UAE Health Insurance Market Trends, Growth, and Demand Forecast 2025-2033

UAE Health Insurance Market Overview

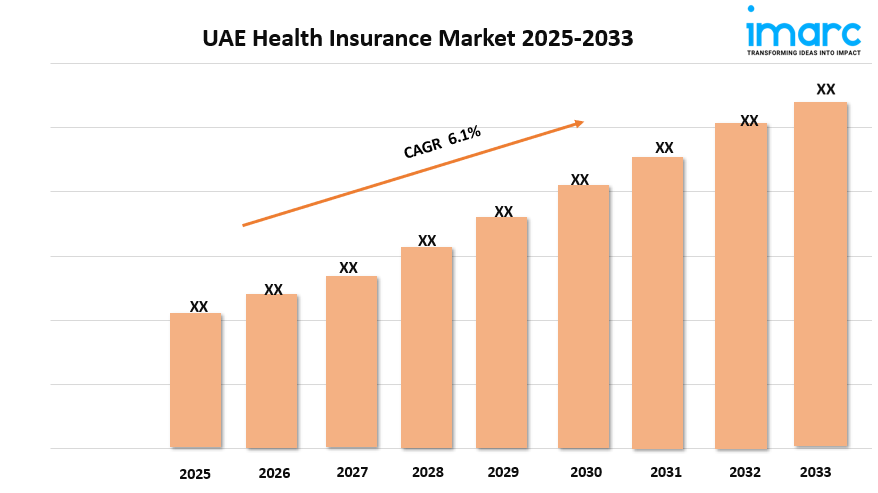

Market Size in 2024: USD 8.72 Billion

Market Size in 2033: USD 14.9 Billion

Market Growth Rate 2025-2033: 6.1%

According to IMARC Group's latest research publication, "UAE Health Insurance Market Size, Share, Trends and Forecast by Type, and Service Provider, 2025-2033", the UAE health insurance market size was valued at USD 8.72 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.9 billion by 2033, exhibiting a CAGR of 6.1% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/uae-health-insurance-market/requestsample

Growth Factors in the UAE Health Insurance Market

- Mandatory Health Insurance Policies

The UAE government’s implementation of mandatory health insurance schemes has significantly expanded the market by ensuring that all residents, particularly in Dubai and Abu Dhabi, have coverage. For instance, the Dubai Health Insurance Law requires employers to provide insurance for their employees, creating a broad customer base. This policy not only boosts market penetration but also fosters a culture of healthcare access. By mandating coverage, the government reduces financial barriers to medical services, encouraging more individuals to seek preventive and curative care, which in turn drives demand for diverse insurance products tailored to various workforce segments.

- Rising Healthcare Costs

Escalating healthcare expenses, fueled by advanced medical technologies and specialized treatments, are pushing residents to seek insurance to mitigate financial risks. For example, treatments for chronic conditions like diabetes, prevalent in the UAE due to lifestyle changes, require ongoing care, making insurance a necessity. This trend is evident in the increasing enrollment in private insurance plans that cover high-cost procedures. As medical costs rise, individuals and employers recognize the value of comprehensive coverage to avoid out-of-pocket expenses, thereby expanding the market as insurers offer innovative plans to address these financial pressures.

- Growing and Diverse Population

The UAE’s population growth, driven by a large expatriate community, has increased the need for health insurance. Expatriates, who often require insurance for residency visas, form a significant market segment. For example, in Abu Dhabi, the government provides coverage for nationals, while private insurers cater to expatriates with tailored plans. This demographic diversity demands varied insurance products, from basic to premium coverage, to meet different cultural and healthcare needs. The influx of medical tourists further amplifies demand, as they seek insurance to access the UAE’s world-class medical facilities, boosting market growth.

Key Trends in the UAE Health Insurance Market

- Digital Transformation in Insurance Services

Insurers are leveraging technology to enhance customer experiences through digital platforms, mobile apps, and telemedicine services. For instance, Abu Dhabi National Insurance Company (ADNIC) offers online quote and claim submission features, streamlining processes. This trend improves accessibility, allowing policyholders to manage policies and access healthcare remotely. Digital tools also enable insurers to analyze data for personalized offerings, increasing customer satisfaction. As technology adoption grows, insurers are investing in AI and blockchain to reduce fraud and improve efficiency, reshaping the market into a more transparent and user-friendly ecosystem.

- Focus on Preventive and Wellness Programs

There is a growing emphasis on preventive healthcare and wellness initiatives to improve policyholder health and reduce long-term costs. Insurers like Daman have introduced programs offering fitness incentives and health screenings to encourage proactive health management. These initiatives align with the UAE’s vision of a healthier population and appeal to health-conscious residents. By promoting wellness, insurers lower claim frequencies for chronic conditions, creating a win-win scenario. This trend reflects a shift from reactive to preventive care, fostering a holistic approach to healthcare within the insurance market.

- Strategic Partnerships and Innovation

Insurers are forming partnerships with healthcare providers and insurtech firms to offer innovative solutions. A notable example is Dubai National Insurance’s collaboration with Takalam, a mental health platform, to provide counseling services through a mobile app. Such partnerships expand service offerings, addressing diverse needs like mental health support. Additionally, insurers are introducing value-based insurance models and wearable health devices to monitor policyholder health. These collaborations enhance market competitiveness by delivering customized, technology-driven solutions, attracting new customers, and retaining existing ones in a crowded market.

The UAE health insurance market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

UAE Health Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

- Individual

- Group

Analysis by Service Provider:

- Public

- Private

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The UAE health insurance market is poised for robust growth, driven by ongoing government support, technological advancements, and increasing awareness of insurance benefits. The government’s commitment to mandatory coverage and healthcare infrastructure development will continue to expand the market, while innovations like AI-driven claims processing and telemedicine will enhance accessibility and efficiency. Rising healthcare costs and a diverse population will sustain demand for tailored insurance products. However, challenges such as limited coverage in basic plans and regulatory complexities must be addressed to ensure inclusivity. With strategic partnerships and a focus on preventive care, the market is set to evolve into a dynamic, customer-centric ecosystem, reinforcing the UAE’s position as a regional healthcare hub.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness