Workforce Management Market Dynamics and Trends

Workforce Management Market: Strategic Questions Business Leaders Must Answer

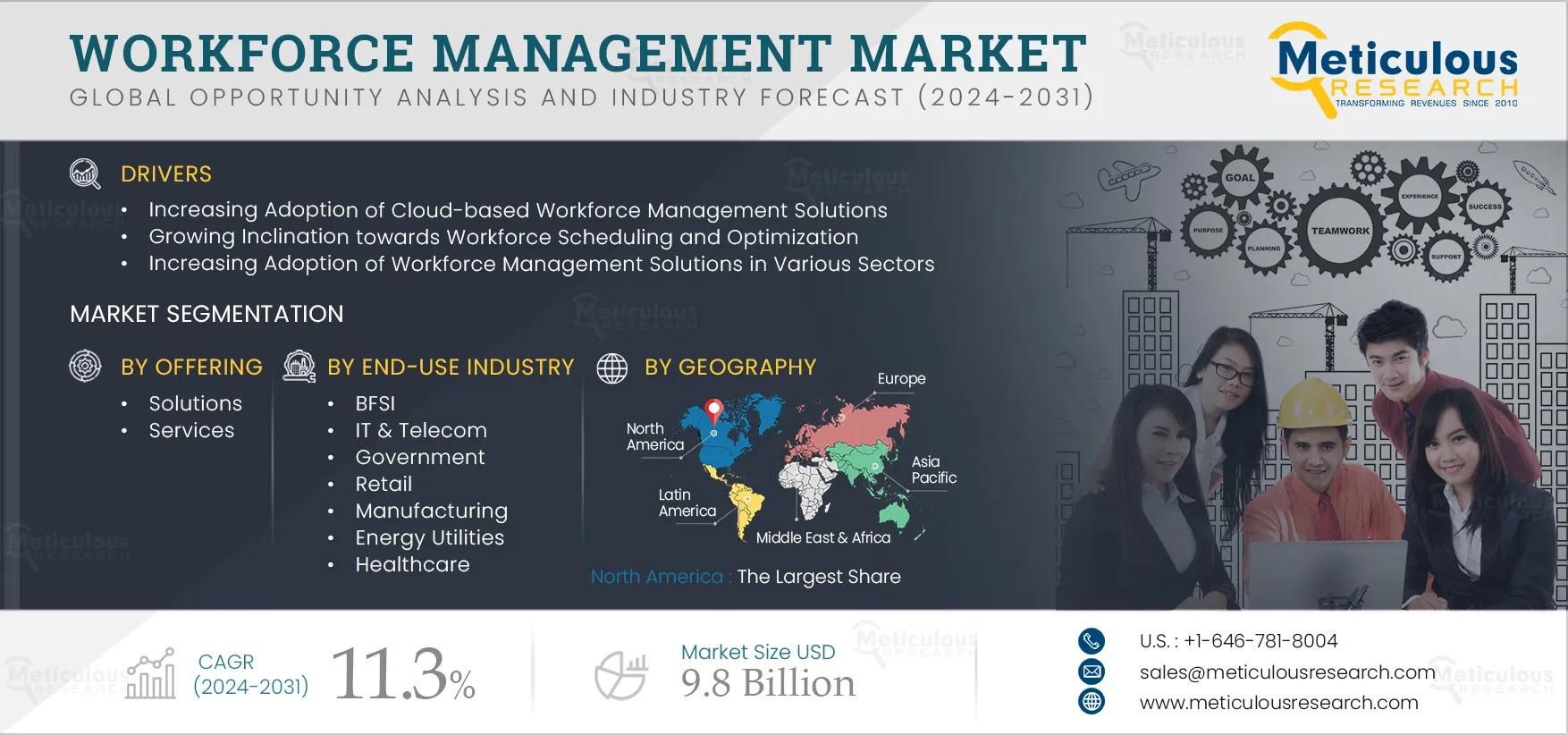

The global workforce management market is experiencing unprecedented growth, with projections showing it will reach $9.8 billion by 2032, expanding at a CAGR of 11.3% throughout the forecast period. This explosive growth brings both opportunities and challenges that business leaders must navigate carefully.

Understanding the ROI Challenge

Making smart investment decisions in workforce management technology isn't as straightforward as vendors suggest. While the promise of quick returns sounds appealing, the reality involves complex considerations that many organizations overlook.

Cloud-based solutions have captured 64% of the market for good reasons - they offer flexibility, reduce infrastructure costs, and support remote work trends. However, this shift raises important questions about control and customization. Companies implementing these solutions need to balance convenience with their specific business requirements.

The solutions segment dominates the market at 76%, driven by increasing demand for data-driven decision making and operational agility. Yet many leaders still focus primarily on direct cost savings rather than broader organizational benefits like improved employee satisfaction, better compliance, and enhanced operational flexibility.

Success in workforce management implementation depends largely on measuring the right metrics. Organizations in the IT and telecom sector, which represents the largest market segment, have found that productivity gains through advanced analytics often outweigh simple cost reductions. The key is identifying success indicators that align with your organization's strategic objectives.

Navigating the Modern Workforce Landscape

The workplace has fundamentally changed, with 90% of organizations now embracing hybrid work models. This shift has created new expectations among employees who demand flexibility, mobile access, and better work-life balance. Workforce management platforms must evolve to meet these changing needs while maintaining productivity and engagement.

Mobile accessibility has become non-negotiable. Employees expect to access their schedules, submit time-off requests, and communicate with colleagues from their smartphones. This technological capability goes beyond convenience - it's becoming a retention and engagement strategy.

However, technology alone cannot solve human resource challenges. While advanced scheduling algorithms can optimize resource allocation and reduce scheduling conflicts, they must be implemented thoughtfully to avoid creating additional stress or reducing the human element that makes organizations unique.

The SME Revolution

Small and medium enterprises are driving significant growth in workforce management adoption. These organizations recognize that automation and analytics can level the playing field with larger competitors. By streamlining manual processes and gaining access to enterprise-level insights, SMEs can compete more effectively while managing their resources efficiently.

The challenge for SMEs lies in implementation and ongoing management. While large enterprises (representing 65% of the market) typically have dedicated IT personnel to manage complex workforce analytics platforms, smaller organizations often lack these resources. This reality requires SMEs to carefully evaluate solutions based on ease of use and vendor support rather than just features and capabilities.

The key question for growing organizations is whether they're building sustainable workforce flexibility or creating dependence on systems they may struggle to manage as they scale. The most successful implementations focus on gradual adoption and building internal capabilities alongside technology deployment.

Geographic Opportunities and Challenges

Market dynamics vary significantly across regions. North America currently dominates with 33% of the global market, benefiting from established technology infrastructure and early adoption of workforce management solutions. However, the most exciting growth opportunities lie elsewhere.

Asia-Pacific is projected to grow at 13% CAGR through 2032, driven by rapid technology adoption and increasing workforce management needs in SMEs. Countries like Japan, China, India, and South Korea are witnessing strong demand growth, creating opportunities for both established players and new entrants.

This geographic shift requires organizations to think strategically about their market approach. Companies focusing solely on established markets may miss significant growth opportunities, while those expanding into emerging markets must understand local workforce practices and regulatory requirements.

Technology Integration Realities

The dominance of cloud-based solutions reflects practical benefits - automatic updates, compliance rule changes, and reduced infrastructure requirements. However, organizations must consider whether they're trading operational control for convenience.

Integration challenges remain significant. While solutions account for 76% of the market, success depends on how well these systems integrate with existing HR, payroll, and business intelligence platforms. The emphasis has shifted toward solution-centric capabilities and R&D investments, but organizations must evaluate whether they're building competitive advantages or creating vendor dependencies.

The most successful implementations focus on gradual integration, starting with core functionality and expanding capabilities as teams become comfortable with the new systems. This approach reduces risk while maximizing the likelihood of successful adoption.

Key Players Shaping the Market

The workforce management landscape features both established leaders and innovative newcomers. Major players like UKG Inc., Oracle Corporation, ADP Inc., and SAP SE control significant market share through strategic partnerships and acquisitions. These companies offer comprehensive solutions backed by extensive resources and established customer bases.

Recent partnerships illustrate how market leaders are strengthening their positions. SAP SE and Red Hat's consolidated external workforce program in North America, and Workday's expanded collaboration with Alight across six European regions, demonstrate strategic moves to capture larger market segments.

However, innovation often comes from unexpected sources. Companies like UJET partnering with Google Cloud and Rippling expanding into Australia show that emerging players can challenge established dominance through strategic partnerships and focused solutions.

The choice between established players and emerging solutions depends on your organization's specific needs, risk tolerance, and growth plans. Established vendors offer stability and comprehensive features, while newer entrants may provide more specialized solutions or better value propositions.

Making Strategic Decisions

The workforce management market's rapid expansion reflects genuine organizational needs, but success requires careful evaluation of options rather than simply following market trends. Leaders must ensure their technology investments align with their human capital strategy and long-term business objectives.

The fundamental question every organization must answer is whether they're using workforce management technology to optimize their people or optimizing their technology to manage people. This distinction determines whether technology enhances organizational capabilities or becomes a constraint on growth and innovation.

The $9.8 billion market projection by 2032 represents significant opportunity, but only for organizations that can successfully navigate the intersection of technology capability and human potential. The decisions made today will determine whether organizations are prepared for tomorrow's workforce challenges.

Success in workforce management requires balancing technological capabilities with human needs, understanding market dynamics while maintaining focus on organizational objectives, and building sustainable solutions that support long-term growth rather than just addressing immediate operational challenges.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5811

Contact Us:

Meticulous Research®

Email- sales@meticulousresearch.com

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness