Japan Private Equity Market Size, Growth & Demand Report 2025–2033

Japan Private Equity Market Overview

Market Statistics

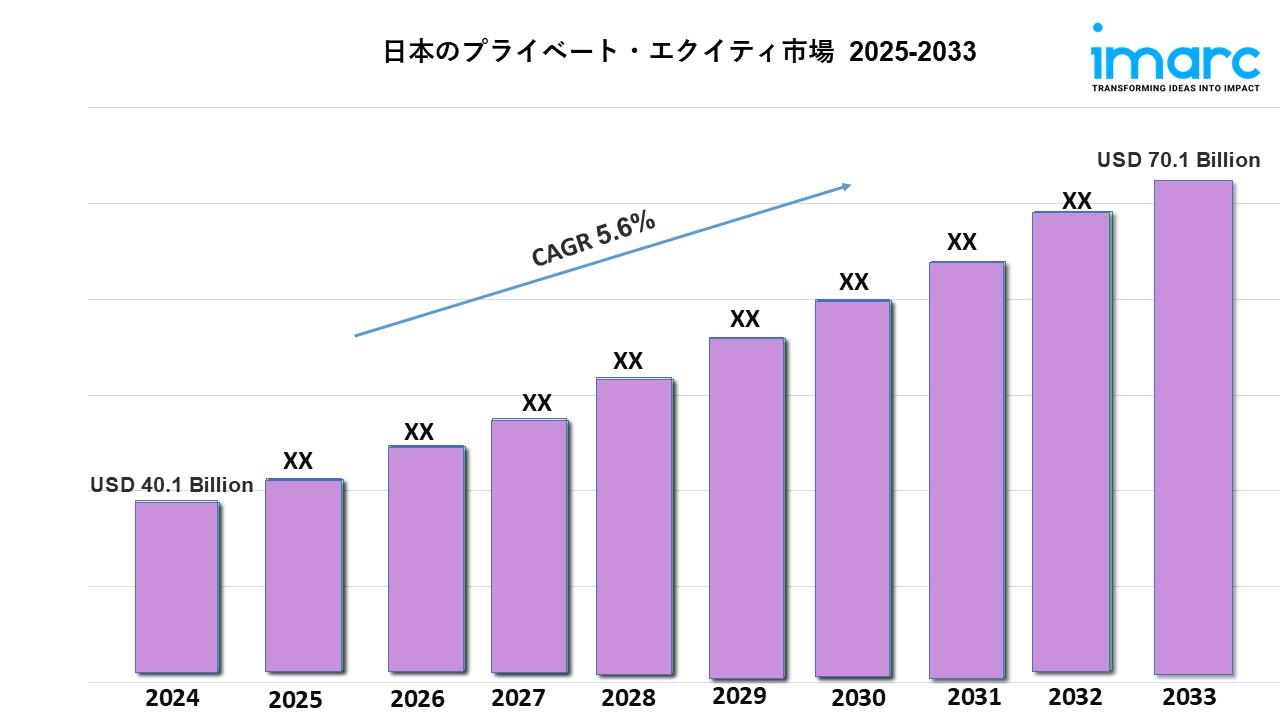

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 40.1 Billion

Market Forecast in 2033: USD 70.1 Billion

Market Growth Rate: 5.6% (2025-2033)

According to the latest report by IMARC Group, the Japan private equity market size reached USD 40.1 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 70.1 billion by 2033, exhibiting a CAGR of 5.6% from 2025 to 2033.

Download a Sample PDF of This Report: https://www.imarcgroup.com/japan-private-equity-market/requestsample

Japan Private Equity Industry Trends and Drivers

foreign investment, corporate restructuring in the country, and a stronger regulatory climate for private equity. Japan's private equity landscape has transformed rapidly over the years. 2024 saw USD 15.6 billion in disclosed deal value over 118 deals, good for a 35% increase from 2023, with buyout funds leading the way. Buyout funds predominate in Japan's private equity space because they tend to acquire more established companies, particularly in technology, healthcare, and consumer goods. Additionally, the aging population in Japan is driving much need for corporate, operational, and digital transformations, and buyout funds are capitalizing on this. Venture capital is gaining popularity in Japan largely on the strength of the startup ecosystems in Tokyo and Osaka, particularly on investments in technology-based sectors such as AI and fintech. Meanwhile, real estate funds and infrastructure funds are also taking off, with a big boost from redevelopment projects in urban centers and surrounding areas, including the government-regulated Tokyo Bay eSG project. Of Japan's 47 prefectures, the Kanto region has seen the most activity, fueled by Tokyo and its financial hubs, followed closely behind by Kinki and Chubu. Japan's government has provided incentives for foreign investment, such as tax breaks and relaxed regulations. As a result, we are seeing large, global players enter Japan with the likes of KKR and Carlyle Group. However, challenges remain, such as cultural resistance to M&A and a preference for traditional business and operating models, but there is potential for success within ESG-focused investments, as well as the privatization of family-owned businesses.

Japan Private Equity Market Segmentation

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan private equity market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=10212&flag=C

Competitive Landscape

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of major companies in the Japan private equity industry.

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness