Egypt Banking Market Size, Growth, Trends, and Forecast 2025-2033

Egypt Banking Market Overview

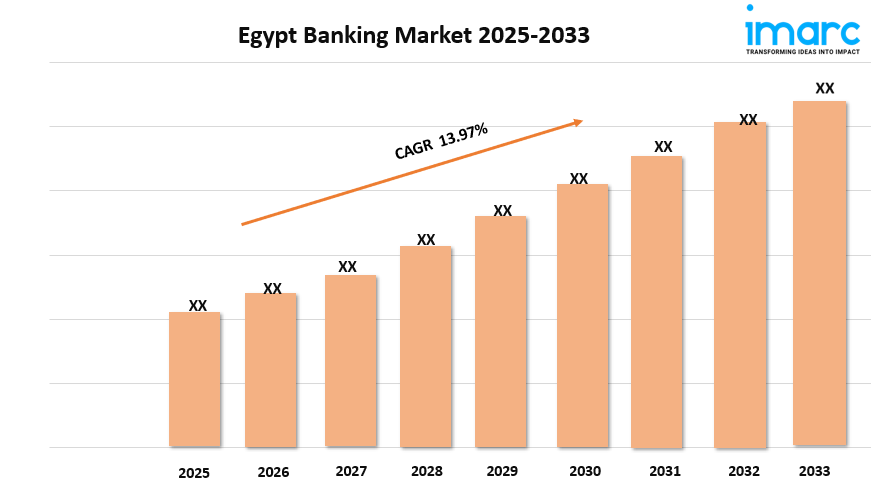

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 13.97% (2025-2033)

Egypt financial sector is growing steadily. This growth comes from economic reforms and digital changes. Increased investor confidence and innovation are shaping a more dynamic and inclusive landscape. According to the latest report by IMARC Group, the Egypt banking market size is projected to exhibit a growth rate (CAGR) of 13.97% during 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/egypt-banking-market/requestsample

Egypt Banking Industry Trends and Drivers:

The banking sector in Egypt is changing fast. Quick digitalization and shifting consumer preferences fuel this change. Financial institutions are using advanced technologies more and more. They are adopting mobile banking apps, contactless payments, and AI-driven customer service tools. These tools help improve accessibility and convenience for customers. This change comes from a tech-savvy crowd, especially younger people. They want banking solutions that are easy and mobile. Banks are investing a lot in cybersecurity. This helps guard against growing digital threats and keeps trust in online platforms. Also, the drive for financial inclusion is changing the market. Banks are connecting with underserved rural areas. They offer microfinance and special loan products. Fintech startups are partnering with traditional banks. This helps banks offer new services like peer-to-peer lending and digital wallets. The mix of technology and inclusivity is creating competition. Banks want to stand out with personalized services and better user experiences. This focus is making Egypt's banking sector a regional leader in innovation.

Regulatory reforms and economic diversification are changing Egypt’s banking scene. They boost resilience and growth. The government's focus on updating financial systems has made banking easier. Now, loan approvals are simpler, and credit scoring is better. This helps small and medium businesses access funds with greater ease. Islamic banking is growing fast. This is due to the high demand for Sharia-compliant products. Banks are also offering new solutions, such as Sukuk bonds and Islamic microfinance. Sustainability is becoming important. Banks are now using environmental, social, and governance criteria in their lending. This change helps support eco-friendly projects. Foreign investment is growing, and regional collaborations are increasing too. Global banks want to access Egypt’s strategic market position. These trends show a strong and flexible banking sector. It meets the changing needs of various customers. It also helps achieve broader economic goals.

Egypt Banking Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Egypt banking market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Type Insights:

- Retail Banking

- Commercial Banking

- Investment Banking

Provider Insights:

- Commercial Banks

- Community Banks

- Credit Unions

- Others

Service Insights:

- Investment Services

- Insurance Services

- Tax and Accounting Services

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness