Accurate Calculations Made Easy with the Wisconsin Sales Tax Calculator

When it comes to running a business in Wisconsin, every penny matters. From managing inventory to paying employees, keeping track of sales and taxes is a vital part of staying compliant and profitable. This is where the Wisconsin sales tax calculator becomes an important tool for any entrepreneur, self-employed individual, or business owner. With varying local rates and ever-changing tax laws, calculating sales tax manually can lead to mistakes. Instead, using a reliable calculator ensures your financial transactions remain accurate and stress-free.

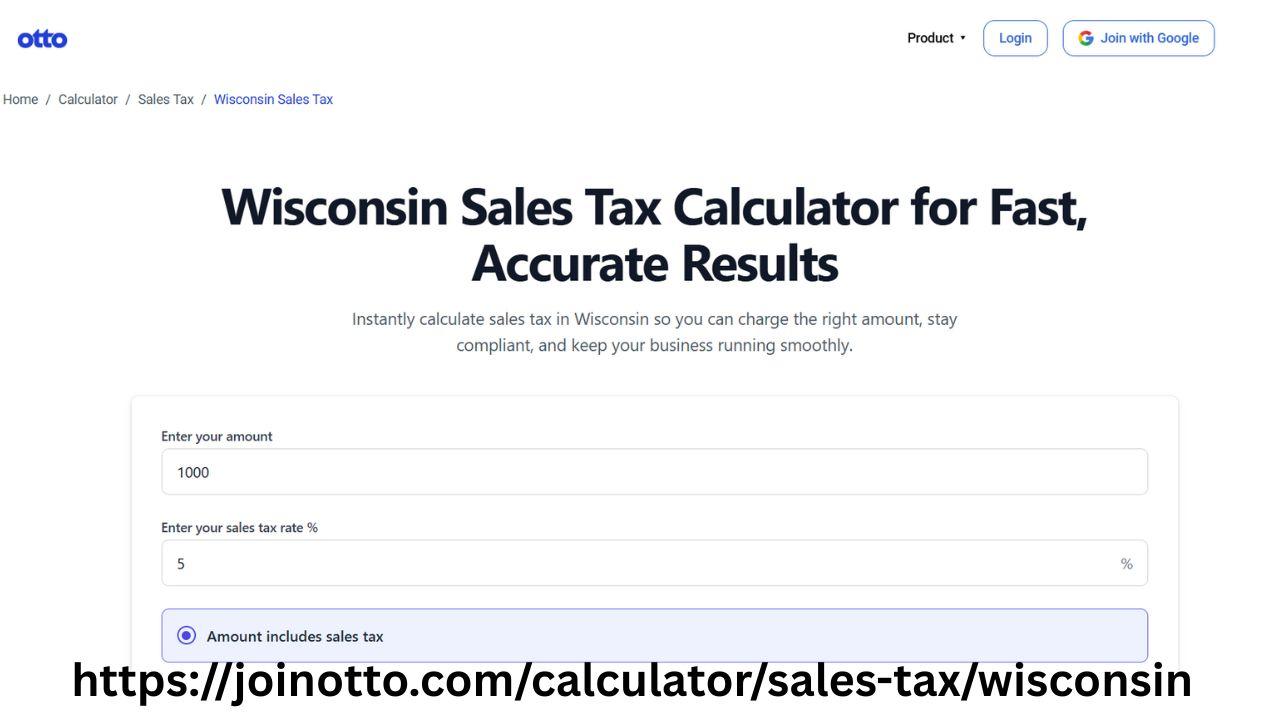

The sales tax calculator Wisconsin users rely on is especially useful because Wisconsin has a statewide base tax rate of 5%, but many counties and municipalities add their own local taxes on top. That means the total rate can vary depending on where a sale takes place. For someone selling online or managing a store that deals with customers from different parts of the state, knowing the exact rate to apply is essential. Even a small error in tax calculation can cost a business in the long run—whether through lost revenue or penalties from incorrect tax filings.

The sales tax in Wisconsin calculator makes the process effortless. All you need is the sale amount, and in some cases, the location of the sale. The calculator automatically does the math for you and adds the correct percentage based on state and local tax rules. This tool is especially helpful during peak sales periods, such as the holidays, when invoices and receipts are generated quickly, and accuracy is non-negotiable.

Otto AI provides a user-friendly sales tax Wisconsin calculator that’s ideal for businesses of all sizes. Whether you’re running a weekend farmers’ market stall or managing multiple storefronts, Otto AI’s calculator gives you the flexibility to calculate taxes fast and without confusion. The platform takes into account local changes and updates, so you don’t have to manually check if a city or county has increased its rate. Instead, you focus on your business while the calculator keeps your transactions tax-compliant.

For those who are self-employed, such as freelancers, artists, or consultants, understanding what to charge for tax can be confusing, especially when dealing with products or services that may have different tax implications. With the Wisconsin sales tax calculator, this guesswork disappears. You can simply enter your sale price and let the calculator tell you the total amount due, including tax. This helps when quoting prices to clients or when filling out invoices—creating a professional image and avoiding underpayment issues.

Even brick-and-mortar businesses that operate in a single location benefit from having a digital calculator on hand. Employees can use it to quickly confirm prices at the point of sale, and managers can double-check totals before submitting financial reports. There’s no need to memorize or look up current tax rates—everything is built into the tool. It saves time, reduces training needs, and lowers the risk of costly errors.

One of the best features of Otto AI’s sales tax calculator Wisconsin businesses love is how adaptable it is. You can use it from a desktop, tablet, or smartphone—whichever device you have nearby. This makes it convenient for mobile sellers and service providers who are always on the go. Whether you’re a handyman offering repairs in different counties or a vendor at a craft fair, the calculator helps you stay compliant with the latest rates wherever you are.

Another challenge faced by many business owners is managing sales tax across multiple product categories. In Wisconsin, not every item is taxed the same way. Groceries, clothing, and digital products may have different exemptions or rules. By using a calculator that factors in Wisconsin-specific tax details, you ensure that you apply the correct rate every time. This avoids overcharging your customers or underreporting your earnings.

Accuracy in tax collection also builds trust with your customers. When buyers see that the tax amount is clearly listed and correctly calculated, it adds to their confidence in your professionalism. Inconsistent or unclear tax calculations can raise doubts and may even discourage future purchases. Using a precise calculator takes the guesswork out of transactions and makes the buying experience smoother.

Otto AI’s calculator also plays a role in backend operations. When it’s time to prepare your taxes or report sales, the correct tax amounts are already calculated and easy to reference. This is especially helpful during tax season, when time is limited and the risk of audit anxiety increases. Knowing your numbers are accurate and consistent allows you to file with confidence.

For new entrepreneurs or those just launching their first product or service, learning the ins and outs of Wisconsin tax law can feel overwhelming. The Wisconsin sales tax calculator simplifies the process by doing the heavy lifting for you. Instead of worrying about tax codes, you can focus on refining your offerings and growing your customer base. As your business expands, you’ll find the calculator becomes an indispensable part of your toolkit.

Also, for those who manage both in-person and online sales, applying the correct tax rate to each sale type is critical. Different platforms may have different rules, and customer locations influence which rates apply. With Otto AI’s tool, you enter the sale price and location, and let the calculator do the rest. This is especially beneficial for e-commerce sellers who might be shipping to customers in Milwaukee, Madison, Green Bay, or smaller towns—each with their own local additions.

Customer satisfaction and compliance are both enhanced when you use tools designed for accuracy. The Otto AI Wisconsin sales tax calculator is built to reduce confusion, minimize errors, and keep your business tax-ready. It’s one less thing to worry about in the daily hustle of entrepreneurship.

In summary, using a Wisconsin sales tax calculator helps business owners stay accurate, professional, and compliant with state tax requirements. From local shops to service providers, every transaction becomes simpler and more transparent. With Otto AI offering a reliable and easy-to-use calculator, you can put your energy into what really matters—running and growing your business. Whether you're working from home, managing a team, or handling customers in-store, having the right tax calculator by your side gives you confidence and control.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness