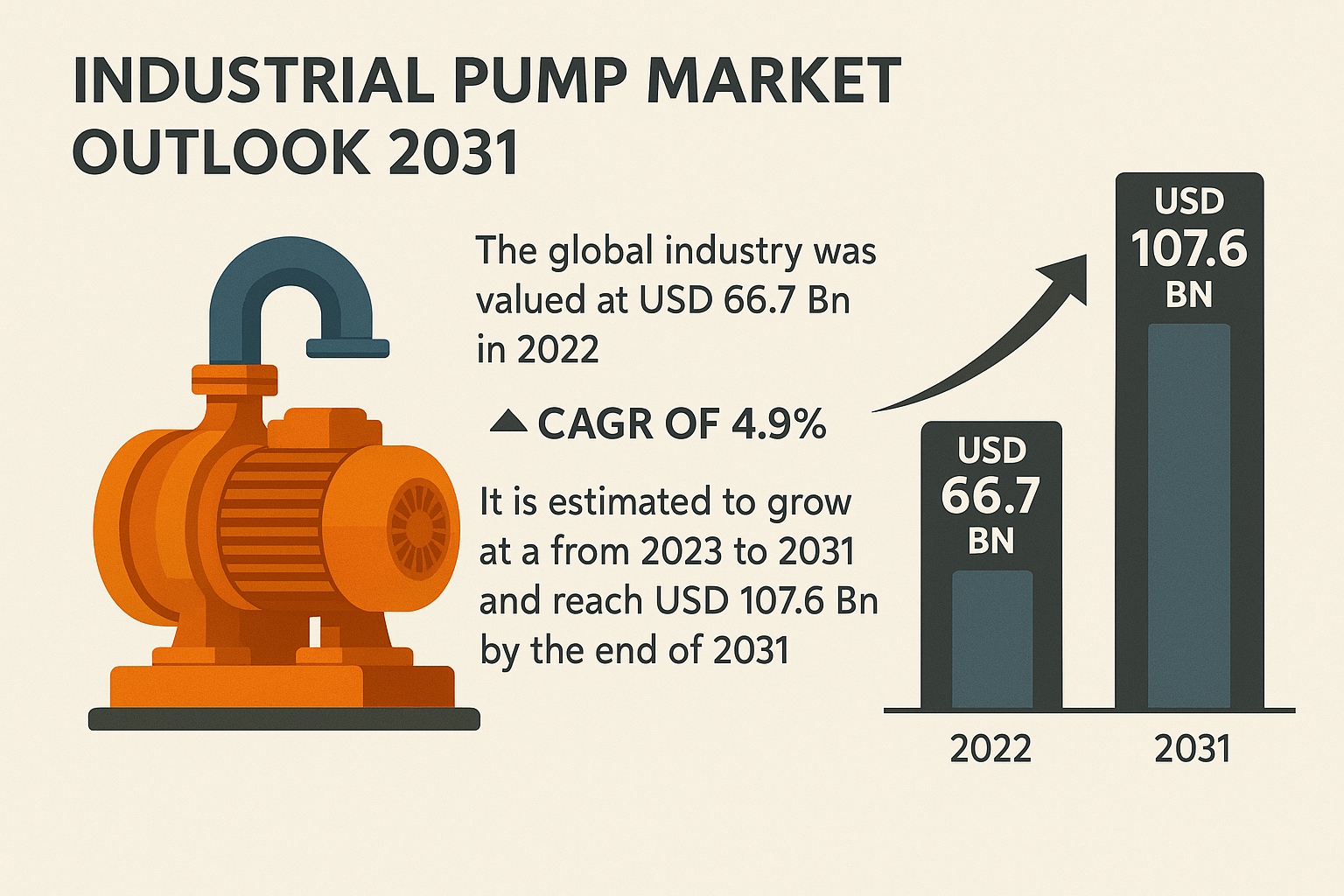

Industrial Pump Market to Reach USD 107.6 Billion by 2031, Growing at 4.9% CAGR

The global industrial pump market was valued at USD 66.7 billion in 2022 and is projected to reach USD 107.6 billion by 2031, expanding at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2031. This growth is driven by increasing demand across sectors such as water and wastewater treatment, oil and gas, chemical processing, and power generation, as industries continue to focus on efficiency, automation, and infrastructure development.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=66917

Market Segmentation

The industrial pump market can be segmented based on various factors, providing a comprehensive view of its intricate landscape:

By Pump Type:

- Centrifugal Pumps: This segment typically holds the largest market share due to their versatility, reliability, cost-efficiency, and ease of setup and maintenance. They are widely used for high flow rates and moderate-to-high pressures.

- Positive Displacement Pumps: These include:

- Reciprocating Pumps: Diaphragm, Piston, Plunger pumps, often used for high-pressure applications or precise dosing.

- Rotary Pumps: Gear, Lobe, Vane, Progressive Cavity, Screw pumps, known for handling viscous and abrasive fluids.

- Other Pumps: This can include specialized pumps like axial flow, mixed flow, and peripheral pumps.

By Horsepower/Power:

- Below 50 HP

- 50-500 HP (often dominates the market)

- 501-1,000 HP

- 1,001-2,000 HP

- Above 2,000 HP

By End-user Industry/Application:

- Water & Wastewater Treatment: A significant driver of the market due to increasing global water scarcity and the need for efficient water management systems, including chemical dosing, sludge management, and filtration.

- Oil & Gas: Crucial for exploration, production, refining, and transportation of crude oil, natural gas, and petrochemical products.

- Chemical & Petrochemicals: Essential for fluid transfer, processing, and circulation of complex and often hazardous fluids.

- Power Generation: Used for circulating cooling water, boiler feed water, and maintaining thermal control in power plants.

- Mining: Involved in dewatering, slurry transport, and other fluid handling tasks in mining operations.

- Food & Beverage: Requires sanitary pumps for fluid transfer and processing to maintain clean and hygienic conditions.

- Construction & Building Services: For transferring cement slurry, sludge handling, and concrete washout treatment.

- Agriculture: For irrigation and other water management needs.

- Pharmaceuticals: For precise fluid handling in sterile environments.

- Manufacturing: Across various manufacturing processes for fluid management.

By Sales Channel:

- Direct

- Indirect

Regional Analysis

Geographically, the industrial pump market is distributed across several key regions:

- Asia-Pacific: Expected to dominate the market and exhibit the highest growth rate during the forecast period. This is primarily due to rapid industrialization, burgeoning infrastructure development, increasing urbanization, and significant investments in water and wastewater treatment facilities in countries like China, India, and Southeast Asia.

- North America: Accounts for a substantial share, driven by strong industrial activity in the oil & gas, chemical, and construction sectors, along with investments in hydraulic fracturing and the need to replace aging infrastructure. The U.S. leads the market in this region.

- Europe: A mature market with significant demand from chemical and petrochemical industries, and a growing emphasis on energy-efficient solutions and advanced technologies.

- Middle East & Africa: Growth is driven by investments in oil & gas projects, infrastructure development, and growing water scarcity issues leading to increased demand for water treatment.

- South America: Witnessing growth with expanding industrial bases and infrastructure projects.

Market Drivers and Challenges

Market Drivers:

- Rapid Industrialization and Urbanization: Expanding manufacturing, construction, and utility sectors, particularly in emerging economies, fuel demand for efficient fluid management solutions.

- Increasing Demand for Water & Wastewater Treatment: Growing population, environmental concerns, and global water scarcity necessitate investments in water infrastructure and treatment plants, boosting pump demand.

- Growth in Oil & Gas and Chemical Industries: Rising global energy consumption, increasing petrochemical production, and complex refining processes demand robust and specialized pumps.

- Technological Advancements: Innovations in pump design, materials, and digital integration are leading to more efficient, reliable, and intelligent pumping systems.

- Emphasis on Energy Efficiency and Sustainability: Regulatory pressures and the drive to reduce operational costs are prompting the adoption of energy-efficient pumps with advanced motor technologies and variable speed drives.

- Infrastructure Investments: Government initiatives and private investments in large-scale infrastructure projects, including smart cities, power generation, and transportation, contribute to market growth.

Market Challenges:

- High Initial Capital and Maintenance Costs: Especially for sophisticated or customized pump systems, the substantial upfront expenditure can be a barrier for small and medium-sized firms.

- Fluctuating Raw Material Prices: Volatility in material costs can impact manufacturing expenses and overall profitability.

- Complexity of Pump Customization: Tailoring pumps for specific industrial needs can be complex and add to costs.

- Regulatory Hurdles: Stringent environmental and safety regulations can increase compliance costs and development complexities.

- Competition: The market is fragmented with numerous players, leading to intense competition and pressure on pricing.

Market Trends

The industrial pump market is undergoing significant transformation, characterized by several key trends:

- Digitization and IoT Integration: Pumps are increasingly equipped with sensors and connectivity features, enabling real-time monitoring of parameters like pressure, temperature, and vibration. This facilitates predictive maintenance, optimizes performance, and reduces downtime and operational costs.

- Variable Speed Drives (VFDs) and Energy Efficiency: Adoption of VFDs allows pumps to adjust their speed based on demand, leading to significant energy savings and reduced operational costs. Manufacturers are prioritizing the development of pumps with lower energy consumption and extended lifespans.

- Smart Pumping Systems and Automation: Integration of IoT, data analytics, AI, and automation enhances operational efficiency, minimizes downtime, and enables remote monitoring and control.

- Digital Twins: Virtual representations of physical pumps allow for real-time monitoring, analysis, and simulation, aiding in predictive maintenance, performance optimization, and troubleshooting.

- Advanced Materials and Coatings: Use of high-performance materials and specialized coatings (e.g., ceramics, advanced alloys) enhances durability, corrosion resistance, and performance in harsh conditions, leading to longer pump lifetimes and reduced maintenance.

- Hybrid and Solar-Powered Pumps: The push for sustainability and renewable energy is driving the development of hybrid and solar-powered pumping systems, particularly suitable for remote and off-grid applications.

- Miniaturization: In specific applications, such as medical technology, there's a trend towards miniaturized diaphragm pumps for portable and wearable devices.

- Focus on Aftermarket Services: Companies are increasingly offering comprehensive aftermarket services, including maintenance, repairs, and spare parts, to maximize the lifespan and efficiency of pumps.

Future Outlook

The future of the industrial pump market appears robust, with continued growth expected across all application areas. The increasing adoption of Industry 4.0 principles, including automation, IoT, and AI, will further revolutionize the sector, leading to more intelligent, self-optimizing pumping systems. The demand for energy-efficient and sustainable solutions will intensify, driving innovation in pump design and materials. Emerging economies will remain key growth drivers, while developed regions will focus on upgrading existing infrastructure and adopting advanced technologies. The market is likely to see further consolidation through mergers and acquisitions as companies seek to expand their product portfolios, technological capabilities, and geographical reach.

Key Market Study Points

- Market Growth Drivers: Understand the primary factors fueling market expansion, such as industrialization, infrastructure development, and demand for water/wastewater treatment.

- Technological Innovations: Identify the impact of IoT, AI, VFDs, and advanced materials on pump performance and efficiency.

- Regional Dynamics: Analyze the differing growth rates and opportunities across key regions like Asia-Pacific, North America, and Europe.

- Competitive Strategies: Examine how leading players are leveraging product innovation, partnerships, and M&A to gain market share.

- Sustainability Imperatives: Assess the influence of energy efficiency regulations and the shift towards eco-friendly pumping solutions.

Competitive Landscape

The industrial pump market is characterized by a moderate degree of concentration with a mix of large global players and numerous regional and local manufacturers. Key players are actively engaged in strategic initiatives such as:

- Mergers and Acquisitions (M&A): Companies acquire smaller entities to expand product portfolios, technological capabilities, and geographical presence. For instance, KSB acquired Bharat Pumps and Compressors' technology in March 2023 to strengthen its foothold, and Ingersoll Rand acquired Air Power Systems, Blutek, and UT Pumps & Systems.

- Product Innovation and Launches: Continuous investment in R&D to develop advanced, energy-efficient, and smart pumps. Examples include Xylem launching an e-80SCXL vertical in-line centrifugal pump with a modular monitoring system (November 2023) and Grundfos introducing new generations of large CR pumps.

- Partnerships and Collaborations: Forming alliances to develop integrated solutions and expand market reach. Wilo SE partnered with Siemens in November 2023 to develop AI-powered and digitally optimized pumps, and Flowserve Corporation partnered with Gradiant for water and wastewater treatment solutions (March 2022).

- Focus on Aftermarket Services: Providing comprehensive support to optimize pump performance and extend lifespan.

Prominent companies in the industrial pump market include:

- Alfa Laval AB

- Dover Corporation

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holdings A/S

- Ingersoll Rand Inc.

- ITT Inc.

- KSB SE & Co. KGaA

- Kirloskar Brothers Limited

- Pentair Industries Inc.

- SPX Flow Inc.

- Sulzer Ltd.

- The Weir Group PLC

- Wilo Group

- Xylem Inc.

Recent Developments

- March 2024: ITT Inc. announced a multi-million-dollar investment in developing advanced digitally enabled pumps, integrating IoT, AI, and machine learning.

- January 2024: SPX Flow Waukesha Cherry Burrell Brand introduced the Universal 2 and Positive Displacement Pump (U2 N D) series for industrial users.

- November 2023: Xylem launched an e-80SCXL vertical in-line centrifugal pump equipped with a modular pump condition monitoring system.

- November 2023: Wilo SE partnered with Siemens to develop AI-powered and digitally optimized pumps.

- March 2023: KSB completed the acquisition of Bharat Pumps and Compressors' technology to strengthen its market position.

- February 2023: Grundfos introduced the latest range of solar-powered SQFlex series pumps for agricultural irrigation.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=66917<ype=S

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness