Exploring the Role of Predictive Maintenance in Modern Defense Logistics

The Military Logistics Market is characterized by diverse regional dynamics and a competitive landscape shaped by defense spending patterns and strategic modernization efforts. Based on the latest (MRFR) data, this blog explores how different regions contribute to market growth and what competitive factors are at play.

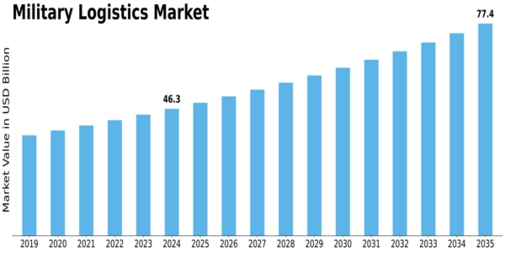

As per MRFR, the global Defense Logistics Market was estimated at USD 25.8 billion in 2024 and is projected to grow to USD 58.2 billion by 2035, at a solid CAGR of 7.71% over the forecast period. These figures indicate that logistics solutions are becoming central to defense preparedness across global armed forces.

North America leads the market, driven by substantial defense budgets and advanced logistics infrastructure. Militaries in the United States and Canada are investing extensively in modern supply chain systems, real-time tracking, and automation to ensure rapid deployment and sustainment of operations. According to MRFR, North America remains the largest regional share, reflecting its continued focus on logistics modernization in both peacetime and conflict scenarios.

In contrast, Asia-Pacific is the fastest-growing region in the military logistics domain. Countries such as India, Japan, South Korea, and others are expanding their logistics capabilities to support increased troop mobility, base expansions, and strategic distribution networks. The rapid growth rate in this region stems from rising defense expenditures, heightened geopolitical tensions, and an urgent need for resilient logistics systems.

Europe also represents a significant market segment, with nations investing in logistics modernization to support NATO commitments and regional security operations. While the MRFR summary does not provide detailed country-level segmentation, Europe’s emphasis on interoperability and digital logistics solutions contributes to its competitive position.

From a competitive standpoint, the market comprises a mix of defense contractors, logistics service providers, and technology integrators. These players are focusing on enhancing their service portfolios, integrating smart logistics technologies, and offering customized solutions for military clients.

One notable trend in the competitive landscape is the collaboration between defense agencies and private logistics companies to bolster military readiness. This includes partnerships for managing supply chains, transportation networks, and base support services—areas that are becoming increasingly complex and technology-intensive.

The expansion of logistics contracts and long-term framework agreements is another competitive element, as militaries seek reliable providers capable of supporting multi-domain operations. Although the MRFR summary does not list individual company rankings, the presence of established defense logistics contractors and service providers underscores the sophistication of competition in this market.

In conclusion, the Military Logistics Market’s regional insights and competitive dynamics reveal a sector that is both strategically vital and rapidly evolving. With North America leading in market share and Asia-Pacific emerging as a growth hotspot, defense logistics will continue to be shaped by investments, partnerships, and innovation through 2035.

Related Report:

Airport Surveillance Radar Market

- Military_Logistics_Market

- Military_Logistics

- Military_Logistics_Market_Share

- Military_Logistics_Industry

- Global_Military_Logistics_Market

- Military_Logistics_Market_Research

- Military_Logistics_Market_Analysis

- Military_Logistics_Market_Size

- Military_Logistics_Market_Research_Report

- Military_Logistics_Market_Forecast

- Military_Logistics_Market_Trends

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness