Oklahoma Sales Tax Calculator by Otto AI for Accuracy

Running a business in Oklahoma comes with many responsibilities, and one of them is calculating the right amount of sales tax. Whether you are selling products in Tulsa, Oklahoma City, or any other part of the state, understanding how much sales tax to collect is important. The Oklahoma Sales Tax Calculator by Otto AI is designed to make this task easier and more accurate for you.

When you run a shop, sell online, or offer services, the price you charge often includes sales tax. But keeping track of changing rates, city-specific taxes, and local rules can get confusing. That’s where a tool like the Oklahoma Sales Tax Calculator becomes a reliable partner for business owners. It not only helps calculate the correct amount of tax but also saves time and avoids mistakes.

What is Sales Tax in Oklahoma?

Sales tax is a fee added to the price of goods or services. In Oklahoma, the base state sales tax rate is 4.5%. However, local cities and counties can add extra percentages. That means the total rate may vary depending on where the sale happens. For example, Oklahoma City adds additional tax, so the final rate could go up to around 8.625% or even more in certain areas.

This is why it’s important to use a sales tax calculator Oklahoma businesses can rely on. If you're manually calculating tax rates without checking each city or county rule, you may end up undercharging or overcharging your customers.

Why Accuracy Matters in Sales Tax

Even a small error in calculating sales tax can lead to problems. Undercharging means you might have to pay the difference yourself during audits. Overcharging may upset customers or lead to unnecessary refunds. An accurate Oklahoma City sales tax calculator avoids these issues by giving the correct numbers instantly.

By using Otto AI’s calculator, business owners can confidently apply the correct sales tax to each transaction, whether it’s in-store or online. It helps keep financial records clean and supports compliance with Oklahoma tax rules.

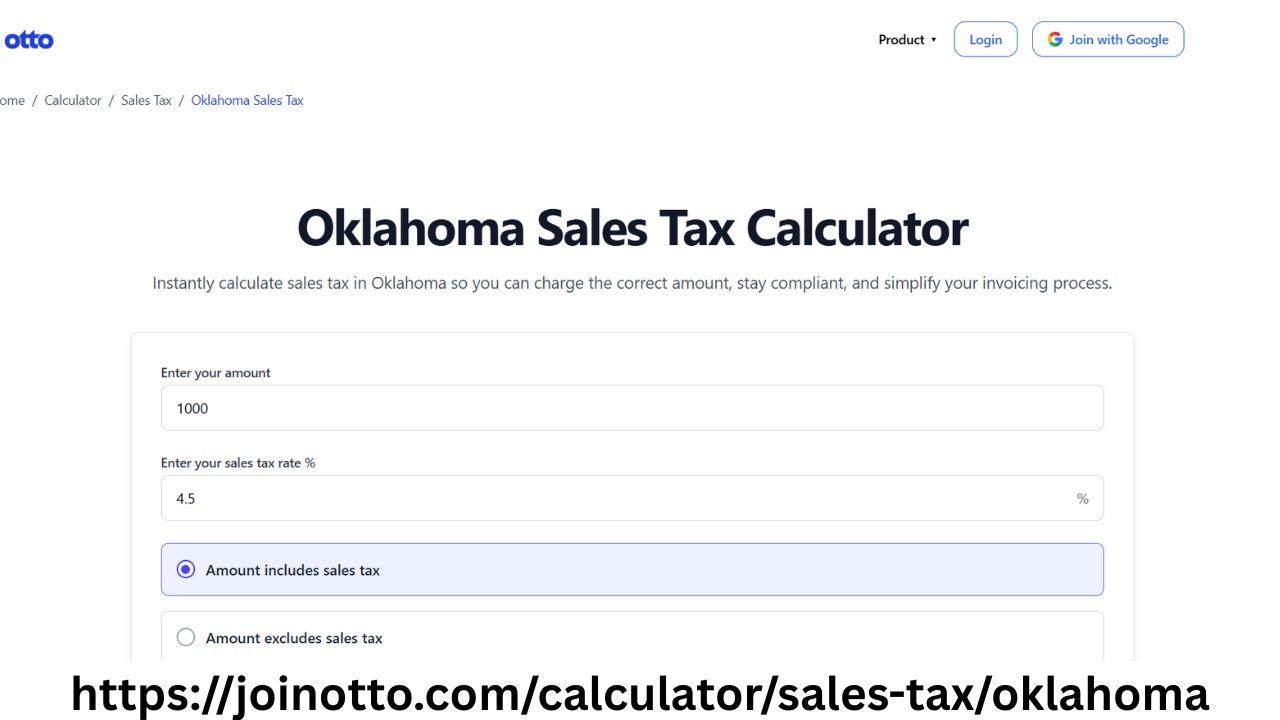

Features of Otto AI’s Oklahoma Sales Tax Calculator

Otto AI created this tool with local business needs in mind. It’s designed for accuracy, speed, and ease of use. Here are some things you can expect:

Enter a price and instantly get the correct tax amount.

Automatically calculates based on Oklahoma’s base rate and local additions.

Works for any location within the state.

Can be used for product sales, services, or online orders.

No need to search manually for each city or county rate.

Instead of searching "sales tax in Oklahoma calculator" every time, you can bookmark Otto AI’s tool and get fast results whenever you need them.

How Location Affects Sales Tax in Oklahoma

One key thing to remember is that Oklahoma does not have a fixed rate across the whole state. Every county and city can add to the base tax. This means sales tax in Tulsa is different from sales tax in Norman or Lawton. Even within Oklahoma City, different areas may have slightly different total rates depending on the district.

That’s why a sales tax calculator Oklahoma tool like Otto AI’s includes location-based adjustments. You won’t have to worry about memorizing different rates. It calculates based on the latest local data.

Perfect for Self-Employed and Entrepreneurs

If you're a freelancer or solo business owner, you may not have a full accounting team. That’s where a helpful tool like the Oklahoma sales tax calculator becomes valuable. It saves time, reduces errors, and allows you to focus on your actual work—serving clients and growing your business.

Entrepreneurs who sell across different parts of Oklahoma will find this tool especially useful. Each time you make a sale, the calculator ensures the right amount is charged without needing to dig into tax tables or government websites.

Handling Online Sales

If you run an online store and ship within Oklahoma, you still need to collect the correct local sales tax. Otto AI’s sales tax in Oklahoma calculator is perfect for this. Enter the buyer’s zip code or location, and it will give the right tax amount to apply to their order.

Online sellers face strict rules when it comes to collecting and remitting taxes, especially across different counties. Having a trusted calculator helps reduce stress and keeps your business on the right track.

Useful for Brick-and-Mortar Stores

Even if you have a physical store in Oklahoma City or nearby, you need to be sure that the tax rate you’re using at the register is correct. With the Oklahoma City sales tax calculator, your staff can double-check amounts during checkout, especially for custom orders or price changes.

Otto AI’s calculator fits smoothly into daily retail operations. It’s also handy for printing receipts with accurate tax details or sharing quotes with customers.

Otto AI: Making Tax Simple and Reliable

Otto AI is known for creating useful business tools that make complex tasks easier. The Oklahoma Sales Tax Calculator is one example of how it supports entrepreneurs, small businesses, and self-employed workers with digital tools built for real-life needs.

With Otto AI, you don’t have to guess. The calculator is updated regularly to reflect the latest changes in tax rules across Oklahoma. This means peace of mind for business owners who want to avoid tax issues and focus on growing their brand.

Easy to Use on Any Device

Otto AI’s calculator works smoothly on desktops, laptops, tablets, and smartphones. Whether you’re working from your office, a coffee shop, or the road, you can quickly open the tool and calculate the right sales tax amount in seconds.

You don’t need to download software or go through complicated steps. It’s made for speed and simplicity.

Helpful for Invoices, Quotes, and Records

If you often send quotes or create invoices for clients, the calculator ensures you apply the right tax amount. This makes your pricing look more professional and helps you build trust with customers. Accurate tax application also means cleaner records when it’s time to file your taxes.

Conclusion

Getting sales tax right is essential for any business operating in Oklahoma. With different local rates across cities and counties, using a reliable calculator can save time, prevent errors, and help you stay compliant. The Oklahoma Sales Tax Calculator by Otto AI is a simple, smart solution built with accuracy and convenience in mind. Whether you're running a store, offering services, or selling online, this tool helps you handle tax correctly every time.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness