PET Packaging Market Analysis with Key Drivers, Restraints, and Opportunities 2032

Global PET Packaging Market: Industry Analysis, Trends, and Forecast (2025–2032)

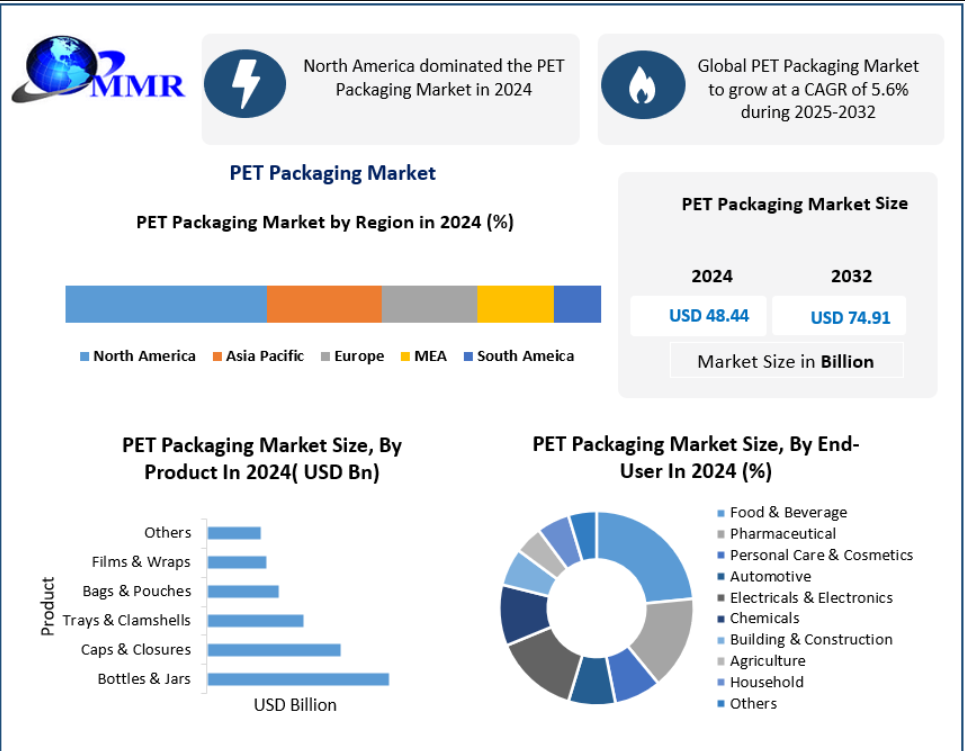

The global PET Packaging Market was valued at USD 48.44 billion in 2024 and is projected to grow steadily over the coming years. Supported by expanding demand from food & beverage, pharmaceuticals, personal care, and FMCG industries, the market is expected to register a CAGR of 5.6% from 2025 to 2032, reaching approximately USD 74.91 billion by 2032. PET packaging continues to gain traction due to its lightweight nature, recyclability, cost efficiency, and strong barrier properties.

Market Overview

Polyethylene Terephthalate (PET) packaging has become a cornerstone of the global packaging ecosystem. Manufactured through the polymerization of terephthalic acid and mono-ethylene glycol, PET delivers an optimal balance of strength, clarity, flexibility, and chemical resistance. Compared to traditional materials such as glass and metal, PET offers a significantly lower carbon footprint while maintaining high performance in product protection and shelf-life extension.

PET packaging is widely adopted across food and beverages, pharmaceuticals, personal care, household goods, and industrial applications. Its transparency, shatter resistance, and compatibility with recycling systems have positioned PET as a preferred solution amid growing sustainability requirements.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/25904/

Market Growth Drivers

Rising Sustainability and Recycling Initiatives

Sustainability has emerged as a primary growth driver for the PET packaging market. Global recycling rates for PET are steadily improving, supported by government mandates and corporate sustainability commitments. Europe reports recycling rates exceeding 50%, while Japan achieved an exceptional 93.5% PET recycling rate in 2022. In the United States, nearly 1.9 billion pounds of PET bottles were recycled in 2021, reflecting a strong shift toward circular packaging models.

The food and beverage sector remains the largest consumer of PET packaging, accounting for over 65 billion PET-packaged servings annually in North America alone. Bottled water has overtaken carbonated soft drinks as the leading beverage category, reinforcing PET’s dominance in beverage packaging.

Expanding Use in Pharmaceuticals and Healthcare

PET plays a critical role in pharmaceutical packaging due to its clarity, chemical stability, and safety. Approximately 40% of liquid pharmaceutical formulations are packaged in PET containers. Between 2019 and 2023, PET usage in healthcare applications increased by 17%, driven by rising demand for liquid medications, vitamins, and over-the-counter products.

Technological Advancements

Innovation continues to transform the PET packaging landscape. Advances in AI-enabled manufacturing, automation, lightweighting technologies, and bio-based PET materials are improving efficiency and reducing environmental impact. Notably, bio-PET bottles made from renewable feedstocks such as used cooking oil and captured carbon emissions are gaining commercial traction, signaling the next phase of sustainable packaging evolution.

Market Restraints

Environmental and Regulatory Challenges

Despite its recyclability, PET packaging faces increasing scrutiny over plastic waste management. Globally, only 14% of plastic packaging is collected for recycling, and just 2% is recycled in a closed-loop system suitable for food-grade applications. This gap in recycling infrastructure limits sustainable adoption and increases environmental leakage.

Stringent regulations further challenge market growth. The EU Single-Use Plastics Directive mandates PET bottles to contain 25% recycled content by 2025 and 30% by 2030, increasing compliance costs for manufacturers. Similar regulations in India and North America are driving investment but also creating short-term supply constraints for high-quality recycled PET (rPET).

Negative consumer perception toward plastics and growing preference for alternative materials such as paper, aluminum, and bioplastics also pose competitive pressure on PET packaging demand.

Segment Analysis

By Product

The PET packaging market is segmented into bottles & jars, caps & closures, trays & clamshells, bags & pouches, films & wraps, and others.

- Bottles and jars dominate the market due to extensive use in beverages, packaged water, pharmaceuticals, and personal care products.

- Caps and closures play a vital role in ensuring product integrity and leak prevention.

- Trays and clamshells are witnessing rapid adoption in ready-to-eat meals and fresh produce packaging.

- Bags, pouches, films, and wraps are increasingly used in snacks, frozen foods, and e-commerce applications due to their flexibility and material efficiency.

By Packaging Type

Based on packaging type, the market is divided into rigid and flexible PET packaging.

The rigid segment dominated the market in 2024, supported by high demand from beverage, food, pharmaceutical, and personal care industries. Rigid PET containers offer superior durability, transparency, and shelf-life protection while remaining highly recyclable. Although flexible PET packaging is expanding, rigid formats continue to lead due to versatility, consumer preference, and cost-effectiveness.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/25904/

Regional Analysis

North America held the largest share of the global PET packaging market in 2024. Strong beverage consumption, advanced recycling infrastructure, and robust sustainability initiatives underpin regional dominance. The U.S. beverage industry alone accounts for over 70% of PET-packaged beverage servings, with bottled water consumption surpassing soft drinks for multiple consecutive years.

Major brands such as Coca-Cola, PepsiCo, and Nestlé Waters have introduced 100% rPET bottles across multiple product lines, strengthening circular economy initiatives. Canada’s expanded deposit return systems further support PET collection and recycling efficiency.

Europe follows closely, driven by strict environmental regulations and high recycling targets.

Asia Pacific is expected to register the fastest growth, supported by urbanization, rising disposable incomes, expanding FMCG consumption, and growing investment in recycling infrastructure across China, India, and Southeast Asia.

The Middle East & Africa and South America are experiencing steady growth as packaging demand rises alongside industrialization and retail expansion.

Competitive Landscape

The PET packaging market is becoming increasingly competitive as sustainability regulations reshape industry strategies. Leading companies are investing heavily in recycling facilities, rPET sourcing, lightweight designs, and circular economy partnerships to maintain compliance and market leadership.

Key players such as Amcor, Indorama Ventures, Berry Global, and ALPLA Group dominate the market through innovation and strategic expansion. Amcor focuses on recyclable and lightweight PET solutions, Indorama Ventures leads global PET resin production and recycling capacity, Berry Global emphasizes post-consumer recycled content, and ALPLA excels in closed-loop recycling systems.

Key Trends Shaping the Market

- Closed-loop recycling systems accelerating rPET adoption

- Strategic sustainability partnerships strengthening ESG performance

- Premium and functional packaging designs enhancing brand differentiation

- Acquisition-led expansion improving regional reach and customization

- Localized manufacturing reducing logistics costs and supply chain risks

Conclusion

The global PET packaging market is positioned for steady and resilient growth through 2032. While environmental concerns and regulatory pressures pose challenges, continuous innovation, expanding recycling infrastructure, and rising demand from food, beverage, healthcare, and FMCG industries ensure PET remains a vital packaging material. The transition toward recycled and bio-based PET will be a defining factor in shaping the future of sustainable packaging worldwide.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness