Japan Consumer Credit Market Size, Share & Trends Forecast 2025–2033

Japan Consumer Credit Market Overview

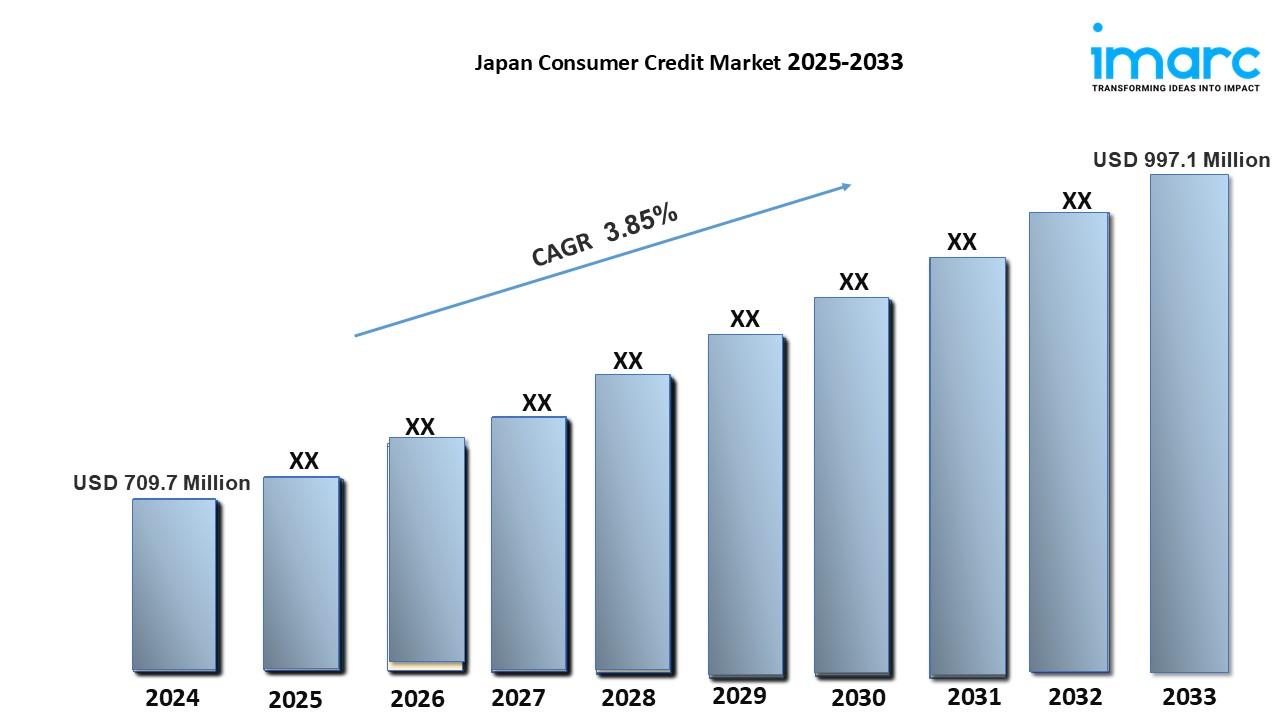

Market Size and Growth

Market Size in 2024: USD 709.7 Million

Market Forecast in 2033: USD 997.1 Million

Market Growth Rate: 3.85% (2025-2033)

According to the latest report by IMARC Group, the Japan consumer credit market size reached USD 709.7 million in 2024. Looking forward, IMARC Group expects the market to reach USD 997.1 million by 2033, exhibiting a CAGR of 3.85% from 2025 to 2033.

Request for a Sample Copy of the Report: https://www.imarcgroup.com/japan-consumer-credit-market/requestsample

Japan Consumer Credit Industry Trends and Drivers

The Japanese consumer credit market is undergoing a structural transformation as a digital evolution and changes in consumer finance behavior spread to the traditional lending market. Japan has an embedded conservative credit culture favoring cash transactions, and although this remains, the sector has accelerated growth in all areas of digital credit following the government cashless initiatives and burgeoning fintech ideas. Leading banks and new fintech business are offering more credit cards, installment loans, and buy-now-pay-later solutions to cater for the increased IoT and digital engagement of younger generations as part of their normal lives. In addition, ongoing low interest rates in Japan are shifting the consumer mindset with regard borrowing, but aged consumers still have a cultural dislike of personal debt which lender must be cautious of.

In parallel, the marketplace is also changing as the regulatory agencies introduce measures for enhanced consumer protection and at the same time, pro-innovation with regards to digital debt. Some examples of changes in the consumer credit market are the growing emergence of AI-based credit scores on lending platforms, financial products offered through ecommerce platforms, and offering products tailored to specific consumer segments. However, there are ongoing concerns with lenders and their ability to balance the required growth of personal credit market with risk management during a transient time as the personal borrowing levels among consumers increase and as competition increases through traditional institutions and Fintech.

Japan Consumer Credit Market Segmentation

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan consumer credit market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments:

Credit Type Insights:

- Revolving Credits

- Non-Revolving Credits

Service Type Insights:

- Credit Services

- Software and IT Support Services

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

Regional Insights:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=18976&flag=C

Competitive Landscape

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of major companies in the Japan consumer credit industry.

- ACOM Co. Ltd. (Mitsubishi UFJ Financial Group Inc.)

- AIFUL Corporation

- Jaccs Co. Ltd.

- Orient Corporation

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness