Mexico Chocolate Market Share, Size, In-Depth Insights, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

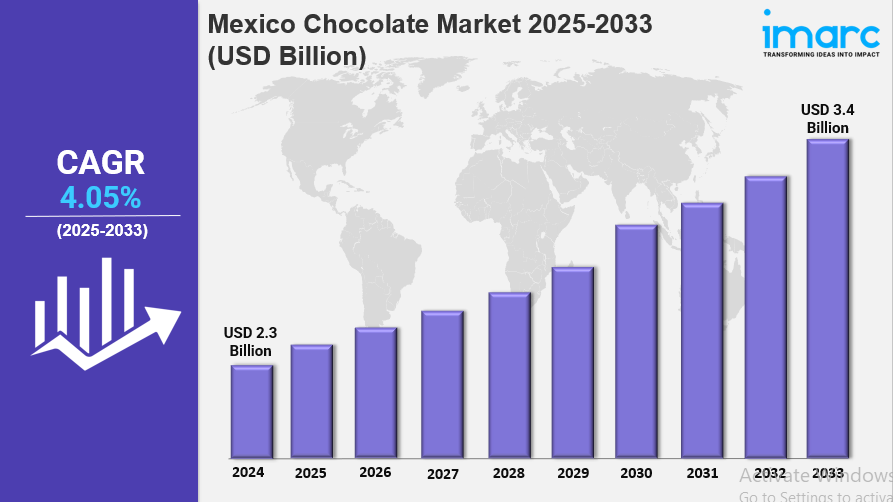

The Mexico chocolate market size reached USD 2.3 Billion in 2024, with a forecasted growth to USD 3.4 Billion by 2033. The market is expected to grow at a compound annual growth rate (CAGR) of 4.05% during the forecast period of 2025-2033. Growth drivers include rising disposable incomes, urban lifestyle changes, increasing demand for premium products, evolving consumer preferences across different chocolate segments, changing festive consumption patterns, and rapid growth in e-commerce.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

Mexico Chocolate Market Key Takeaways

-

Current Market Size: USD 2.3 Billion in 2024

-

CAGR: 4.05% during 2025-2033

-

Forecast Period: 2025-2033

-

Increased consumer demand for health, organic, and premium chocolates driven by higher disposable incomes and urbanization.

-

Key market trends include artisanal chocolate, dark chocolate with functional ingredients, and locally themed seasonal assortments.

-

Competition intensifies with innovations in taste, packaging, sustainability, and retail through online channels.

-

Challenges include price sensitivity and supply chain issues, while opportunities arise from demand for sustainable cacao and health-focused formulations.

-

The launch of new flavor combinations featuring native ingredients is redefining traditional tastes and supporting market growth.

Sample Request Link: https://www.imarcgroup.com/mexico-chocolate-market/requestsample

Mexico Chocolate Market Growth Factors

Mexico Chocolate Market growth is being driven by rising disposable incomes and an expanding middle-class population, both of which are significantly increasing consumer demand for a wide variety of chocolate products. Consumers increasingly favor premium chocolates, including high-quality imported and artisanal varieties that emphasize superior taste, premium ingredients, and refined packaging. Features such as single-origin cacao and organic certification are key focus areas for brands, fueled further by gifting trends during holidays and festive occasions.

Health-conscious preferences among urban and younger consumers enhance market growth by shifting consumption habits toward nutrition and well-being. There is a rising demand for products with high cacao content, sugar-free options, organic, or plant-based offerings. As an example, Barry Callebaut introduced the SICAO Zero sugar-free chocolate line in 2023 targeting health-conscious consumers seeking guilt-free indulgence. Additionally, the inclusion of functional ingredients such as fiber, superfoods, and antioxidants aligns with wellness-centric lifestyles and supports growth.

Innovation in flavor profiles is a notable growth driver, with major players incorporating native and unconventional ingredients like chili, cinnamon, mezcal, hibiscus, and amaranth into chocolates. This innovation caters to consumer interest in authenticity and experiential treats. For instance, Nestlé launched the Choco Trio in 2025 in Mexico, combining three textures—crunchy, creamy, and smooth—in one bar to create a unique sensory experience. Such product developments help brands differentiate themselves in an increasingly saturated marketplace.

To get more information on this market, Request Sample

Mexico Chocolate Market Segmentation

Breakup by Product Type:

-

White Chocolate

-

Milk Chocolate

-

Dark Chocolate

-

Others

The report provides detailed breakup and analysis for these types.

Breakup by Product Form:

-

Molded

-

Countlines

-

Others

Includes analysis of market share for molded, countlines, and other product forms.

Breakup by Application:

-

Food Products: Bakery Products, Sugar Confectionery, Desserts, Others

-

Beverages

-

Others

Detailed segment-wise analysis in the food and beverage categories is provided.

Breakup by Pricing:

-

Everyday Chocolate

-

Premium Chocolate

-

Seasonal Chocolate

Provides pricing segment breakdown reflecting everyday, premium, and seasonal chocolate products.

Breakup by Distribution:

-

Direct Sales (B2B)

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Stores

-

Others

Includes distribution channel segmentation covering direct, retail, and online sales.

Breakup by Region:

-

Northern Mexico

-

Central Mexico

-

Southern Mexico

-

Others

Comprehensive geographical analysis of the market is included.

Regional Insights

The report segments the Mexican chocolate market into Northern, Central, Southern Mexico, and others. Specific statistical data such as market share or CAGR by region is not explicitly provided. This segmentation reflects the distribution and consumption patterns across the country.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32041&flag=C

Recent Developments & News

In February 2025, the Mexican government launched the "Chocolate del Bienestar" program to support cacao farmers and provide affordable, high-quality chocolate through government-run stores. This initiative aims to strengthen the agricultural sector and improve consumer access to quality chocolate.

Mondelēz's Cocoa Life program announced in 2025 a pledge exceeding USD 1 billion, including a USD 600 million investment through 2030, focused on sustainable cocoa farming. This program emphasizes farmer empowerment, ethical sourcing, and supply chain transparency in Mexico.

In 2023, Barry Callebaut extended its chocolate supply agreement with Mars Wrigley in Mexico, reinforcing the strategic importance of the Mexican market in the global confectionery supply chain. Barry Callebaut continues supplying various chocolate products to Mars Wrigley’s manufacturing facilities in the country.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness