Japan Data Center Market Size, Share Outlook 2033

Japan Data Center Market Overview

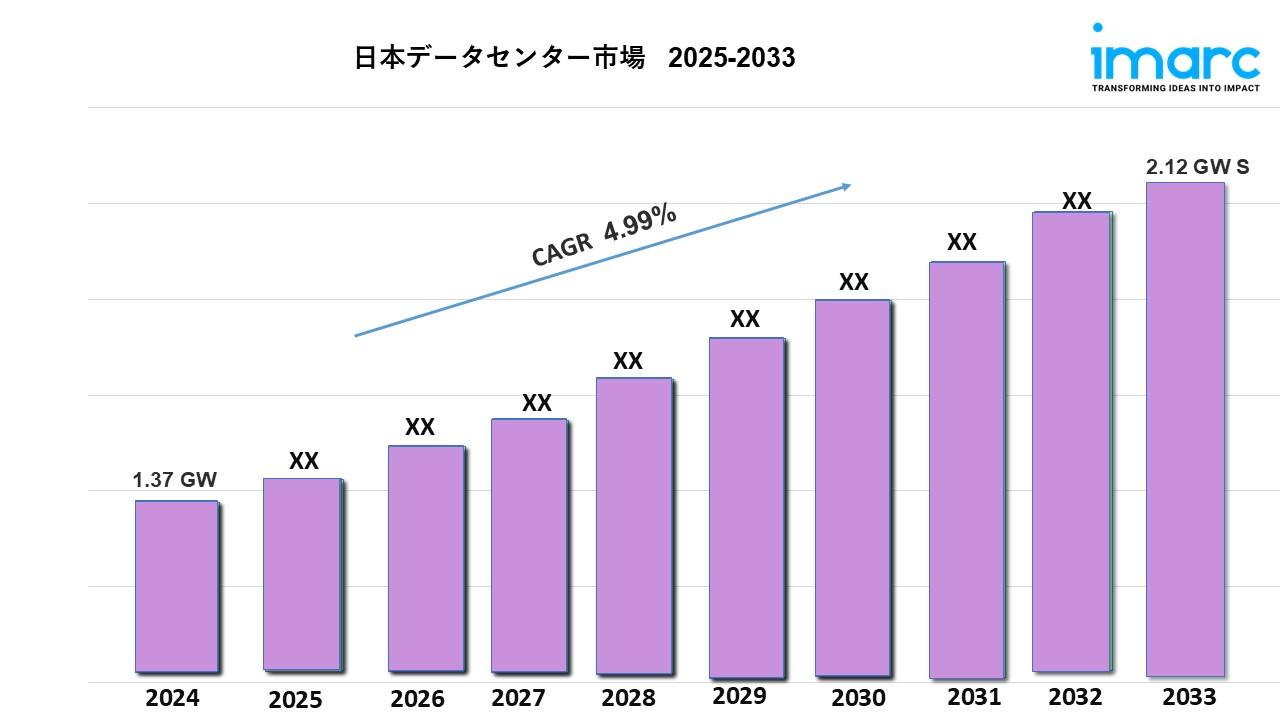

Market Size in 2024: 1.37 GW

Market Forecast in 2033: 2.12 GW

Market Growth Rate 2025-2033: 4.99%

According to IMARC Group's latest research publication, "Japan Data Center Market Report by Component, Type, Enterprise Size, End User, and Region 2025-2033," the Japan data center market size reached 1.37 GW in 2024. IMARC Group expects the market to reach 2.12 GW by 2033, exhibiting a growth rate (CAGR) of 4.99% during 2025-2033. The market is driven by increasing demand for cloud services, digital transformation, rising adoption of AI and IoT technologies, and government initiatives promoting sustainable data center infrastructure.

Download a Free Sample PDF of this report: https://www.imarcgroup.com/japan-data-center-market/requestsample

Growth Factors in the Japan Data Center Market

Increasing Demand for Cloud Services

The surge in cloud computing adoption, with 70% of Japanese businesses using cloud solutions in 2024, fuels data center growth. In the Kanto Region, cloud service demand drove a 20% increase in data center capacity, with a projected CAGR of 5.2%. Major providers like AWS and Microsoft Azure are expanding hyperscale facilities to meet this demand.

Digital Transformation Initiatives

Japan’s "Society 5.0" initiative and corporate digitalization efforts boost the need for scalable data centers. In the Kansai Region, digital transformation projects increased data center investments by 18% in 2024, with a projected CAGR of 5.0%. Industries like e-commerce and finance are key contributors.

Rising Adoption of AI and IoT Technologies

AI and IoT applications, requiring high computational power, are driving demand for hyperscale and edge data centers. In the Chubu Region, AI-driven data center deployments grew by 22% in 2024, with a projected CAGR of 5.3%. Innovations like NTT DOCOMO’s 6G trials in November 2024 enhance data center requirements.

Government Support for Sustainability

Japan’s push for green data centers, supported by subsidies for renewable energy and rural data center development, drives growth. In the Hokkaido Region, renewable energy-powered data centers grew by 25% in 2024, with a projected CAGR of 5.5%. The "GX 2040 Vision" promotes low-carbon hubs near wind and nuclear facilities.

Key Trends in the Japan Data Center Market

Solutions Dominate Component Segment

Solutions, including hardware like servers and networking equipment, held a 60% market share in 2024. In the Tohoku Region, solution deployments grew by 20%, with a projected CAGR of 5.1%. Services, such as consulting and managed services, are the fastest-growing segment, with a CAGR of 5.4%, driven by demand for operational efficiency.

Hyperscale Leads Type Segment

Hyperscale data centers accounted for 45% of the market share in 2024, driven by cloud providers like AWS and Google. In the Kanto Region, hyperscale capacity grew by 23%, with a projected CAGR of 5.6%. Edge data centers are the fastest-growing type, with a CAGR of 6.0%, due to low-latency needs for IoT and 5G.

Large Enterprises Lead Enterprise Size Segment

Large enterprises, with complex IT needs, held a 70% market share in 2024. In the Kinki Region, large enterprise data center investments grew by 19%, with a projected CAGR of 5.0%. Small and medium enterprises (SMEs) are the fastest-growing segment, with a CAGR of 5.8%, driven by affordable colocation and cloud solutions.

IT and Telecom Dominate End User Segment

The IT and telecom sector held a 35% market share in 2024, driven by 5G and cloud computing demands. In the Kyushu-Okinawa Region, IT and telecom data center usage grew by 21%, with a projected CAGR of 5.3%. BFSI is the fastest-growing end user, with a CAGR of 5.7%, due to stringent security and compliance needs.

Japan Data Center Market Industry Segmentation

The report has segmented the market into the following categories:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan Data Center Market Share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Component Insights:

- Solution

- Services

Type Insights:

- Colocation

- Hyperscale

- Edge

- Others

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

End User Insights:

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

Regional Insights

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=10540&flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

The Japan data center market is poised for robust growth through 2033, driven by cloud adoption, AI and IoT advancements, and government sustainability initiatives. Tokyo and Osaka, within the Kanto and Kansai regions, will lead due to advanced IT infrastructure, with Tokyo accounting for 40% of market share. Challenges include limited land availability, with urban land costs up 15% in 2024, and power supply constraints, with multi-year delays in substation build-outs. Innovations in photonics, edge computing, and renewable energy integration will ensure sustained expansion.

Research Methodology

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness