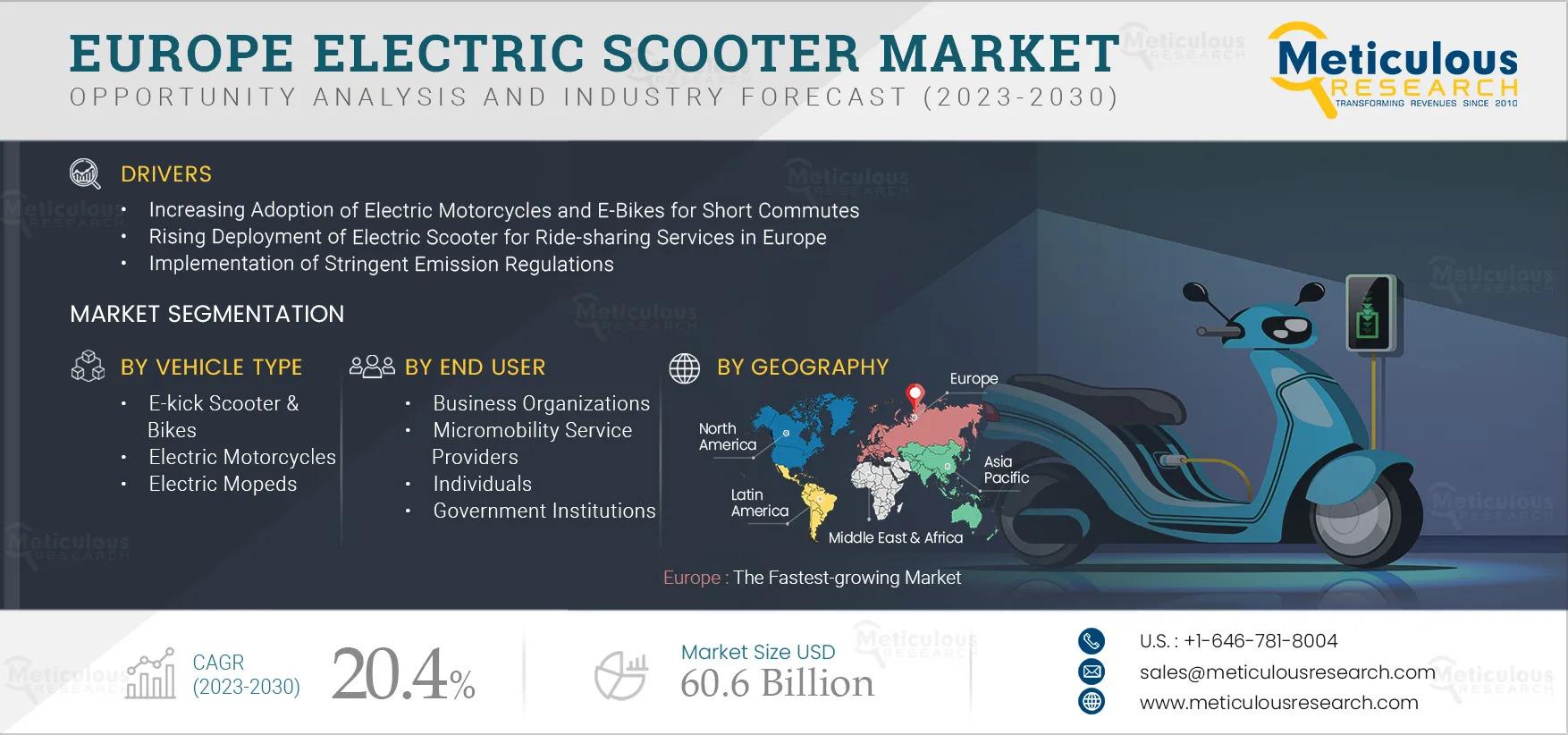

Europe's electric scooter industry is rapidly growing. Market researchers predict the sector will reach $60.6 billion by 2030. This represents an impressive 20.4% annual growth rate starting in 2023. Electric scooters are becoming one of the fastest-growing transportation segments on the continent.

What's Fueling This Electric Revolution?

Several factors are driving Europeans to choose electric two-wheelers. The main reason is the increasing popularity of electric motorcycles and e-bikes for daily short-distance travel. As urban congestion worsens and parking becomes harder to find, commuters are realizing that electric scooters provide a practical way to navigate busy city streets.

The rise of ride-sharing services has also greatly increased demand. Cities across Europe are seeing fleets of shared e-scooters popping up on street corners. These offer convenient last-mile transportation options. At the same time, stricter environmental regulations are pushing both consumers and businesses to move away from gas-powered vehicles and toward cleaner alternatives.

Moreover, health awareness among younger people is giving additional momentum to this trend. Millennials, in particular, are adopting electric scooters not only for convenience but also as part of a more active and environmentally friendly lifestyle.

Market Challenges and Barriers

Even with this positive outlook, several challenges could slow growth. The main issue is cost. Electric scooters, motorcycles, and e-bikes still have high price tags, making them unaffordable for many consumers. Additionally, limitations in battery technology mean these vehicles often need costly battery replacements, which increases long-term ownership expenses. Another serious concern is the unclear regulations in the industry. The absence of consistent rules for electric two-wheelers and micromobility devices creates confusion for manufacturers and users. This confusion could hinder market growth.

Market Leaders and Technology Trends

E-kick scooters and bikes currently lead the European market, thanks to government subsidies that encourage electric mobility. These lighter vehicles are especially popular for courier services and e-commerce deliveries. Their maneuverability and zero emissions offer clear benefits.

Most electric scooters are in the lower power category, with less than 3.6 kW. This reflects their primary use for urban commuting and recreational activities. Lithium-ion batteries have become the standard due to their better performance and reliability compared to older lead-acid batteries.

Manufacturers prefer hub motors because they provide the flexibility and stability that users appreciate. Traditional connector charging remains more common than wireless options. This is mainly because it offers quicker charging times, which helps reduce range anxiety.

Business Applications and Geographic Leaders

Business organizations represent the largest user group, especially for logistics and delivery services. Companies find that electric scooters can navigate narrow streets and sensitive areas without causing noise pollution. They also help significantly cut operating costs compared to traditional delivery vehicles.

Germany leads the European market, benefiting from substantial government incentives for electric vehicle adoption and significant investments in charging infrastructure. The country's supportive regulatory environment and appeal to international EV companies have made it the hub for electric scooters on the continent.

Looking Ahead

Europe's electric scooter market signifies a major change in urban transportation. As cities get more congested and environmental concerns grow, electric two-wheelers provide a more appealing solution. Although challenges around cost and regulation remain, the trajectory suggests electric scooters will become a vital part of Europe's transportation system over the next decade.

Key Players:

The key players operating in the Europe electric scooters market are Energica Motor Company S.p.A. (Italy), Yamaha Motor Co., Ltd. (Japan), Niu Technologies (China), Riese & Müller GmbH (Germany), Leon Cycle (Germany), Govecs AG (Germany), Walberg Urban Electrics GmbH (Germany), myStromer AG (Switzerland), Zero Motorcycles, Inc. (U.S.), and emco electroroller GmbH (Germany).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5239

Contact Us:

Meticulous Research®

Email- sales@meticulousresearch.com

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness