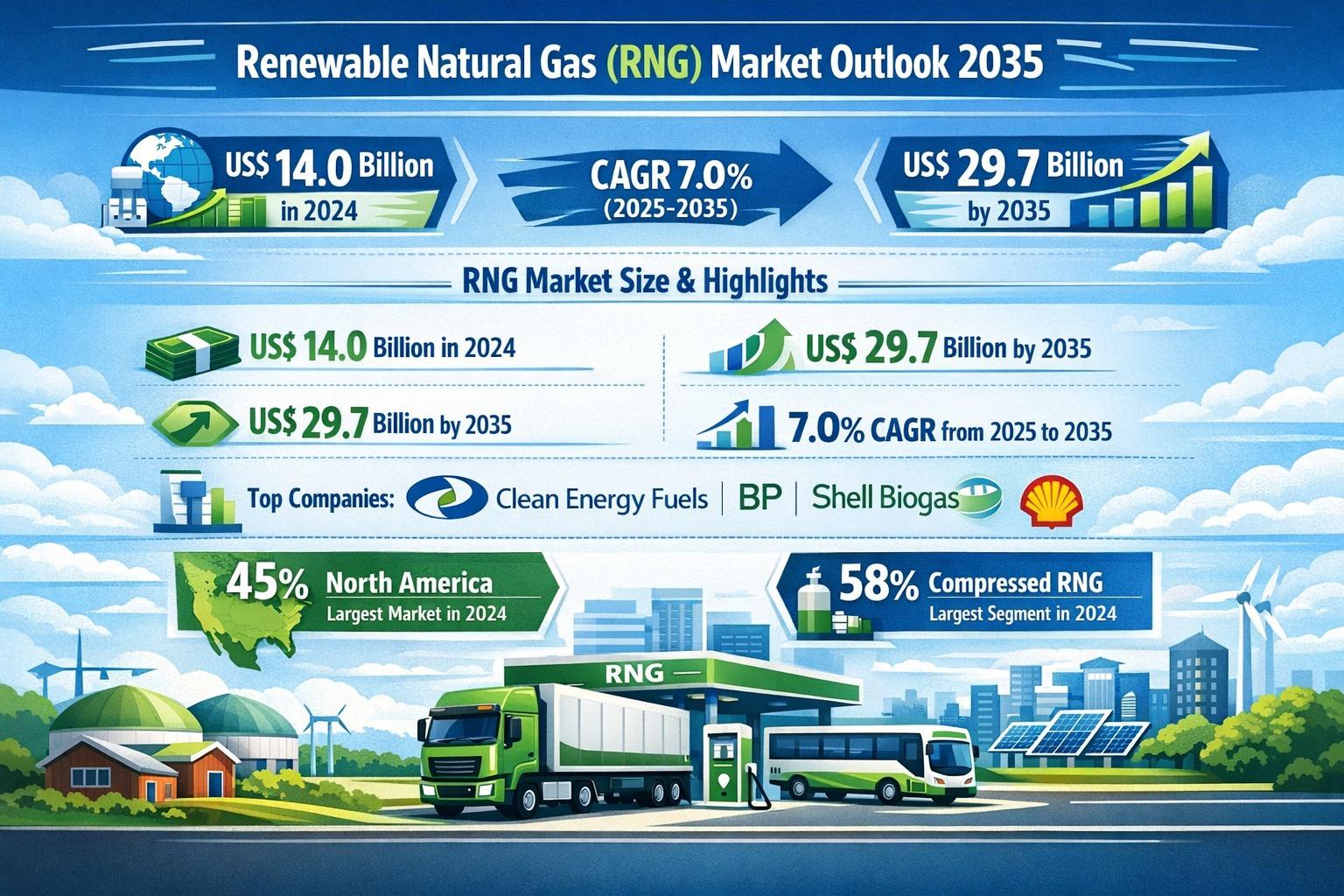

The global renewable natural gas (RNG) market is entering a strong expansion phase as governments, utilities, and corporations prioritize scalable decarbonization solutions. Valued at US$ 14.0 billion in 2024, the market is projected to reach US$ 29.7 billion by 2035, growing at a CAGR of 7.0% from 2025 to 2035. This growth is underpinned by robust policy incentives, tightening emissions mandates, and rising demand for low-carbon fuels across transportation, utilities, and industrial energy use.

Market Size & Key Highlights

-

Market size (2024): US$ 14.0 Billion

-

Forecast (2035): US$ 29.7 Billion

-

CAGR (2025–2035): 7.0%

-

Leading companies: Clean Energy Fuels, BP Plc, Shell Biogas

-

Leading region: North America (45% revenue share in 2024)

-

Top product type: Compressed RNG (C-RNG), 58% share in 2024

RNG’s ability to integrate seamlessly into existing gas infrastructure while delivering measurable and verifiable carbon reductions makes it one of the most commercially attractive renewable molecules available today.

Analysts’ Viewpoint: RNG as a Premium Decarbonization Asset

Analysts view RNG as moving from early commercialization into scaled deployment, driven by synchronized demand across transportation, utilities, and corporate energy procurement. North America remains the global growth engine due to powerful incentives such as the U.S. Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS), abundant landfill and agricultural feedstock, and rapid adoption of C-RNG in heavy-duty fleets.

Europe is emerging as the second major growth hub, supported by RED III and REPowerEU targets that are accelerating biomethane production and grid injection. Companies including BP, Waste Management, Ameresco, and Vanguard Renewables are reducing development risk through standardized technologies, modular upgrading systems, and vertically integrated business models—shortening timelines and improving project bankability.

As carbon-intensity scoring increasingly influences energy procurement, RNG’s potential for negative emissions, particularly from manure-based pathways, positions it as a high-value decarbonization tool for transportation, industrial heating, and municipal waste-to-energy ecosystems.

Global Renewable Natural Gas (RNG) Market Overview

Renewable natural gas is produced by upgrading biogas from landfills, wastewater treatment plants, agricultural operations, and food-waste facilities to pipeline-quality methane. Once upgraded, RNG is fully interchangeable with conventional natural gas, allowing direct use in existing pipelines, industrial systems, power generation, and vehicle fueling infrastructure.

Its core advantage lies in delivering substantial lifecycle greenhouse-gas reductions—and in some cases carbon-negative outcomes—while leveraging existing assets. This makes RNG particularly valuable for hard-to-abate sectors where electrification is costly or technically constrained.

Utilities are increasingly blending RNG into gas portfolios to meet renewable gas mandates, while transportation fleets rely on compressed and liquefied RNG to cut emissions without replacing vehicles or fueling infrastructure. Long-term offtake agreements, vertical integration, and partnerships between energy companies and waste operators continue to accelerate adoption.

Policy Incentives and Decarbonization Mandates Fuel Growth

Strong regulatory support is the single most important catalyst for RNG market expansion. In the U.S., LCFS and RFS credits can account for 40–60% of total project revenue, significantly improving returns. Dairy-based RNG often achieves carbon intensity scores between –150 and –300 gCO₂e/MJ under LCFS, commanding premium credit values. D3 RIN prices, typically ranging from US$ 2.50–3.00, enable large facilities to generate tens of millions of dollars annually in compliance revenue.

Canada’s Clean Fuel Regulations (CFR) require a 15% reduction in carbon intensity by 2030, driving utilities such as FortisBC toward 15% renewable gas blending. In Europe, RED III sets a 42.5% renewable energy target by 2030, while REPowerEU aims for 35 bcm of biomethane production, prompting rapid expansion in Germany, France, Denmark, and Italy.

These policies materially reduce investment risk, shorten payback periods, and establish RNG as a financially viable pathway to meet national and corporate climate goals.

Low-Carbon Transportation Demand Accelerates Adoption

Transportation remains the largest and fastest-growing application for RNG. Compared to diesel, RNG can deliver 70–300% lower lifecycle GHG emissions, with manure-based RNG achieving carbon-negative performance. As a result, RNG accounted for over 69% of all on-road natural gas vehicle fuel in the U.S. in 2023, underscoring its transition from niche to mainstream.

Waste haulers, logistics providers, municipal bus fleets, and last-mile delivery operators are rapidly converting to C-RNG, leveraging existing CNG engines and fueling infrastructure. Beyond mobility, commercial buildings and industrial facilities are adopting pipeline-grade RNG for low-carbon heating, while utilities commit to 5–15% RNG blending by 2030.

Compressed RNG Dominates Product Segmentation

Compressed renewable natural gas (C-RNG) is the leading product type, driven by its compatibility with transportation fleets and widespread CNG infrastructure—over 900 public and private stations in the U.S. alone. C-RNG offers 15–25% lower cost per mile than diesel and substantial emissions reductions, making it the preferred option for heavy-duty applications.

Refuse collection fleets represent the largest consumers, often converting more than half of their vehicles to RNG. Attractive LCFS and RFS credits continue to reinforce C-RNG’s leadership within the product mix.

Regional Insights: North America Leads, Europe Scales Fast

North America dominates the RNG market, supported by a strong policy framework and extensive project pipeline. The U.S. operates 300+ RNG facilities, accounting for over 55% of global capacity, and RNG fuels nearly 70% of U.S. on-road NGV demand.

Europe ranks second, with biomethane production exceeding 4.2 bcm in 2023—a 20% year-on-year increase. Expansion is accelerating under REPowerEU, positioning Europe as a long-term growth engine for RNG grid injection and industrial use.

Competitive Landscape and Key Developments

Leading players include Clean Energy Fuels, BP Plc, Ameresco, Montauk Renewables, Verbio SE, Opal Fuels, Waste Management, FortisBC, Vanguard Renewables, and Shell Biogas. Recent developments highlight rapid scaling:

-

Waste Management (2025): Accelerated a 20-facility RNG build program, converting landfill gas into pipeline-grade RNG and transportation fuel.

-

Ameresco (2025): Secured a major EPC contract for a landfill-to-RNG facility in Utah, strengthening utility-grade RNG assets.

-

Vanguard Renewables (2024): Launched a large-scale anaerobic digestion and depackaging facility for food and agricultural waste.

-

BP / Archaea Energy (2024): Commissioned a modular landfill-to-RNG plant in Kansas, demonstrating scalable production for utility, industrial, and transport offtake.

Outlook to 2035

Through 2035, the RNG market is set for steady, policy-backed growth, transitioning from a compliance-driven fuel to a strategic decarbonization asset. With negative-emissions potential, mature technology, and expanding offtake markets, RNG will play a central role in reducing emissions across transportation, utilities, and industrial energy systems worldwide.