Spain Medical Loupes Market Growth Explained Strategic Tips for New Entrants

Market Overview

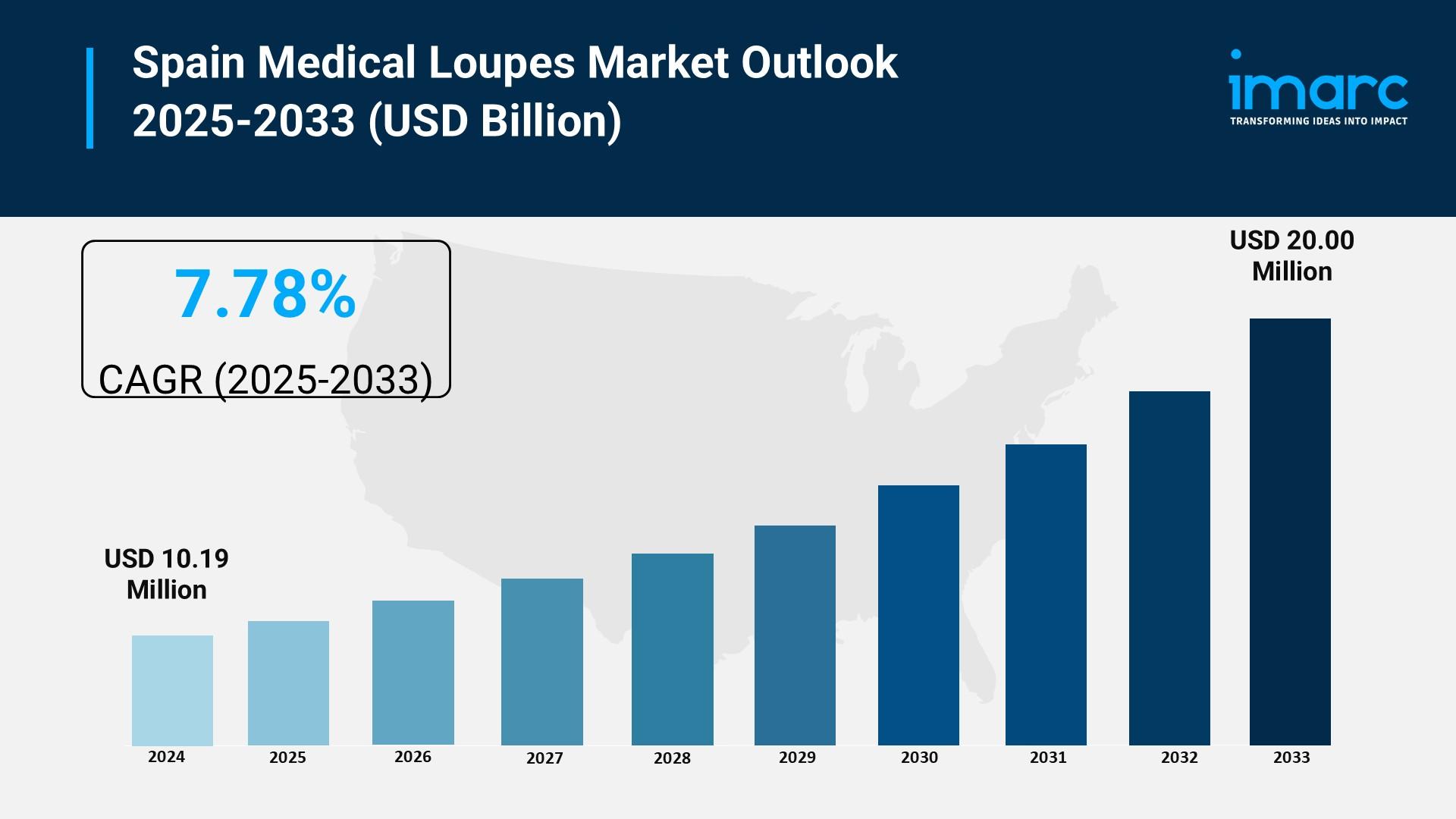

The Spain medical loupes market size was valued at USD 10.19 Million in 2025 and is projected to reach USD 20.00 Million by 2034, growing at a compound annual growth rate (CAGR) of 7.78% during 2026-2034. The market growth is driven by expanding healthcare infrastructure, rising demand for precision optical devices in dental and surgical fields, and increasing ergonomic considerations among healthcare professionals. Rising investments in public and private healthcare and advanced magnification technologies support sustained market expansion across Spain.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Spain Medical Loupes Market Key Takeaways

- The Spain medical loupes market size was valued at USD 10.19 Million in 2025, with a CAGR of 7.78% expected from 2026 to 2034.

- Through-The-Lens (TTL) Loupes dominated the market with approximately 54% revenue share in 2025 due to superior optical alignment, comfort, and lightweight design.

- Up to 3.0x magnification segment led with a 48% market share in 2025, favored for general clinical applications and training.

- Galilean lens types commanded a 70% share in 2025, preferred for cost-effectiveness and compact design.

- Offline distribution channels accounted for about 75% of sales in 2025, attributed to hands-on fitting and professional consultation.

- Dental applications represented 48% market share in 2025, driven by Spain’s extensive dental implant market and dental clinic proliferation.

- Dental clinics accounted for 45% market share, supported by Spain’s robust private dental sector and growing ergonomic device adoption.

Sample Request Link: https://www.imarcgroup.com/spain-medical-loupes-market/requestsample

Market Growth Factors

Expansion of Healthcare Infrastructure and Government Investment

Spain’s ongoing investments in its National Health System (SNS) infrastructure propel the medical loupes market. For example, the University Hospital of Melilla, inaugurated in 2025 with over 150 million euros invested, features state-of-the-art surgical and diagnostic technology, reflecting government commitment to clinical precision and patient care. Continued public healthcare expenditure supports facility upgrades nationally, creating procurement opportunities for advanced visualization equipment manufacturers. Autonomous communities independently investing in specialized medical equipment also drive demand across regions.

Rising Demand for Precision Dental Procedures

Spain's dental implant market growth fuels demand for precision optical devices. According to SEPA, over 17 million dental implants were placed between 2015 and 2024, reflecting a high volume of restorative dental work. The popularity of cosmetic dentistry and minimally invasive techniques also requires magnification devices for enhanced visualization and accurate procedures. Additionally, Spain's expanding dental tourism industry motivates practitioners to equip clinics with advanced medical loupes to meet international patient expectations.

Growing Awareness of Ergonomic Benefits Among Healthcare Professionals

There is increasing recognition of the occupational health benefits of ergonomically designed medical loupes among Spanish healthcare workers. Awareness campaigns focusing on musculoskeletal disorder prevention support magnification device adoption as essential for proper posture during clinical procedures. The Spain dental devices market size of USD 195.62 Million in 2024, expected to grow at a CAGR of 6.07% through 2033, underscores rising demand for ergonomic and precision-enhancing tools. Professional bodies and medical schools also influence increased adoption by recommending magnification use and including loupe training in curricula.

Request Customization:

https://www.imarcgroup.com/request?type=report&id=29272&flag=E

Market Segmentation

Type

- Through-The-Lens (TTL) Loupes: Dominant segment with 54% market share in 2025. Preferred for permanently aligned optical configuration, eliminating repeated adjustments, and offering comfort and efficiency during extended dental and surgical procedures.

Magnification

- Up to 3.0x: Leading magnification segment with 48% share in 2025. Offers versatility across general dental exams, routine surgeries, and training scenarios. Known for wider field of view and reduced user fatigue.

Lens Type

- Galilean: Largest lens type segment holding 70% share in 2025. Valued for compactness, lighter weight, cost-effectiveness, and simplicity, making it suitable for entry-level practitioners and smaller facilities.

Distribution Channel

- Offline: Commands approximately 75% market share as of 2025 due to healthcare professionals’ preference for personalized fitting, consultation, hands-on evaluation, and post-sales support.

Application

- Dental: Major application sector with 48% share in 2025, driven by Spain’s extensive dental implant procedures, expanding dental clinics, and rising precision demands in restorative dentistry.

End User

- Dental Clinics: Primary end-user segment with 45% share in 2025, supported by Spain’s large private dental sector, increasing patient volumes, and practitioners’ awareness of ergonomic benefits.

Regional Insights

Northern Spain leads the medical loupes market in terms of demand, buoyed by the Basque Country’s advanced healthcare infrastructure and top-ranked health services. Established hospitals in Galicia, Cantabria, and Asturias also contribute to steady market demand. Regional investments and emphasis on high quality care drive magnification device adoption among dental and surgical professionals.

Recent Developments & News

In February 2025, it was reported that Spain performed more than 17 million dental implants over the past decade, reflecting rising demand for high-precision dental procedures. The increasing complexity of oral surgeries is encouraging clinicians to adopt advanced visualization tools, boosting demand for medical loupes. This trend enhances procedural precision and efficiency among dental professionals nationwide.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness