BOPET Price Trend: Global Market Movement and Key Developments in Q3 2025

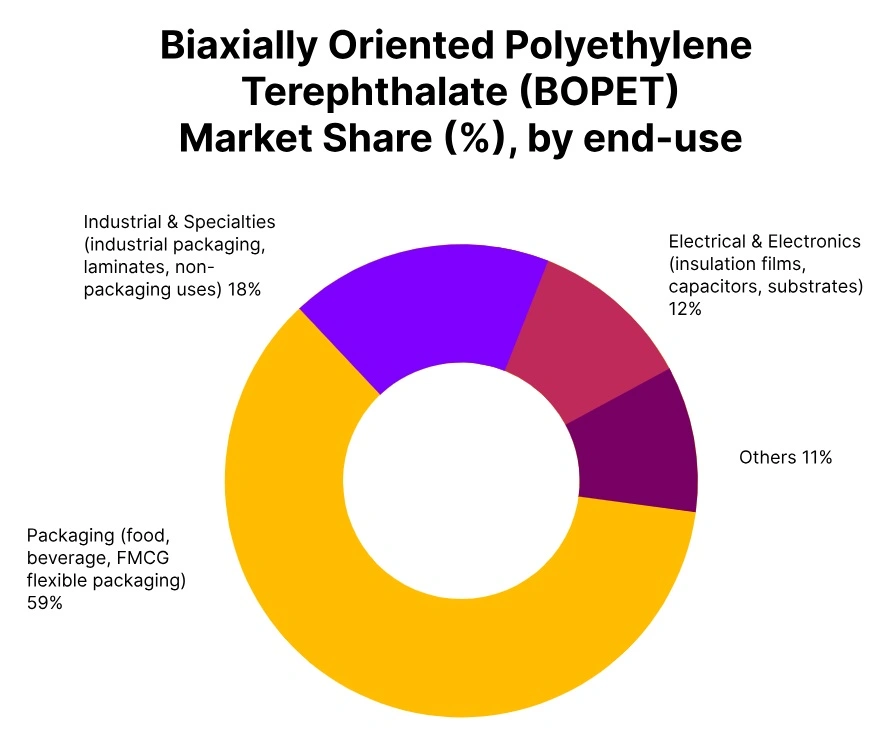

The BOPET Price Trend during the third quarter of 2025 continued to reflect a soft and cautious global market. Across most regions, prices moved lower compared to the previous quarter, as weak demand from packaging converters and limited export activity kept market sentiment under pressure. Biaxially Oriented Polyethylene Terephthalate (BOPET) film is widely used in flexible packaging, lamination, insulation, and industrial applications, making its pricing closely tied to consumer demand, manufacturing activity, and global trade conditions.

In Q3 2025, the global BOPET market recorded an average price decline of around 2% compared to Q2 2025. This decline was not sudden but rather a continuation of the downward movement that began earlier in the year. Buyers across regions remained cautious, placing orders only when necessary and avoiding inventory buildup. As a result, the BOPET Price Trend remained weak throughout the quarter, with limited signs of recovery.

Global Market Overview and Demand Conditions

One of the key themes shaping the BOPET Price Trend in Q3 2025 was persistently weak demand. Packaging converters and industrial users continued to face margin pressure, which led them to adopt conservative procurement strategies. Instead of stocking up, many buyers focused on running down existing inventories.

Producers responded by maintaining moderate operating rates to prevent excess stock accumulation. Even with these adjustments, supply remained sufficient across most markets, adding pressure to prices. Export activity also stayed slow, especially across Asian destinations, as overseas buyers delayed purchasing decisions due to uncertain economic conditions.

Please Submit Your Query For BOPET Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

Feedstock costs for PTA and MEG remained relatively stable during the quarter. While this stability helped producers manage costs, it did not provide enough support to lift prices. In fact, soft feedstock pricing further contributed to the bearish tone, as producers had limited room to push for price increases. Overall, the BOPET Price Trend stayed muted, reflecting subdued trading activity and restrained buying interest.

India: Moderate Decline with Sharp September Correction

In India, the BOPET Price Trend showed a moderate decline during Q3 2025. Domestically traded BOPET prices in Nashik averaged around USD 1,107 per metric ton, reflecting a 2% drop compared to Q2 2025. The market experienced softer buying sentiment as converters remained cautious due to tight margins.

Demand from packaging and industrial film sectors stayed steady but was not strong enough to absorb available supply. Producers maintained flexible operating rates to manage inventories while competing aggressively on pricing. Feedstock PTA and MEG prices stayed stable, offering limited cost support.

Export activity remained subdued, and global uncertainty further weighed on overseas demand. In September 2025, Indian BOPET prices saw a sharper month-on-month decline of around 6%, pulling the overall quarterly sentiment into slightly bearish territory.

China: Strong Downward Pressure Continues

China experienced one of the sharper declines in the BOPET Price Trend during Q3 2025. Prices fell by around 6% over the quarter, extending the downward momentum from late Q2. Domestic prices reached some of the lowest levels seen in 2025.

Weak demand from flexible packaging, electrical insulation, and industrial lamination sectors played a major role in this decline. Slower domestic consumption and cautious export activity limited order inflows. Stable operating rates among major producers kept supply steady, while limited restocking interest further pressured prices.

The expected seasonal pickup after mid-year holidays did not materialize, keeping sentiment bearish. In September, prices declined by another 2%, reflecting ongoing inventory adjustments and intense price competition.

United States: Demand-Constrained Market

In the United States, the BOPET Price Trend declined by around 2% during Q3 2025. Demand from packaging and industrial film sectors remained soft, with converters hesitant to rebuild inventories amid uncertain economic signals.

Supply conditions remained stable, but limited demand kept prices under pressure. Competitive offers from Asian suppliers, especially from China and South Korea, added to the downward movement. In September, prices declined by approximately 4%, reflecting weak export demand and competitive imports.

Spain: Soft European Market

Spain followed the broader European trend, with BOPET prices declining by around 2% in Q3 2025. Weak demand from flexible packaging and industrial film sectors, along with slow consumer spending, limited buying activity.

Converters adopted cautious procurement strategies, focusing on minimal restocking. Despite stable production levels, the lack of strong downstream demand prevented any meaningful price recovery. In September, prices fell by around 4%, as sellers adjusted offers to stimulate demand.

Philippines: Stable but Slightly Bearish

In the Philippines, the BOPET Price Trend showed a mild decline of around 2% during Q3 2025. Demand from packaging and lamination sectors remained soft, with buyers operating cautiously due to limited end-user consumption.

Regular import availability from China and India kept supply steady, while competitive pricing led to minor downward adjustments. In September, prices declined by another 1%, influenced by lower export quotations from China and soft feedstock costs.

Poland: Sharper European Decline

Poland recorded a sharper decline of around 4% in Q3 2025, making it one of the weaker European markets. Weak demand from packaging and industrial film sectors, combined with broader economic uncertainty, weighed heavily on prices.

An oversupplied European market and competitive imports from Asia intensified price pressure. In September, prices dropped by around 8%, supported by lower feedstock costs and limited restocking activity.

Malaysia: Mildly Bearish Market

In Malaysia, the BOPET Price Trend declined by around 2% during Q3 2025. Sluggish demand from flexible packaging and industrial film sectors, along with high inventories, kept buying interest low.

Competitive offers from China and Thailand limited price recovery, while muted export opportunities further weakened sentiment. In September, prices declined by around 1%, reflecting ongoing softness.

Nigeria: Steep Quarterly Correction

Nigeria saw a significant 5% decline in Q3 2025, driven by weak demand, currency challenges, and limited liquidity among converters. Import activity remained constrained, while competitive Asian pricing added pressure.

In September, prices declined by another 1%, supported by lower feedstock costs and minimal cost pass-through.

United Arab Emirates: Continued Softness

In the UAE, BOPET prices declined by around 5% during Q3 2025. Subdued demand from packaging and industrial film converters, combined with competitive imports from India and China, kept prices under pressure.

Stable freight rates and adequate supply balanced the market but did not support recovery. In September, prices declined by around 1%, reflecting persistent demand weakness.

Overall Market Outlook

Overall, the BOPET Price Trend in Q3 2025 remained under pressure across most global markets. Weak demand, stable-to-soft feedstock costs, and cautious buying behavior shaped a bearish environment. While supply remained balanced, demand recovery was limited. Looking ahead, any improvement in prices will depend on stronger packaging demand, better export activity, and improved consumer spending. Until then, the BOPET market is likely to remain cautious and price-sensitive.

Please Submit Your Query For BOPET Price Trend, Market Analysis and Forecast: https://www.price-watch.ai/book-a-demo/

About Price Watch™ AI

Price-Watch AI is an India-based, independent raw material price reporting agency that provides real-time price forecasts and data-driven insights into global raw material markets. Price-Watch AI specializes in tracking raw material prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand-supply dynamics. The Price-Watch AI platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions. Leveraging AI-powered forecasting and over a decade of historical data, Price-Watch AI transforms market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

LinkedIn: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness