Iowa Sales Tax Calculator Tool for Everyday Business Use

Running a business in Iowa involves keeping track of several important financial details, and one of the most important among them is understanding and applying sales tax correctly. For entrepreneurs, freelancers, and growing businesses, dealing with taxes can feel overwhelming, especially when there are constant updates and varying rates depending on the location. That’s where a tool like the Iowa sales tax calculator becomes very useful. It helps you get accurate sales tax amounts instantly, without diving into complex tax rules or state documents.

When selling goods or taxable services in Iowa, the right tax rate must be charged. This may change depending on the city, county, or special district in which the sale is made. If you enter the wrong tax rate or forget to include sales tax, you could face penalties or have to pay the missing amount from your own pocket. A reliable sales tax calculator Iowa tool can help you prevent such issues by showing the exact amount to charge based on your customer’s location.

For example, a sale in Des Moines might have a different sales tax rate compared to a sale in Cedar Rapids. The basic state sales tax rate in Iowa is 6%, but local areas often add extra, bringing the total to as high as 7% or even 7.5%. Instead of memorizing these rates or checking government websites all the time, you can use a calculator that provides the latest numbers with just a few inputs. This is especially useful for small businesses that do not have a separate accounting team or software.

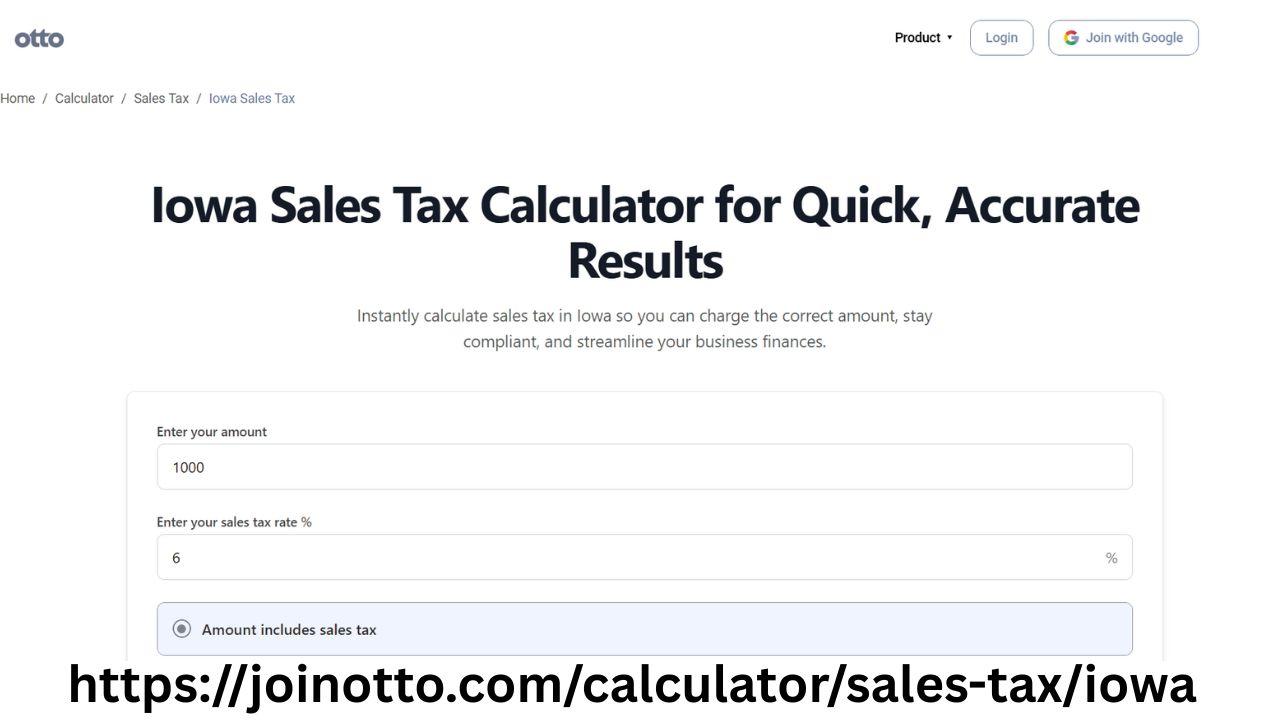

One of the most helpful tools for this purpose is the Otto AI Iowa sales tax calculator. It is designed with simplicity in mind, allowing users to enter just the sale amount and location details to receive the accurate tax breakdown. Whether you’re selling online, in a physical shop, or at pop-up events, this tool helps you stay on track. It’s like having a pocket accountant without any complicated forms.

Freelancers and self-employed professionals who sell products or charge for taxable services in Iowa can also take advantage of such a tool. Many creative professionals, from graphic designers to Etsy sellers, often struggle with the question of whether to include sales tax in their invoices. Instead of second-guessing or searching online for answers each time, a sales tax in Iowa calculator can provide quick answers. This lets you focus on your business while staying confident in your tax process.

Even service providers who deal with a mix of taxable and non-taxable services can use the Iowa sales tax calculator to figure out what part of the service should be taxed and how much. In Iowa, not all services are taxable, but when they are, you must apply the correct rate. Having a calculator makes it easier to manage these mixed invoices.

Another benefit of using a sales tax Iowa calculator is during tax filing time. When preparing your monthly, quarterly, or yearly sales tax reports, you need to know how much sales tax you’ve collected. By using a reliable calculator for every transaction or sale, your records will already have the right amounts. This makes your filings more accurate and reduces the chances of facing issues during audits.

The Otto AI tool is also great for business owners who are expanding into new locations. When you start selling in a new city or county in Iowa, you may not know the local sales tax rate offhand. A calculator with location-based input will help you quickly adjust your pricing and invoices. This ensures compliance from the start, avoiding any trouble from incorrect tax collections.

For mobile businesses like food trucks or event vendors, this kind of calculator is almost essential. Since you move from one location to another, the sales tax rate can change daily depending on where you park. Having a mobile-friendly Iowa sales tax calculator lets you get instant tax amounts wherever you are. You don’t need to guess or delay transactions just to figure out the correct tax rate.

When you build trust with customers, being transparent about taxes also helps. Showing the sales tax breakdown clearly on receipts or invoices shows that your business is professional and honest. It avoids customer confusion and builds a positive reputation. A calculator helps you offer clear, exact pricing that includes the right tax without rounding errors or guesswork.

Also, if you sell online to buyers in different parts of Iowa, each customer might have a slightly different tax rate. For e-commerce sellers, an accurate sales tax calculator Iowa tool can help apply the correct tax to every order. This is especially useful when you’re setting up a shopping cart system or writing custom invoices.

Many small business owners worry that using tax tools might be difficult or time-consuming. However, tools like Otto AI’s Iowa sales tax calculator are created to be user-friendly and require no training. You don’t have to understand tax law or install special software. It’s all available in one simple place that you can visit anytime.

Over time, this kind of habit—using a calculator before billing—can help you avoid tax underpayments and overpayments. You don’t want to collect too much tax and risk upsetting customers, nor do you want to collect too little and have to pay the rest yourself. An Iowa calculator that is accurate and up to date takes this burden off your shoulders.

In addition, keeping records of calculated tax from each sale with a calculator makes your accounting system stronger. Whether you use spreadsheets or accounting software, having exact numbers from the start helps avoid mismatched reports and improves your cash flow accuracy. You know exactly how much money belongs to the state and how much you can keep.

For growing businesses looking to manage operations more efficiently, adopting a tool like this early can save time and stress later. As your transactions increase, the benefits of fast and precise tax calculation grow too. It becomes part of your daily business routine, making sure your prices, invoices, and filings are always aligned with Iowa laws.

Using the Iowa sales tax calculator is more than just a convenience; it’s a smart way to stay compliant and organized. Whether you’re running a store, selling online, or offering professional services, having this tool available helps you make fast, confident decisions. And with Otto AI supporting it, you get the benefit of technology designed to meet the real needs of modern business owners.

In conclusion, an Iowa sales tax calculator is a must-have tool for anyone doing business in the state. It ensures your tax collection is always correct, no matter the size or location of the sale. With Otto AI’s easy-to-use calculator, small business owners, freelancers, and entrepreneurs can work with peace of mind. You don’t have to guess your way through taxes anymore—just use the calculator and move forward with confidence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness