India Personal Loan Market Analysis by Size, Share, Trends and Forecast (2025–2033) | UnivDatos

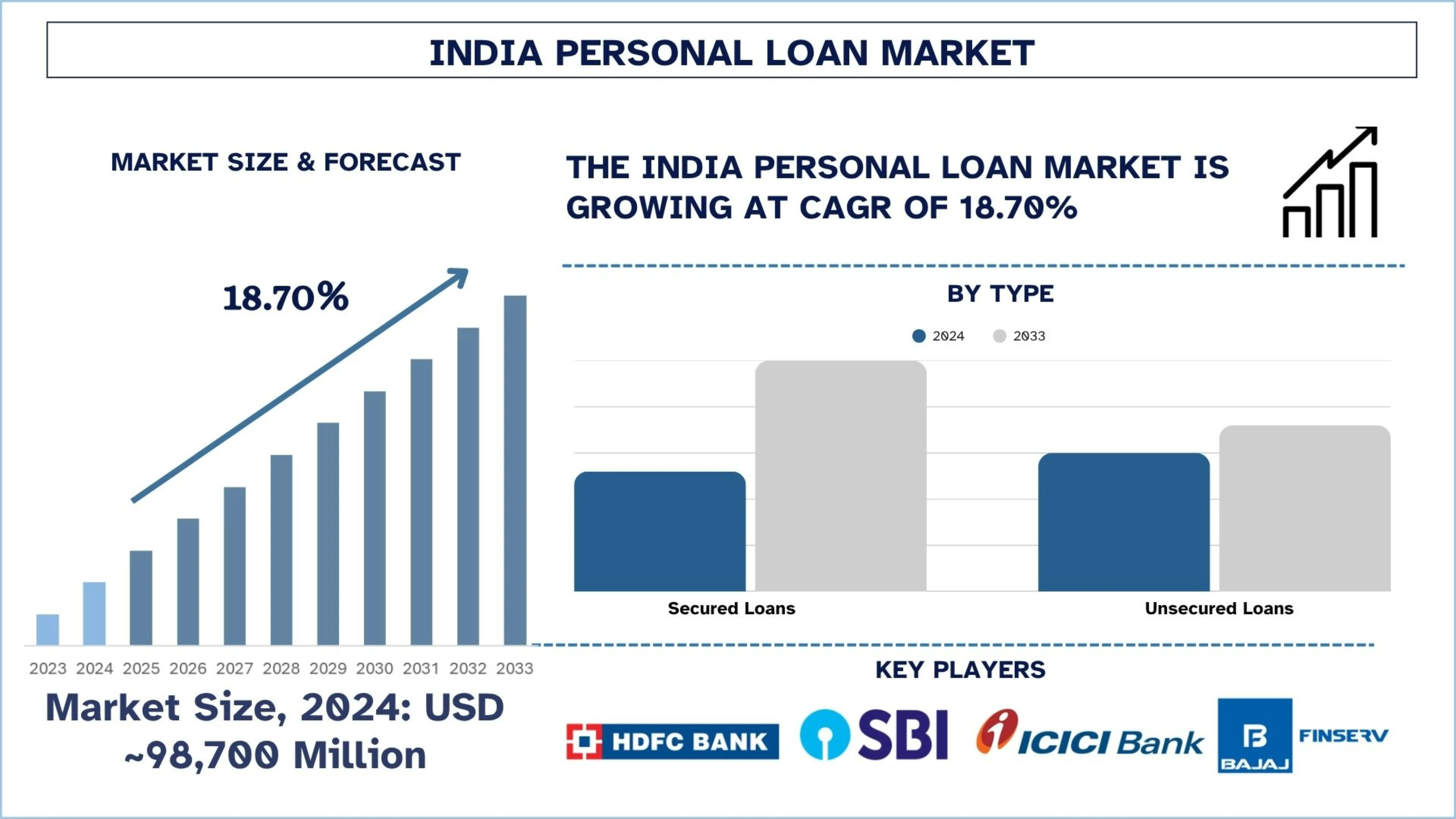

According to the UnivDatos, the rising urbanization and middle-class expansion, digitization of lending services, increase in consumer spending, simplified KYC and credit assessment, growth in Tier II and Tier III cities, expanding credit access to millennials and Gen Z, rising penetration of NBFCs and FinTechs drive the India Personal Loan market. As per their “India Personal Loan Market” report, the Indian market was valued at USD ~98,700 million in 2024, growing at a CAGR of about 18.70% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The Indian personal loan landscape is changing rapidly: digitization, changing consumer demands, and ecosystem dynamics, defining the future of loans. The regulated and traditional disbursement model of credit options relies on in-person banking, but now we have a dynamic, on-demand, technology-driven segment of retail finance. Fintech innovations, increasing availability of credit in Tier II and III cities, and increasing appetite of young Indians for aspirational consumption are fuelling this change.

In recent years, personal loans — among salaried professionals and millennials — have seen a big jump in unsecured credit, particularly in India. This demand has a large component of needing funds for lifestyle purposes, education, home renovation, weddings, and to consolidate the debt that they may have taken from nontraditional lenders. Societal attitudes have changed, while credit awareness is more thorough, so borrowing is no longer the bad thing it used to be. Rather, it’s now an instrument of personal empowerment and a piece of financial planning.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-personal-loan-market?popup=report-enquiry

Financial Inclusion with Alternative Data

In addition, the use of data analytics and the possibilities of alternate credit assessment mechanisms have enabled lenders to extend coverage. But most fintechs are also now beginning to evaluate borrower credibility by unconventional indicators like mobile phone usage, digital payment history, and patterns of utility bill payments. Credit access has been widened, especially for individuals with a thin credit file or no prior borrowing history.

Laws & Regulatory Guidelines for Personal Loans in India

Regulatory Update on RBI’s Consolidated Digital Lending Framework – May 2025

The Reserve Bank of India (RBI) issued comprehensive and consolidated guidelines titled Reserve Bank of India (Digital Lending) Directions, 2025 vide circular RBI/2025-26/36 dated May 8, 2025. These Directions supersede and replace earlier regulations, including:

· The Guidelines on Digital Lending dated September 2, 2022 [RBI/2022- 23/111/DOR.CRE.REC.66/21.07.001/2022-23], and

· The Guidelines on Default Loss Guarantee (DLG) dated June 8, 2023 [RBI/2023- 24/41/DOR.CRE.REC.21/21.07.001/2023-24].

These new Directions aim to consolidate the digital lending framework while introducing important clarifications and refinements that strengthen customer protection, transparency, data privacy, and governance of Lending Service Providers (LSPs).

Rise of Digital Platform Lending

Digital platforms are making one of the biggest shifts in the Indian personal loan sector, as they become increasingly dominant. Now you can have a paperless loan journey with traditional banks, NBFCs, or fintech companies through their mobile apps and websites. Where the days of processing what we’re talking about are now done in a matter of minutes. Improvements in the speed, convenience, and penetration of personal loans, particularly for underserved and new to credit segments, have been realized through increasingly relying on digital KYC, capturing user behavior and user spending through AI-driven credit scoring and offerings of pre-approved personal loans.

Innovation in Fintech and Embedded Credit

The digital lending space has also risen with greater competition in the ecosystem. While older generations have loyalty for established banks due to the sheer trust building, the fresh generation of consumers prefers fintechs that offer better terms, slicker interfaces, and fast disbursal. The e-commerce trends have fueled Buy Now, Pay Later (BNPL) startups as well as startups offering embedded lending and virtual short-term credit at the point of sale. These credit models are pioneering new ways of lending, allowing customers to separate payments from classic loan cases, extending lending far beyond the standard lending model.

Prospective Reframing of Settlement

There is also geographical diversification of the personal loan market. As the penetration of better smartphones and internet connectivity in rural markets is rising, so is the credit demand in nonmetro and semi-urban regions. Other than that, the infrastructure gap is also being bridged between urban and rural credit accessibility, which results in the availability of finance for the rural poor, due to government initiatives on digital finance and financial literacy. For shapes of credit products and customer support adapted to the needs of rural borrowers, vernacular apps and localized customer support, lenders are now targeting these regions.

Home loans should be oriented toward Niche Borrower segments.

Additionally, lenders increasingly are targeting niche segments like women borrowers, gig economy workers, and students. To lure these categories, these categories are getting special schemes and pre-approved offers with flexible repayment options. In addition to salaried individuals in the private sector or startups, fintechs are actively targeting salaried individuals in the private sector and the startup side because they are likely to have a regular income with a relatively lower risk profile.

Click here to view the Report Description & TOC https://univdatos.com/reports/india-personal-loan-market

Next-Gen Lending in India

The Indian personal loan sector is forecasted to mature with deeper cooperation between fintech and banks, a tighter regulatory framework, and the start of new business models such as embedded credit and loyalty-based financing. The credit decision and fraud prevention would continue to involve AI, machine learning, and blockchain to make them more secure. Essentially, the Indian personal loan market is showing the same digital-first, customer-driven, and inclusive change that is now underway in the country’s entire financial ecosystem. The market will only get more attuned to the evolving aspirations of the Indian borrower and more efficient, more transparent, as lenders continue to innovate and adapt.

Related Report:-

India Fintech Market: Current Analysis and Forecast (2024-2032)

Electronic Bill Presentment and Payment Market: Current Analysis and Forecast (2022-2028)

Global Digital Payment Market: Current Analysis and Forecast (2020-2026)

Payment as a Service Market: Current Analysis and Forecast (2022-2028)

India Buy Now Pay Later Market: Current Analysis and Forecast (2025-2033)

Micro Lending Market: Current Analysis and Forecast (2022-2028)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness