Nebraska Paycheck Calculator for Quick Take-Home Pay

When you receive your paycheck in Nebraska, the amount you see is often different from your total salary. That’s because of taxes and other deductions. For anyone working, freelancing, or running a business in Nebraska, knowing your exact take-home pay is important. A Nebraska Paycheck Calculator helps you figure out how much money you will actually get after all deductions.

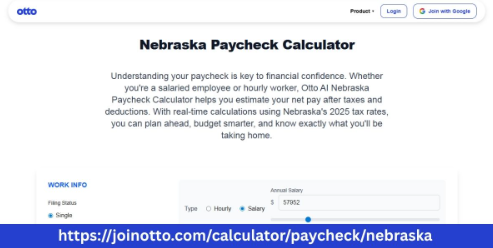

In this blog, we’ll explain how to calculate take home pay Nebraska, what deductions affect your paycheck, and how Otto AI’s simple paycheck calculator can make the process quick and easy.

What is a Nebraska Paycheck Calculator?

A Nebraska Paycheck Calculator is a tool that calculates your net pay. Net pay is the amount you take home after all deductions such as:

Federal income tax

Nebraska state income tax

Social Security tax

Medicare tax

Personal deductions (health insurance, retirement savings, etc.)

This tool is useful for employees who want to understand their paychecks, and for small business owners who need to manage payroll. A paycheck calculator Nebraska provides quick, accurate estimates with just a few simple steps.

Why You Should Calculate Take-Home Pay in Nebraska

Knowing your take-home pay helps you plan your budget, pay bills, and save for the future. For business owners, it ensures payroll is processed correctly. For freelancers, it helps with tax planning.

Nebraska’s state tax is progressive, meaning it increases as your income rises. Without a calculator, it’s hard to know how much you will actually take home. Using a Nebraska Paycheck Calculator eliminates guesswork and gives you clarity.

Common Deductions in Nebraska Paychecks

When you use a paycheck calculator, it will show the following deductions:

1. Federal Income Tax

Withheld based on your earnings and filing status (single, married, head of household).

2. Nebraska State Income Tax

Rates range from 2.46% to 6.64%, depending on your income.

3. Social Security Tax

6.2% of your gross salary, up to a federal wage limit.

4. Medicare Tax

1.45% of your gross income. High earners pay an extra 0.9% Medicare tax.

5. Other Deductions

Health insurance premiums, 401(k) contributions, and wage garnishments, if any.

The Nebraska Paycheck Calculator subtracts these amounts to give you a clear figure of your actual take-home pay.

How to Use a Nebraska Paycheck Calculator

Calculating your net pay with a paycheck calculator is very easy. Follow these steps:

Enter Your Gross Pay

Input your salary before deductions.

Choose Pay Frequency

Select if you are paid weekly, bi-weekly, semi-monthly, or monthly.

Select Filing Status

Indicate your tax filing status — single, married, or head of household.

Add Pre-Tax Deductions

Enter amounts for deductions like health insurance or retirement contributions.

Calculate Net Pay

The calculator will automatically subtract federal and state taxes, Social Security, Medicare, and other deductions, showing you your final take-home pay.

Otto AI’s Nebraska Paycheck Calculator simplifies this process, making it quick and accurate for employees, freelancers, and small business owners alike.

Why Otto AI’s Nebraska Paycheck Calculator is the Right Choice

Otto AI’s paycheck calculator stands out because:

It’s Always Accurate

Otto AI keeps its calculator updated with Nebraska’s latest tax rates and deductions.

Simple and Easy to Use

You don’t need any technical skills or payroll software experience to use it.

Saves Time and Effort

Get instant results without manual calculations or spreadsheets.

Ideal for Small Businesses

Small business owners can manage payroll without hiring an accountant.

Helpful for Freelancers and Entrepreneurs

Know exactly how much you earn after taxes and plan your finances accordingly.

Important Points to Remember When Calculating Take-Home Pay Nebraska

While paycheck calculators are very helpful, keep these things in mind:

Enter accurate gross income and deduction amounts.

Nebraska tax rates may change, so always use an updated calculator like Otto AI’s.

Self-employed individuals should consider additional taxes like estimated quarterly payments.

Overtime, bonuses, or commissions may need to be calculated separately.

Otto AI’s Nebraska Paycheck Calculator handles all these variations, giving you precise take-home pay figures every time.

Stay Updated with Nebraska Tax Changes

Nebraska periodically updates its income tax brackets, which can impact your paycheck deductions. Manual calculations may not reflect these changes. Otto AI ensures its calculator is always in sync with Nebraska’s latest tax codes, so you can rely on its accuracy.

Conclusion

A Nebraska Paycheck Calculator is an essential tool for anyone wanting to understand their earnings after taxes. Whether you are an employee, a freelancer, or a small business owner managing payroll, this tool simplifies the process and provides accurate results.

Otto AI’s Nebraska Paycheck Calculator is designed to make paycheck calculations easy, fast, and reliable. Start using Otto AI today to take the guesswork out of your paycheck and manage your finances with confidence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness