Italy Cyber Insurance Market Size, Share, Growth, and Forecast 2025-2033

Market Overview

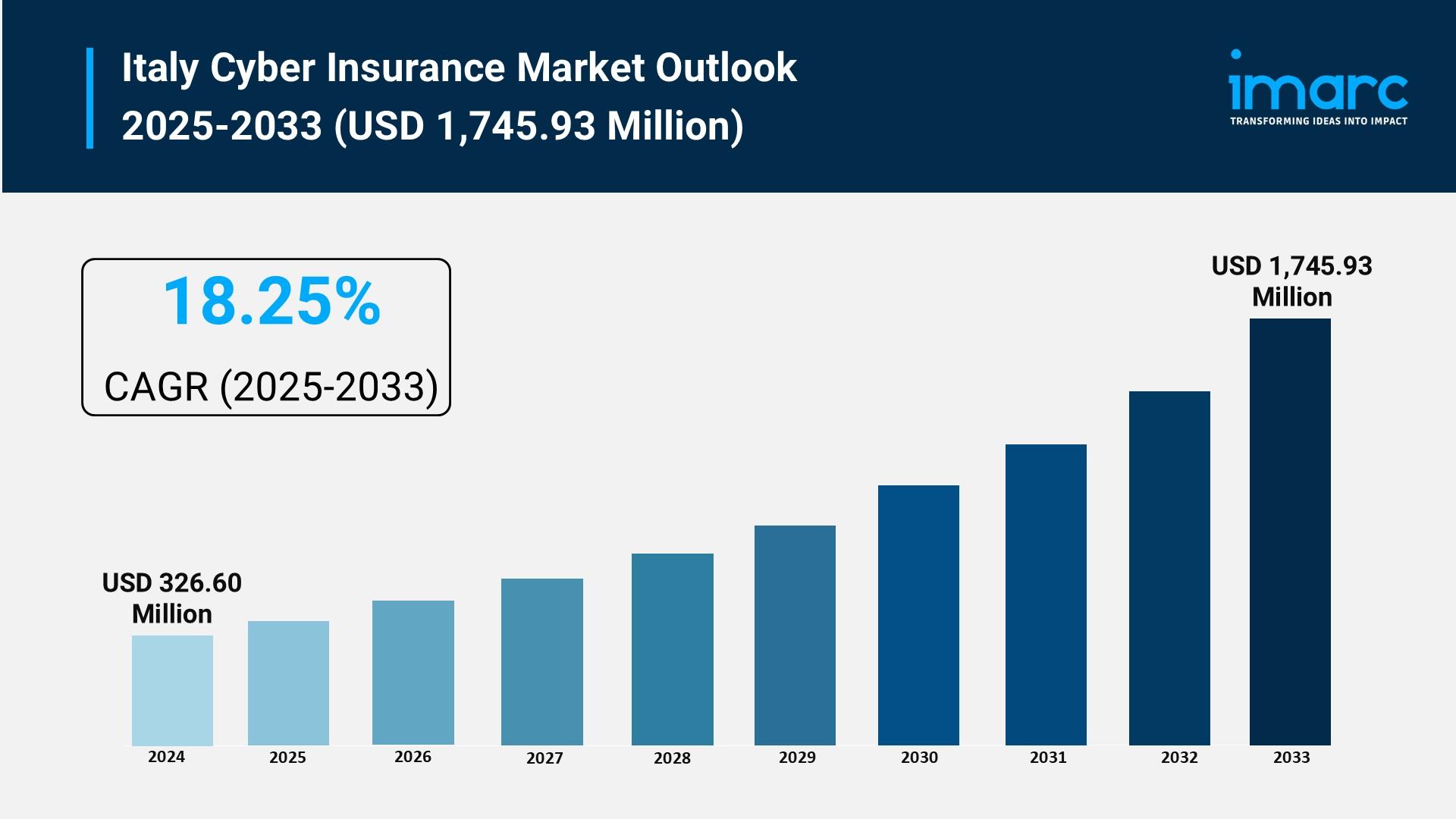

The Italy cyber insurance market size reached USD 326.60 Million in 2024 and is projected to grow to USD 1,745.93 Million by 2033. The market is expected to expand with a CAGR of 18.25% during the forecast period of 2025-2033. Factors such as rising data breaches, stricter compliance requirements, and increased use of digital platforms are driving demand for cyber coverage. Advances in risk assessment tools and tailored policies are strengthening the market across various sectors. The growing digitalization of industries like finance, healthcare, and manufacturing underpins this steady growth. For detailed insights, visit Italy Cyber Insurance Market.

How AI is Reshaping the Future of Italy Cyber Insurance Market

- AI enhances risk assessment tools used by insurers to tailor policies accurately, improving coverage accessibility for diverse industries.

- Integration of AI enables real-time monitoring assistance as part of policy packages, helping prevent losses proactively.

- AI-driven underwriting improves assessment of client-specific risk profiles, leading to precise pricing models.

- Partnerships between insurers and cybersecurity firms leverage AI-powered forensic analysis for faster incident response.

- Sector-specific AI-based policies are being introduced targeting industries with higher cyber exposure such as finance and e-commerce.

- AI helps in the expansion of insured base by supporting the increasing uptake among medium-sized enterprises through better risk mitigation.

Grab a sample PDF of this report: https://www.imarcgroup.com/italy-cyber-insurance-market/requestsample

Market Growth Factors

The Italy cyber insurance market growth is fueled by a significant rise in cyberattacks targeting both private and public sectors. Businesses increasingly recognize financial and reputational risks linked to data breaches, ransomware, and phishing scams. This awareness drives demand for cyber insurance solutions even among small enterprises, which historically overlooked coverage. Furthermore, ongoing regulatory developments, including stricter data protection laws, compel organizations to adopt robust risk management strategies, spurring demand for specialized cyber policies. These factors combined support a more comprehensive adoption of cyber insurance across industry sectors.

Insurance providers in Italy have responded by enhancing policy offerings to cover a wider array of incidents, such as business interruption losses and legal expenses. The rise of remote work has introduced new vulnerabilities, prompting insurers to innovate coverage solutions. Technological advancements, particularly in threat detection and risk assessment tools, enable more tailored and accessible insurance products. The market benefits from increased digitalization in finance, healthcare, and manufacturing industries, which represent key segments exhibiting steady insurance demand growth.

Growing sophistication of cyber threats has driven Italian insurers toward proactive policy innovation and risk mitigation efforts. Increasingly, insurers include services like pre-breach consultation, employee training programs, and real-time monitoring in their packages, reflecting a shift towards preventing losses before occurrence. Collaboration between insurers and cybersecurity firms enhances incident response and forensic investigation capabilities. The adoption of AI in underwriting processes enables insurers to better understand client risk profiles for accurate pricing. Recently introduced sector-specific policies for high-risk industries, such as finance and e-commerce, support expanding coverage. The push for comprehensive protection extends to global supply chain integration, where a breach at one partner impacts multiple entities, underscoring the growing need for robust cyber insurance solutions.

IMARCs report provides a deep dive into the Italy cyber insurance market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Market Segmentation

Component Insights:

- Solution

- Services

Insurance Type Insights:

- Packaged

- Stand-alone

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Recent Developement & News

- December 2024: Legislative Decree 138/2024 transposes the EU NIS2 Directive, expanding mandatory cybersecurity coverage to over 100,000 Italian entities including insurers, with fines up to €10 million or 2% of global turnover for non-compliance, spurring a 33.4% surge in cyber insurance sales for firms like Tinexta.

- January 2025: Insurers integrate AI-driven threat detection into cyber policies, enabling real-time risk assessment that boosts compliance rates by 40% for policyholders under new DORA regulations for the financial sector.

- March 2025: Blockchain security innovations in cyber insurance offerings enhance data integrity for critical infrastructure, driving a 21% increase in premium turnover to €168 million for providers like Leonardo S.p.A. through sovereign SOC integrations.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness