Ion Exchange Membrane Market Outlook 2034: Rising Demand in Wastewater Treatment and Oil & Gas Applications Fuels Market Expansion

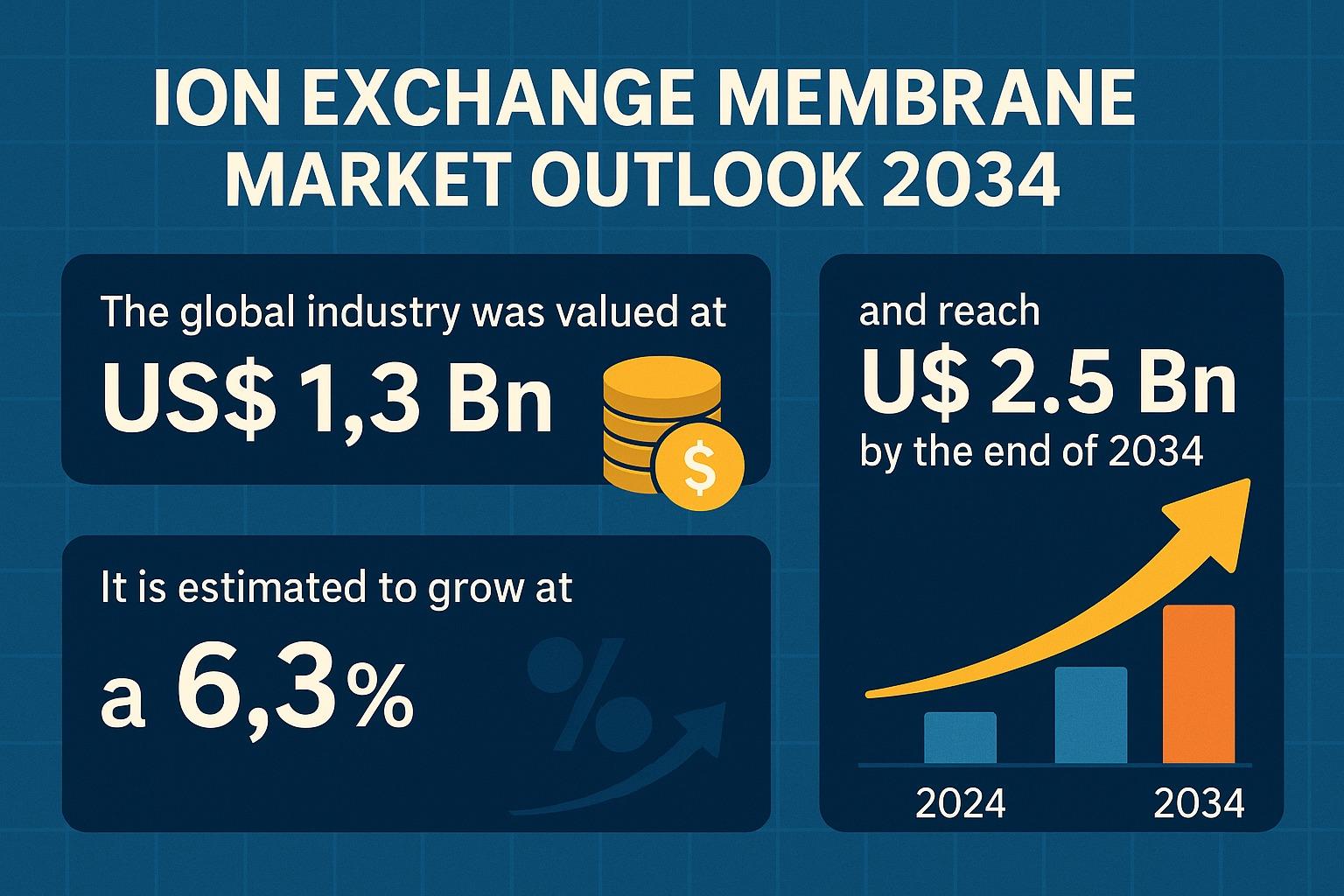

The global ion exchange membrane market continues to gain momentum as industries intensify efforts to improve water quality, recover valuable by-products, and optimize production efficiency. Valued at US$ 1.3 Bn in 2023, the market is projected to witness steady growth at a CAGR of 6.3% from 2024 to 2034, ultimately reaching US$ 2.5 Bn by 2034. The growing importance of advanced filtration solutions in industrial, environmental, and energy processes is shaping market dynamics worldwide.

Analyst Viewpoint

According to industry analysts, rising wastewater treatment activities remain one of the most significant drivers of ion exchange membrane market development. These membranes effectively remove undesirable ionic contaminants and help industries comply with increasingly stringent environmental regulations. With freshwater resources depleting and water quality concerns intensifying, municipalities and private industries are investing heavily in membrane-based treatment technologies.

Another major catalyst is the expansion of the oil & gas sector, where ion exchange membranes are deployed in multiple critical processes—from treating contaminated water associated with drilling operations to managing process streams in refineries and petrochemical units. By facilitating the recovery of valuable by-products and enabling safer discharge or reuse of treated water, these membranes are becoming indispensable across upstream and downstream operations.

Leading players such as DuPont, 3M, and Lanxess are focusing on expanding their product portfolios and improving membrane performance through enhanced chemical stability and optimized manufacturing processes. Innovation in inorganic and fluorinated membranes reflects the industry’s commitment to durability, cost-efficiency, and environmental compliance.

Market Introduction

Ion Exchange Membrane (IEM) technology is built around semipermeable polymer-based membranes equipped with fixed ionic groups. These membranes selectively transport charged ions, making them essential in processes such as desalination, chemical recovery, dialysis, and electrodialysis. Depending on the nature of the ionic groups attached to their backbone, IEMs are categorized as:

- Cation Exchange Membranes (CEMs)

- Anion Exchange Membranes (AEMs)

- Amphoteric Membranes

- Bipolar Membranes

- Mosaic Membranes

IEMs play a major role in Zero Liquid Discharge (ZLD) systems—one of the most advanced water treatment processes that reduce environmental impact by eliminating liquid waste. They are also widely used in food processing, pharmaceutical production, and bioprocessing for pH control, extraction, and concentration of valuable components.

Key Market Drivers

1. Rising Wastewater Treatment Activities

With only a small portion of Earth’s water available for human consumption, the pressure on governments and industries to manage water responsibly is intensifying. Ion exchange membrane technologies are at the forefront of:

- Pre-treatment and post-treatment of industrial wastewater

- Recycling and reuse of process water

- Sewage treatment

- Packaged drinking water production

- Desalination and seawater distillation

As the water technology sector grows, businesses are adopting membrane-based systems to enhance purity levels and achieve sustainable water management targets. This rising focus on wastewater circularity plays a crucial role in boosting ion exchange membrane adoption globally.

2. Expansion in the Oil & Gas Sector

Water contaminated during oil extraction, refining, and petrochemical production contains complex impurities that must be removed before disposal or reuse. Ion exchange membranes are widely utilized in:

- Oil well injection systems

- Refinery wastewater treatment

- Contaminant removal from ballast water

- Treatment of cooling tower and boiler water

- Elimination of VOCs and H₂S emissions

- Recycle and reuse of process wastewater

The continuous growth of oil & gas production, especially in Asia Pacific, the Middle East, and North America, is contributing significantly to market expansion.

3. High Demand for Inorganic Membranes

In 2023, the inorganic membrane segment accounted for the largest market share due to its superior chemical stability. These membranes are widely adopted in:

- Food & beverage processing

- Pharmaceutical concentration and separation

- Electrodialysis of brackish water

Their resilience and longer operational life make them ideal for high-temperature and chemically aggressive environments.

Regional Outlook

Asia Pacific led the global market with 33.6% share in 2023, driven by its massive population, rising demand for potable water, and industrial growth. Countries such as China, India, and Japan are adopting advanced filtration technologies across municipal and industrial segments.

Middle East & Africa is also witnessing rapid adoption due to scarcity of freshwater resources and growing infrastructural development.

Other regional shares in 2023 include:

- Europe: 28.2%

- North America: 15.7%

- Latin America: 4.3%

- Middle East & Africa: 18.2%

Europe’s stable 5.9% CAGR reflects consistent demand driven by environmental regulations and technological advancements.

Competitive Landscape and Key Developments

The ion exchange membrane market is highly consolidated, with the top three players—DuPont, Lanxess, and 3M—accounting for around 31% of the market in 2023. Companies are focusing on reducing production costs, improving durability, and launching eco-friendly materials.

Recent strategic developments include:

- February 2024: AGC, Inc. announced a major investment of 15 Bn Japanese yen to build a new facility for its FORBLUE S-Series fluorinated ion exchange membranes for green hydrogen production.

- January 2023: The Chemours Company committed US$ 200 Mn to expand capacity for Nafion ion exchange materials in France.

Other prominent players include FUJIFILM Holdings Corporation, SUEZ Group, Merck KGaA, Ion Exchange India Ltd., Liaoning Yichen Membrane Technology, and Evergreen Technologies.

Conclusion

The ion exchange membrane market is poised for strong and sustained growth through 2034 as global industries intensify efforts toward water purification, resource recovery, and environmental sustainability. Supported by technological advancements, strategic investments, and rising demand across oil & gas, pharmaceuticals, and municipal wastewater treatment, the market is expected to reach US$ 2.5 Bn by 2034, cementing its role as a critical enabler of industrial and environmental transformation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness