Alternative Financing Market Size, Share, Trends & Research Report, 2033 | UnivDatos

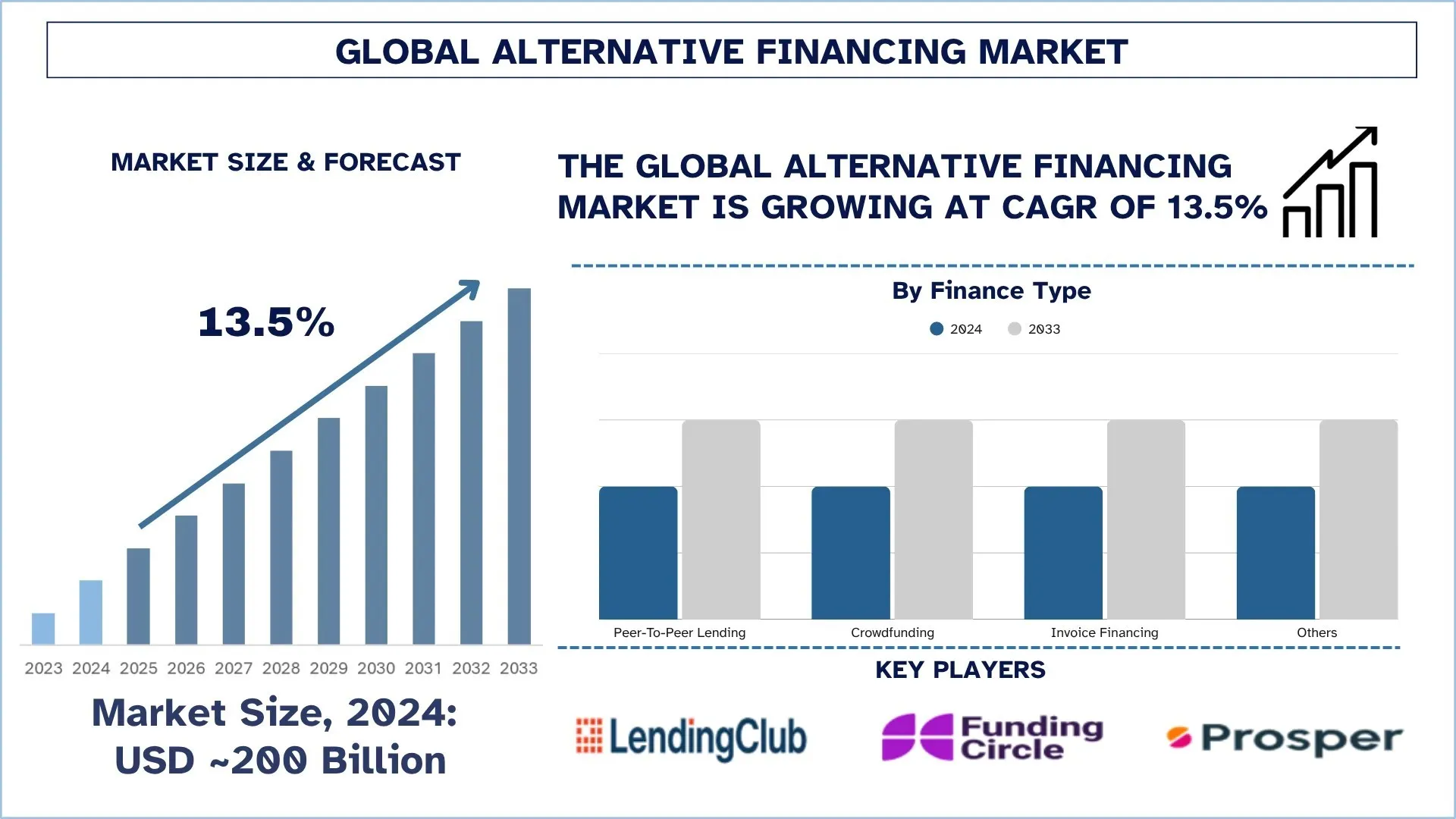

According to UnivDatos analysis, rising demand for accessible and flexible capital, the increasing digitalization of financial services, and the integration of advanced technologies such as AI, blockchain, and data analytics are the major factors driving the growth of the alternative financing market. As per their “Alternative Financing Market” report, the global market was valued at USD ~200 billion in 2024, growing at a CAGR of about 13.5% during the forecast period from 2025 - 2033 to reach USD billion by 2033.

Technology is the bedrock of the alternative financing market, enabling real-time credit analysis, automation, and secure peer-to-peer transactions. The integration of AI, machine learning, and blockchain architecture has greatly improved credit assessment accuracy and fraud prevention, while digital onboarding makes loan disbursements more efficient. These advancements have driven the development of decentralized finance (DeFi) models and tokenized lending systems. With rising consumer demand for fast, transparent, and personalized financing options, fintech platforms are outperforming traditional banks in both customer experience and processing speed. Furthermore, major firms are heavily investing in analytics infrastructure and digital security to build trust with users. As regulatory frameworks evolve, technology will keep transforming accessibility, compliance, and scalability, supporting continued growth for digital lending ecosystems.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/alternative-financing-market?popup=report-enquiry

The Rising Shift from Traditional Financial Services Towards Alternative and Digital Financing

The rising shift from traditional financial services toward alternative and digital financing is one of the most notable trends in the global alternative financing market. Traditional banks, due to their strict lending criteria, manual processes, and limited accessibility, are increasingly being replaced or complemented by fintech-driven platforms providing fast, flexible, and convenient services. Consumers and businesses are transforming toward online lending, crowdfunding, and peer-to-peer (P2P) platforms that provide instant credit decisions, lower interest rates, and minimal paperwork. This change is driven by technological innovation, increasing internet access, and the rising demand for personalized financial services. For example, the Cornerstone Advisor 2025 study showed that in the US, over USD 2 trillion in deposits have moved from traditional banks to fintech-led savings and lending platforms. This shift is sped up by the emergence of alternative financing lenders like SoFi, LendingClub, and Upstart, which utilize AI and data analytics to evaluate creditworthiness beyond traditional metrics, thus fueling market growth.

Strategic Investments and Technological Innovations Driving Growth in the Global Alternative Financing Market

Leading industries are heavily investing in research and development to improve the platform's scalability, automation, and credit intelligence. These investments mainly focus on integrating AI and IoT devices, as well as blockchain architecture, to improve credit-risk evaluation, transaction transparency, and operational efficiency. Fintech innovators are developing advanced algorithms and decentralized systems to facilitate faster, more secure lending and payment processes, catering to underserved individual and SME segments. A form of investment is through continuous mergers and acquisitions (M&A), which allow industries to expand geographically, diversify their product offerings, and expand into new regions. For instance, in June 2025, Citi Group announced a partnership with Carlyle to invest in fintech lending platforms, enhancing digital credit infrastructure and increasing capital access for non-traditional borrowers. These strategic investments assist in improving the money lending process, increasing operational efficiency, and bringing innovative ideas to the alternative financing sector.

Click here to view the Report Description & TOC https://univdatos.com/reports/alternative-financing-market

Rising Digitalization and Strategic Investments Powering Alternative Financing Market Growth

The alternative financing market is well poised to continue on a consistent uptrend, driven by the continuous investment in research and development to improve the platform's scalability, automation, and credit intelligence. Strategic investments are also vital for expanding the product portfolio, ensuring product availability, and strengthening the integration of the value chain. As AI features, blockchain architectures, cloud computing platforms, partnerships, mergers, and acquisitions become more integrated, companies are expected to boost their operational efficiency and long-term competitiveness in the global alternative financing industry.

Related Report:-

India Personal Loan Market: Current Analysis and Forecast (2025-2033)

Micro Lending Market: Current Analysis and Forecast (2022-2028)

Asset and Wealth Management Market: Current Analysis and Forecast (2022-2028)

Asset Tokenization Market: Current Analysis and Forecast (2024-2032)

India Fintech Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness