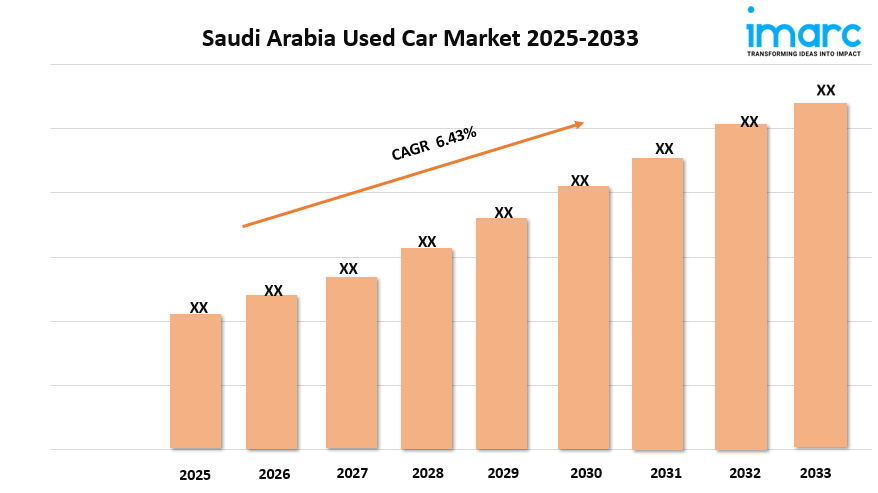

Saudi Arabia Used Car Market Size, Share, Growth, and Forecast 2025-2033

Saudi Arabia Used Car Market Overview

Market Size in 2024: USD 9.60 Billion

Market Size in 2033: USD 16.80 Billion

Market Growth Rate 2025-2033: 6.43%

According to IMARC Group's latest research publication, "Saudi Arabia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, Vendor Type, and Region, 2025-2033", the Saudi Arabia used car market size was valued at USD 9.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.80 Billion by 2033, exhibiting a CAGR of 6.43% from 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/saudi-arabia-used-car-market/requestsample

Growth Factors in the Saudi Arabia Used Car Market

- Rising Demand for Affordable Transportation

The Saudi Arabia used car market is experiencing significant growth due to the increasing need for cost-effective transportation options. With the high cost of new vehicles, many consumers, particularly expatriates and young drivers, are turning to used cars as a budget-friendly alternative. For instance, expatriates on short-term contracts often prefer affordable used vehicles over expensive new ones, as they may sell their cars before leaving the country. This trend is supported by the growing population, which includes a large youth demographic seeking reliable yet economical cars. Platforms like Syarah and Haraj have made it easier for buyers to access a wide range of affordable used vehicles, further fueling market expansion.

- Economic Diversification and Rising Disposable Income

Saudi Arabia’s Vision 2030 initiative, aimed at reducing oil dependency, has boosted non-oil sectors like retail, tourism, and manufacturing, leading to increased disposable income for many residents. This economic diversification has enhanced consumer confidence, encouraging spending on used cars as a practical investment. For example, middle-class families in urban centers like Riyadh and Jeddah are increasingly purchasing used SUVs for their practicality and value. The availability of financing options, such as low-interest loans from banks, has also made used cars more accessible, enabling a broader demographic to enter the market and driving consistent demand.

- Government Policies and Infrastructure Development

Government initiatives under Vision 2030, including infrastructure improvements and economic reforms, are significantly contributing to the used car market. Enhanced road networks and urban development projects, such as NEOM and the Red Sea Project, have increased the need for personal transportation. Additionally, policies facilitating used car trading, like regulatory bodies ensuring vehicle compliance, have boosted consumer trust. For instance, the partnership between TUV Rheinland and SASO ensures imported used cars meet national standards, encouraging buyers to invest confidently. These efforts create a favorable environment for market expansion, particularly in urban hubs like Dammam.

Key Trends in the Saudi Arabia Used Car Market

- Surge in Online Sales Platforms

The rise of online platforms has transformed the Saudi Arabia used car market by offering convenience and transparency. Platforms like YallaMotor, Carswitch, and OLX Saudi Arabia allow buyers to browse diverse vehicle inventories, compare prices, and access vehicle history reports. For example, Syarah’s recent Series C funding round, led by Artal Capital, highlights the growing investment in digital marketplaces. These platforms leverage technologies like virtual tours and AI to enhance user experiences, reducing the need for physical showroom visits. This trend aligns with high internet penetration, with most Saudis accessing these platforms via smartphones, driving sales growth.

- Growing Popularity of Certified Pre-Owned Programs

Certified pre-owned (CPO) vehicles are gaining traction as buyers seek assurance of quality and reliability. Dealerships like Abdul Latif Jameel Motors and Al-Futtaim Automotive offer CPO programs with verified service histories and limited warranties, justifying a slight price premium. For instance, buyers of CPO Toyota models benefit from the brand’s reputation for reliability and easy access to spare parts. This trend is shifting market share from unorganized peer-to-peer sales to organized dealers, as consumers value the added security. The focus on transparency and post-purchase support is reshaping buyer preferences and fostering trust.

- Increasing Demand for SUVs and Eco-Friendly Vehicles

Consumer preferences in Saudi Arabia are shifting toward SUVs and eco-friendly vehicles, reflecting cultural and environmental priorities. SUVs, valued for their spaciousness and versatility, dominate the used car market, with models like the Toyota Hilux and Hyundai Accent being top sellers. Meanwhile, the push for sustainability under Vision 2030 has increased interest in used hybrid and electric vehicles. For example, the Renault Zoe, a used electric hatchback, is gaining popularity among budget-conscious buyers seeking fuel efficiency. This trend highlights a growing awareness of environmental benefits and the practicality of used eco-friendly cars for urban driving.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging Saudi Arabia used car market trends.

Egypt Home Appliances Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Vehicle Type:

- Hatchback

- Sedan

- MUV and SUV

Analysis by Sales Channel:

- Online

- Offline

Analysis by Vendor Type:

- Organized

- Unorganized

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The Saudi Arabia used car market is poised for sustained growth, driven by ongoing economic diversification, technological advancements, and evolving consumer preferences. The continued expansion of online platforms will enhance accessibility, with companies like YallaMotor and Syarah likely to integrate advanced features like virtual reality tours to streamline purchasing. Urbanization and infrastructure projects will further boost demand for personal vehicles, particularly in emerging cities like Jazan. However, challenges such as counterfeit vehicles and inconsistent inspection standards must be addressed through stricter regulations and standardized processes. With government support and a focus on certified pre-owned programs, the market will likely see increased consumer trust and robust growth, offering opportunities for both buyers and dealers.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness