Automotive Battery Management Systems Market Size, Share, and Forecast 2025–2032

Global Automotive Battery Management Systems Market: Industry Analysis, Innovation Landscape, and Forecast (2025–2032)

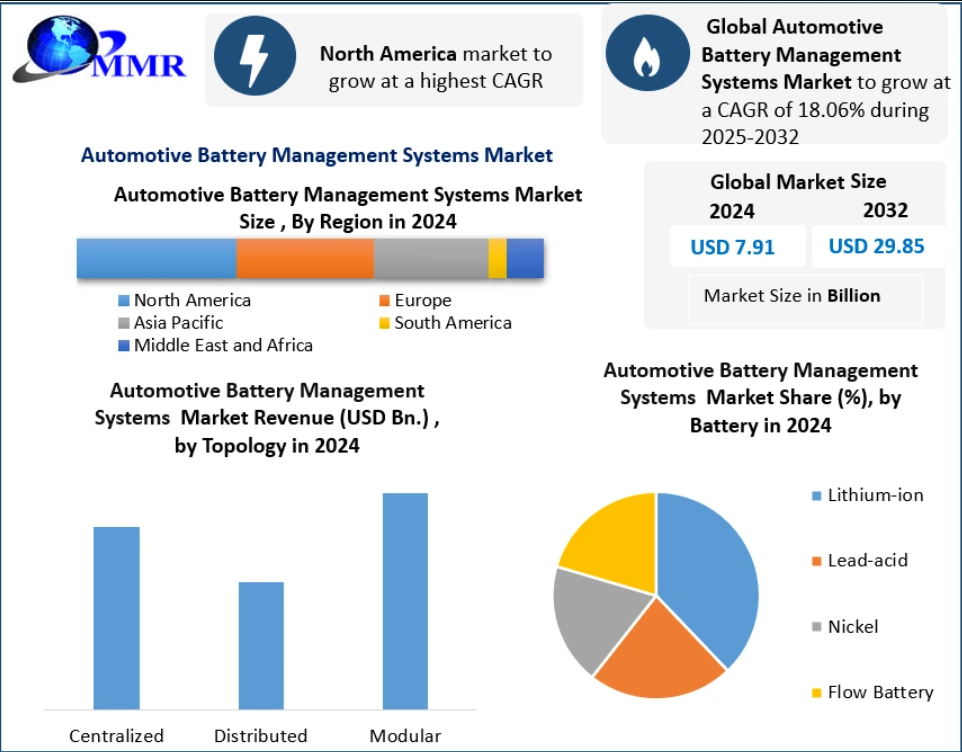

The Global Automotive Battery Management Systems (BMS) Market was valued at USD 7.91 billion in 2024 and is projected to grow at a robust CAGR of 18.06% from 2025 to 2032, reaching approximately USD 29.85 billion by 2032. This exceptional growth trajectory reflects the accelerating transition toward electric mobility, stricter emission norms, and rapid advancements in battery intelligence technologies.

Market Overview

Automotive Battery Management Systems represent a critical layer of automotive electronics designed to monitor, control, and optimize vehicle battery performance. These systems continuously track key parameters such as voltage, current, temperature, state of charge (SoC), state of health (SoH), power consumption, charging cycles, and remaining battery life.

With the evolution of connected vehicles, cloud computing, and wireless communication technologies, modern BMS platforms have become more intelligent, adaptive, and predictive. These advancements have transformed BMS from a passive monitoring tool into an active decision-making system that ensures battery safety, enhances efficiency, and extends operational lifespan.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/22584/

Market Drivers

Rapid Electrification of the Automotive Industry

The global surge in electric and hybrid vehicle adoption is the primary catalyst driving the Automotive BMS market. Governments worldwide are enforcing stringent emission regulations and promoting EV adoption through subsidies, tax incentives, and infrastructure investments. Battery management systems play a vital role in ensuring EV safety, performance, and regulatory compliance.

As EV batteries become larger and more energy-dense, the demand for high-precision battery monitoring and control systems continues to rise. Wireless and intelligent BMS solutions are increasingly preferred due to their reduced complexity, improved scalability, and cost efficiency.

Growing Demand for Intelligent Battery Features

Modern vehicles integrate numerous power-intensive systems such as electric power steering, regenerative braking, start-stop systems, and advanced driver assistance features. This growing electrical load necessitates intelligent battery management systems (IBMS) capable of real-time diagnostics and proactive fault prevention.

Advanced IBMS platforms utilize multi-sensor architectures to simultaneously monitor SoC, SoH, and thermal conditions, enabling predictive alerts and orderly system shutdowns to prevent thermal runaway or battery failure.

Market Restraints

High System Costs and Integration Challenges

Despite strong demand, the market faces challenges from the high cost of advanced BMS architectures. Sophisticated sensors, embedded electronics, AI algorithms, and safety-certified components significantly increase system costs, creating adoption barriers—particularly in cost-sensitive vehicle segments.

Additionally, integrating advanced BMS solutions into existing vehicle architectures requires technical expertise and customization, which can further increase development costs for OEMs.

Segment Analysis

By Battery Type

Lithium-ion batteries dominated the Automotive BMS market in 2024 due to their superior energy density, fast charging capability, lightweight design, and long cycle life. These batteries remain the backbone of BEVs, HEVs, and PHEVs, as they meet OEM requirements for driving range and performance.

Lead-acid batteries continue to be used in internal combustion engine vehicles for SLI applications; however, their lower energy density and heavier weight limit their suitability for electric propulsion systems.

Asia-Pacific leads global lithium-ion battery production, with China accounting for the majority of manufacturing capacity, supported by control over raw material processing and component supply chains. Europe is rapidly expanding its battery production footprint through large-scale investments in gigafactories.

By Topology

The modular BMS topology is expected to witness the fastest growth during the forecast period. Modular systems consist of multiple identical monitoring units placed close to battery cells, improving scalability, safety, and data accuracy.

Compared to centralized systems, modular BMS architectures offer easier expansion, reduced wiring complexity, enhanced fault isolation, and improved functional redundancy—making them ideal for electric vehicles and smart grid applications.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/22584/

Regional Insights

North America

North America held 29.90% of the global market share in 2024, driven by strong EV adoption, extensive R&D investments, and the presence of leading semiconductor and automotive technology providers. Strict emission regulations, rising fuel costs, and federal funding programs continue to support market growth in the region.

Europe

Europe accounted for 28.77% of global revenue, supported by the presence of major automotive OEMs, aggressive decarbonization policies, and large-scale investments in battery innovation projects under EU programs such as Horizon Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding 25.29% of the market in 2024. China, Japan, and South Korea dominate battery production and BMS innovation, benefiting from strong government support, vertically integrated supply chains, and expanding EV exports.

Middle East & Africa and South America

The Middle East and Africa market is expected to grow at a CAGR of 17.2%, driven by renewable energy storage projects and EV infrastructure development. South America shows moderate growth, constrained by limited EV penetration but supported by gradual electrification initiatives.

Competitive Landscape

The global Automotive Battery Management Systems market is highly competitive, featuring a mix of established electronics giants, automotive suppliers, battery manufacturers, and emerging technology start-ups.

Semiconductor leaders such as Texas Instruments and Analog Devices focus on precision battery monitoring ICs, while automotive suppliers like Bosch and Continental integrate BMS into broader vehicle control systems. Asian players, including CATL, Panasonic, and BYD, leverage vertical integration to deliver cost-optimized, high-volume solutions.

Start-ups and technology specialists are disrupting the market with AI-driven battery analytics, cloud-connected platforms, and wireless BMS architectures, accelerating innovation across the value chain.

Recent Developments

- Tesla (2024): Introduced AI-enabled predictive BMS technology extending battery life by up to 20%.

- CATL (2024): Launched wireless BMS for enhanced EV safety and simplified battery pack architecture.

- Bosch (2024): Unveiled modular BMS supporting 800V fast-charging platforms.

- LG Energy Solution (2025): Developed BMS optimized for solid-state battery integration.

- Panasonic–Toyota (2025): Deployed cloud-connected BMS for real-time fleet battery health monitoring.

Key Market Trends

- Digitalization of Battery Intelligence

Cloud-connected and data-driven BMS platforms enable predictive maintenance and significantly reduce battery failure rates. - AI and Machine Learning Integration

AI-based SoH and SoC estimation improves accuracy, extends battery life, and lowers warranty costs for OEMs. - Regulatory-Driven Safety Standards

Increasing adoption of ISO 26262 and ASIL-D compliant BMS solutions is reshaping product development priorities.

Conclusion

The Automotive Battery Management Systems market is becoming a cornerstone of the global electric mobility ecosystem. As EV adoption accelerates and battery technologies evolve toward solid-state and next-generation chemistries, the role of advanced, intelligent BMS platforms will become even more critical. Continuous innovation in AI, modular architectures, and cloud connectivity positions the market for sustained, high-growth expansion through 2032.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness