Naphtha Market Report 2025 | Size, Share, and Demand Forecast by 2033

Market Overview:

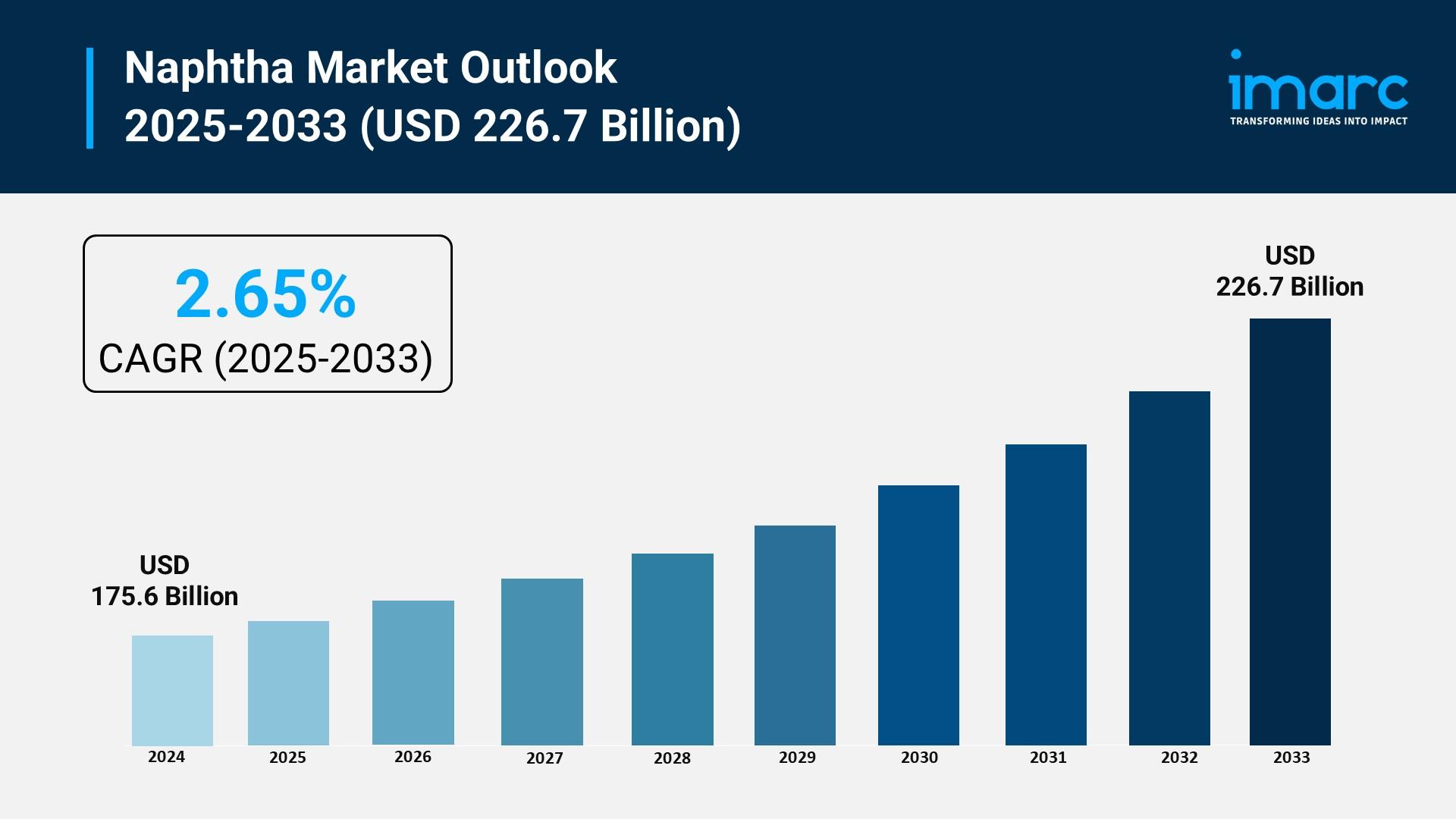

The naphtha market is experiencing rapid growth, driven by escalating demand from the petrochemical sector, growing consumption in transportation fuels, and strategic expansion of refining and cracking capacity. According to IMARC Group's latest research publication, "Naphtha Market Report by Application (Petrochemical Feedstock, Gasoline Blending, and Others), and Region 2025-2033", the global naphtha market size reached USD 175.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 226.7 Billion by 2033, exhibiting a growth rate (CAGR) of 2.65% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/naphtha-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Naphtha Market

- Escalating Demand from the Petrochemical Sector

The foremost driver of global naphtha growth is its essential role as a primary feedstock in the booming petrochemical industry, particularly in Asia-Pacific. Light naphtha is critical for steam crackers, which produce fundamental building blocks like ethylene and propylene, used in manufacturing plastics, synthetic fibers, and resins. Demand for these derivatives is escalating due to rapid industrialization, urbanization, and a rise in global consumer goods consumption. For instance, petrochemical feedstock consumption accounts for a significant majority of total global naphtha demand, demonstrating its entrenched position. Major companies like Indian Oil Corporation (IOCL) are investing heavily, with plans for a large-scale naphtha cracker project at Paradip, highlighting the commitment of national energy firms to secure this feedstock for domestic chemical expansion and self-reliance. This wave of capacity additions cements naphtha’s growth trajectory as the foundational material for the plastics and polymer value chain.

- Growing Consumption in Transportation Fuels

The expansion of the global transportation sector, particularly the gasoline market in emerging economies, significantly contributes to naphtha demand. Heavy naphtha is a crucial component for catalytic reformers, where it is converted into high-octane blendstocks, such as aromatics, necessary for formulating high-quality gasoline. Rising vehicle ownership and expanding infrastructure in regions like India and China are pushing up overall fuel consumption. The segment of naphtha used in gasoline blending remains a substantial end-use application globally. Furthermore, regulatory shifts, such as stricter global emissions standards, necessitate advanced refining processes to produce cleaner, more efficient fuels, which often rely on high-quality naphtha reforming processes. This continuous need to upgrade fuel quality and meet surging mobility demands ensures a sustained, robust market for naphtha.

- Strategic Expansion of Refining and Cracking Capacity

Significant global investments in new, integrated refining and petrochemical complexes, especially in Asia and the Middle East, are structurally driving naphtha market growth. These large-scale projects are designed to maximize feedstock flexibility and optimize product output, with a strong focus on high-value petrochemicals. Quantitative data shows the Asia-Pacific region alone accounts for over two-fifths of global naphtha consumption, underpinned by its vast refining capacity and downstream industrial growth. Governments often support these initiatives, such as through India's policies aimed at increasing exploration and refining capabilities. The commissioning of new, integrated mega-crackers in countries like China, designed to use light naphtha for maximizing ethylene output, directly translates to a non-stop escalation in naphtha consumption, firmly locking in its market expansion as a preferred chemical input.

Key Trends in the Naphtha Market

- Transition Towards Bio-Naphtha and Renewable Feedstocks

A critical emerging trend is the accelerated push toward producing bio-naphtha, a sustainable drop-in alternative derived from sources like vegetable oils, animal fats, or used cooking oil. This trend is heavily influenced by global decarbonization targets and consumer demand for low-carbon products, which is compelling refiners to integrate renewable processing into existing assets. For example, the renewable naphtha market is witnessing high growth rates as leading energy companies explore co-processing renewable materials in their conventional hydrotreatment units. This strategy allows producers to secure certified carbon-intensity premiums on their output, enhancing profitability while reducing the overall carbon footprint of their product slate. The focus is on leveraging existing infrastructure for a lower-carbon value chain.

- Deepening Integration of Refinery-Petrochemical Complexes

Refiners are increasingly adopting a trend of deeper integration with co-located petrochemical plants to maximize margins and operational flexibility. This involves setting up integrated facilities where naphtha and other fractions are directly channeled from the refinery to the steam cracker. This configuration allows for real-time feedstock optimization, enabling operators to swiftly shift production based on the margin differences between fuel products (like gasoline) and petrochemicals (like ethylene). Technological advancements, such as the Honeywell Naphtha to Ethane and Propane (NEP) process, exemplify this, allowing for flexible conversion of naphtha into higher-value light olefins. This strategic integration improves overall energy efficiency and strengthens the in-house security of naphtha supply for the downstream chemical sector.

- Digitalization and Advanced Process Optimization

The adoption of digital technologies, including Statistical Process Control (SPC), advanced process monitoring, and real-time data analytics, represents a significant operational trend. Refiners are deploying these tools to fine-tune naphtha production and utilization. For instance, over two-thirds of leading refineries are currently investing in sophisticated data analysis systems for naphtha quality assurance and process optimization. This digitalization allows plants to manage feedstock volatility and market price fluctuations with greater agility, ensuring that naphtha output meets precise specifications for various downstream applications, such as aromatics content for reforming or paraffin content for steam cracking. This focus on maximizing yield, minimizing waste, and enhancing operational safety is becoming standard across large-scale naphtha processing facilities worldwide.

The naphtha market report provides a comprehensive overview of the industry. This analysis is essential for stakeholders aiming to navigate the complexities of the naphtha market and capitalize on emerging opportunities.

Leading Companies Operating in the Global Naphtha Industry:

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- Lotte Chemical Corporation

- Mangalore Refinery and Petrochemicals Limited

- OAO Novatek

- Saudi Basic Industries Corporation (SABIC)

- Shell International B.V.

- Sinopec Group

- Total S.A.

- Vitol SA

- Mitsubishi Chemical

- Reliance Industries Limited

- Indian Oil Corporation

Naphtha Market Report Segmentation:

By Application:

- Petrochemical Feedstock

- Gasoline Blending

- Others

Petrochemical Feedstock represents the largest market, driven by the growing demand for plastics and synthetic materials, advancements in refining processes, and a shift towards cleaner and more sustainable chemicals.

Regional Insights:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific exhibits clear dominance in the market, accounting for the largest naphtha market share among all regions analyzed.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness