Japan Private Equity Market Size Share Growth Outlook 2025-2033

Japan Private Equity Market Overview

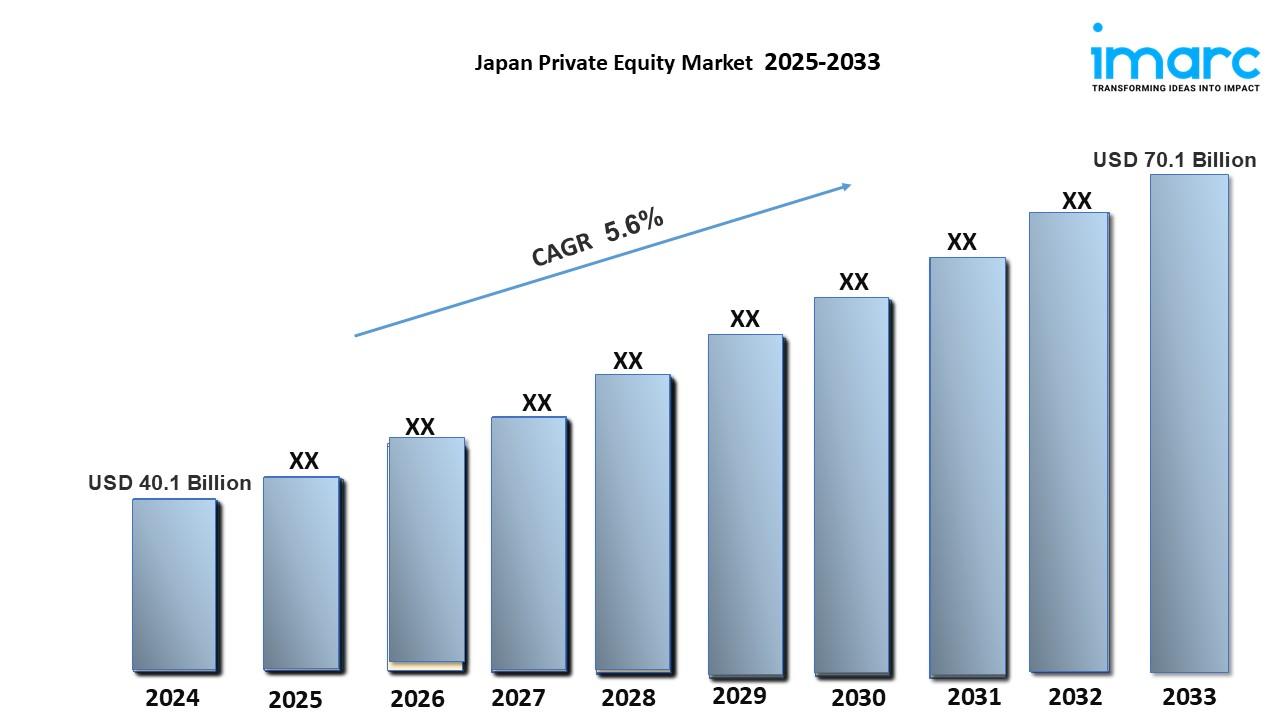

Market Size and Growth

Market Size in 2024: USD 40.1 Billion

Market Forecast in 2033: USD 70.1 Billion

Market Growth Rate: 5.6% (2025-2033)

According to the latest report by IMARC Group, the Japan private equity market size reached USD 40.1 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 70.1 billion by 2033, exhibiting a CAGR of 5.6% from 2025 to 2033.

Japan Private Equity Industry Trends and Drivers

There is great momentum in Japan's private equity market driven by systemic changes in corporate governance, influxes of global capital into Japan, and restructuring efforts seen across a wide range of industries. With the government's emphasis on transparency, management accountability, and the formation of an unbroken merger and acquisition framework, there is an obvious fertile ground for deal flow including carve-outs, take-private transactions, succession alternatives, and solutions for family businesses or underperforming assets. Capital is flowing in from domestic and international investors alike from all over the globe as global investors recognize Japan's foundations of a stable economy, compelling relative valuations, and robust pipeline of companies in Japan that want to change the way they operate or accelerate their growth.

The market is rapidly changing and evolving in reaction to the global movement for technology, healthcare, and infrastructure investment as Japan is evolving in its quest for digital transformation, sustainability, and productivity. ESG is front of mind with investors increasing attention to private equity backed firms through their sustainability or carbon-neutral policy mandates. The sophistication of deal structures is increasing as secondary or third buyouts, minority and junior investments, minority or non-control investments, cross-border legal and accounting partnerships become more competitive and innovative. All in all, Japan's private equity market remains strong and there exists a situation of ample capital and the coupling of reinvention opportunities for global investors with local business owners.

Request for a Sample Copy of the Report: https://www.imarcgroup.com/japan-private-equity-market/requestsample

Japan Private Equity Market Segmentation

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan private equity market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=10212&flag=C

Competitive Landscape

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of major companies in the Japan private equity industry.

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Musik

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness