Autonomous Drones Market Size, Growth Outlook, and Industry Analysis

The Global Autonomous Drones Market is witnessing rapid expansion as industries, government agencies, and commercial enterprises increasingly adopt unmanned aerial systems capable of performing complex missions with minimal human intervention.

Autonomous drones leverage advanced technologies such as artificial intelligence (AI), machine learning, computer vision, and sophisticated navigation algorithms to execute tasks in logistics, agriculture, public safety, infrastructure inspection, and defense. Rising demand for operational efficiency, enhanced data acquisition, and reduced human‑risk exposure are key drivers underpinning adoption across diverse sectors worldwide.

Advancements in sensor technology, communication protocols, and power‑efficient propulsion systems—alongside supportive regulatory frameworks for beyond‑visual‑line‑of‑sight (BVLOS) and automated operations—are accelerating commercial deployment. Integration with cloud analytics, edge computing, and autonomous decision‑making architectures is further transforming the capabilities and application reach of autonomous drones.

Market Overview

The autonomous drones market comprises unmanned aerial vehicles (UAVs) outfitted with autonomous capabilities that enable self‑navigation, object avoidance, mission planning, and real‑time decision making. These systems reduce dependency on constant human control, allowing for programmable and adaptive operations across complex environments.

Autonomous drones vary from fixed‑wing platforms for wide‑area surveillance and mapping to multi‑rotor systems optimized for precision tasks such as crop monitoring, infrastructure inspection, and delivery. They integrate sensors (LiDAR, radar, RGB/IR cameras), GPS/INS systems, onboard AI processors, and communication modules to support autonomy, situational awareness, and safe airborne behavior.

Definition and Market Significance

Autonomous drones refer to unmanned aerial systems capable of perceiving, planning, and executing flight operations without continuous human input. They rely on embedded intelligence, autonomous navigation algorithms, and environmental awareness sensors to perform complex tasks, avoid obstacles, and adapt to dynamic conditions.

The significance of the market lies in the transformative potential of autonomous drones to improve operational performance, increase safety, reduce costs, and enable new services across multiple industries. From accelerating last‑mile logistics to enhancing precision agriculture and augmenting emergency response, autonomous UAVs are redefining aerial capabilities and data acquisition paradigms.

Market Drivers

A principal driver of the autonomous drones market is the growing adoption of automation and robotics across industry verticals seeking greater efficiency, accuracy, and operational scalability. Autonomous drones support repetitive, high‑risk, or remote tasks that would be cost‑prohibitive or unsafe for human operators.

Demand for real‑time aerial data—such as high‑resolution imaging, multispectral sensing, and geospatial mapping—fuels investment in autonomous platforms that can execute missions with minimal oversight. Integration with AI and machine learning enhances on‑board decision making, enabling drones to interpret sensor data, detect anomalies, and autonomously adjust flight paths.

The expansion of e‑commerce and demand for rapid delivery solutions are also propelling interest in autonomous delivery drones capable of BVLOS operations. In addition, defense and public safety agencies seek autonomous systems for surveillance, search & rescue, perimeter monitoring, and tactical reconnaissance.

Market Trends

A key trend in the autonomous drones market is the advancement of BVLOS capabilities that allow drones to operate beyond the pilot’s visual range using redundant navigation systems, automated detect‑and‑avoid technologies, and secure communication links. Regulatory bodies in major markets are increasingly defining frameworks that support certified BVLOS operations for commercial services.

There is also a rising trend toward swarm and collaborative autonomous operations, where multiple UAVs coordinate missions, share sensor data, and optimize coverage for large‑area surveying, disaster response, and infrastructure inspection tasks.

Edge computing integration is enhancing autonomous capabilities by enabling onboard processing of telemetry data, object recognition, and environmental modeling, reducing latency and reliance on continuous ground station connectivity.

Market Restraints

Despite strong growth prospects, the autonomous drones market faces restraints related to regulatory uncertainty, safety and airspace integration challenges, and concerns surrounding privacy and data security. Harmonizing global standards for autonomous UAS operations, especially BVLOS flights and urban air mobility corridors, remains an ongoing challenge.

Battery endurance—limiting flight time—and payload capacity constraints continue to impact mission duration and scalability for heavy‑lift or long‑range applications. Additionally, concerns over cybersecurity threats and unauthorized access to autonomous control systems necessitate robust security architectures and trusted communication protocols.

Market Opportunities

The autonomous drones market presents significant opportunities in advanced logistics and delivery services, particularly for time‑critical medical supplies, e‑commerce parcels, and humanitarian aid in remote regions. Partnerships between drone manufacturers, logistics firms, and regulators can accelerate commercial service rollouts.

Emerging opportunities also exist in precision agriculture, where autonomous UAVs perform automated spraying, crop health monitoring, and yield forecasting at scale. Inspection of critical infrastructure—such as pipelines, power lines, wind turbines, and bridges—offers another high‑growth application, leveraging autonomous navigation and analytical algorithms to reduce inspection time and operational risk.

Integration with digital twin environments, urban air mobility planning, and smart city frameworks further expands potential use cases where autonomous drones provide persistent aerial data and situational awareness.

Product/Technology Segmentation

The autonomous drones market can be segmented by platform type, component technology, autonomy level, application, and end user. Platform types include multi‑rotor, fixed‑wing, hybrid VTOL (vertical take‑off and landing), and tethered UAVs.

Component technologies encompass navigation systems (GPS/INS), LiDAR, RGB/IR cameras, radar, onboard processors, communication modules, and autonomous flight algorithms. Autonomy levels span from semi‑autonomous to fully autonomous systems with decision‑making capabilities.

Application segments include logistics and delivery, agriculture, infrastructure inspection, public safety and emergency response, mapping and surveying, environmental monitoring, and defense & homeland security. End users range from logistics companies, agricultural enterprises, energy & utilities sectors, government agencies, and defense organizations.

Regional Analysis

North America holds a dominant position in the autonomous drones market due to advanced technological infrastructure, supportive regulatory progressions for commercial UAS operations, and extensive adoption across agriculture, logistics, and public safety sectors. The United States leads regional growth with accelerated BVLOS testing, innovation hubs, and strong industry‑academic collaboration.

Europe follows with significant uptake in autonomous drone applications, particularly in precision agriculture, infrastructure inspection, and emergency services, supported by coordinated regulatory frameworks and investments in drone corridor trials.

Asia‑Pacific is emerging as a high‑growth region driven by smart city initiatives, rising interest in autonomous delivery services, and increased defense spending on unmanned systems. China, Japan, South Korea, and Southeast Asian countries are key contributors to regional market expansion.

Latin America and the Middle East & Africa exhibit developing opportunities as infrastructure modernization and adoption of automation technologies scale region‑wide.

Download a Complimentary PDF Sample Report:

https://dimensionmarketresearch.com/request-sample/autonomous-drones-market/

Competitive Landscape

The autonomous drones market is highly competitive, featuring global drone manufacturers, avionics and sensor technology providers, software developers, and service integrators. Key players focus on enhancing autonomous capabilities, expanding product portfolios, and establishing strategic partnerships with industry stakeholders.

Competitive strategies include investments in R&D to improve perception systems, navigational accuracy, AI‑driven decision making, and BVLOS compliance; collaborations with logistics, energy, and public safety sectors for tailored applications; and acquisitions to integrate complementary technologies and expand geographic reach.

Technological Advancements

Technological advancements in the autonomous drones market include improvements in onboard AI processors, robust detect‑and‑avoid systems, advanced LiDAR and radar sensing, and secure encrypted communication protocols that enhance autonomous performance. Progress in energy‑dense batteries, hybrid propulsion, and solar‑assisted power systems are gradually extending flight endurance.

Software advancements—such as autonomous mission planning tools, digital twin integration, real‑time SLAM (simultaneous localization and mapping), and cloud‑based analytics—enable sophisticated autonomous operations across dynamic environments and multi‑drone coordination.

Consumer Adoption Patterns

Adoption of autonomous drones varies by sector and user expertise. Commercial enterprises in logistics, agriculture, and infrastructure prioritize systems that deliver operational efficiencies, regulatory compliance, and demonstrable ROI. Government and defense sectors adopt autonomous UAVs for surveillance, border security, and disaster mitigation where human risk reduction is vital.

Early adopters seek interoperability with existing enterprise systems and strong after‑sales support, while mid‑market and emerging users increasingly embrace as‑a‑service and managed autonomous drone offerings that lower entry barriers.

Regulatory and Policy Environment

Regulatory and policy environments play a crucial role in autonomous drones adoption, with authorities establishing frameworks for airspace integration, BVLOS operations, safety standards, and operator certification. The US FAA, EASA in Europe, and equivalent bodies in Asia‑Pacific are progressing regulatory pathways that support scalable autonomous missions while safeguarding public safety and national airspace sovereignty.

Policies that encourage unmanned traffic management (UTM) systems, digital identification requirements, and spectrum allocation for UAS communications further enable complex autonomous operations.

Market Challenges

Key challenges in the autonomous drones market include regulatory alignment across borders, cybersecurity threats, public privacy concerns, and gaps in interoperability standards. Technical barriers—such as limited battery life, reliable obstacle avoidance in cluttered environments, and translation of autonomous research into operational reliability—persist.

Addressing these challenges requires collaboration among regulators, industry consortia, and technology developers to harmonize standards, enhance safety frameworks, and foster innovation in resilient autonomous systems.

Future Outlook

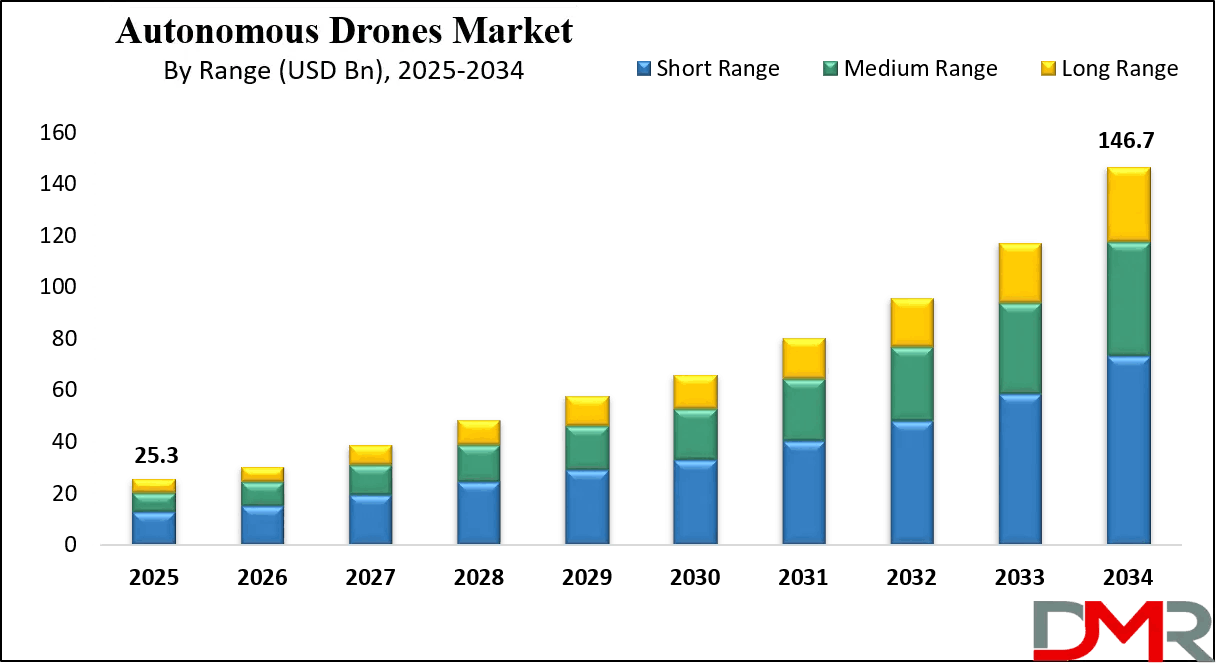

The autonomous drones market is expected to maintain strong growth through 2033 as technological innovations, regulatory progress, and expanding commercial use cases shape future adoption. Continued advancements in AI, sensing systems, autonomous navigation, and energy solutions will enable more reliable and scalable operations across industries.

Ecosystems that integrate cloud services, digital twins, edge computing, and autonomous UAVs will unlock new applications in smart cities, logistics networks, and environmental monitoring, reinforcing drones’ role as versatile automated platforms.

Frequently Asked Questions (FAQs)

What is an autonomous drone?

An autonomous drone is an unmanned aerial vehicle capable of self‑navigating and executing missions with minimal human intervention using onboard intelligence, sensors, and navigation algorithms.

Where are autonomous drones used?

Applications include logistics and delivery, agriculture, infrastructure inspection, public safety, environmental monitoring, mapping, and defense operations.

What technologies enable autonomy?

Key technologies include AI/machine learning, GPS/INS navigation, LiDAR/radar sensing, obstacle avoidance, SLAM, and secure communication systems.

What are key market drivers?

Drivers include demand for automation, real‑time data acquisition, operational efficiency, reduced human risk, and expansion of BVLOS capabilities.

What challenges affect market adoption?

Challenges include regulatory complexity, cybersecurity threats, battery limitations, privacy concerns, and standardized interoperability.

Summary of Key Insights

The global autonomous drones market is poised for substantial growth through 2033 as technological advancements, regulatory evolution, and expanding commercial use cases drive adoption across multiple industries. AI‑enabled capabilities, BVLOS operational frameworks, and integrated data ecosystems will propel autonomous UAVs into mainstream enterprise and government operations.

Purchase the report for comprehensive details:

https://dimensionmarketresearch.com/checkout/autonomous-drones-market/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness