Indian Data Center Market Economic Impact and Industry Attractiveness 2030

Indian Data Center Market: Growth Outlook, Key Drivers, and Emerging Opportunities (2024–2030)

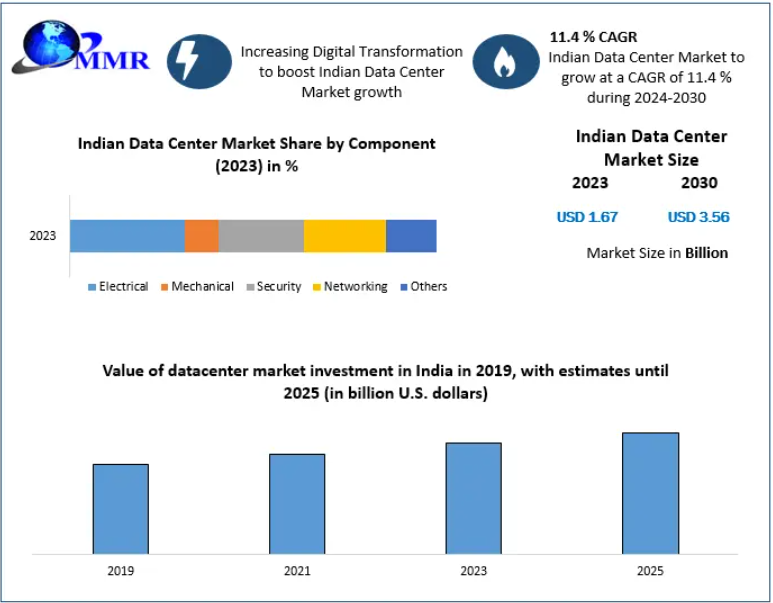

The Indian Data Center Market has entered a high-growth phase driven by rapid digital transformation, cloud adoption, and the rising need for secure data storage infrastructure. Valued at USD 1.67 billion in 2023, the market is expected to reach USD 3.56 billion by 2030, expanding at a CAGR of 11.4% during the forecast period.

India’s rapid shift towards digital services—across banking, government, retail, healthcare, manufacturing, and telecom—is creating exceptional demand for next-generation data center capacity. As a result, the country is evolving into a major data center hub within the Asia-Pacific region.

Market Overview

Data centers serve as the backbone of modern digital ecosystems, housing the hardware, software, and network systems required to support mission-critical applications. These include:

- Servers

- Storage systems

- Routers and switches

- Firewalls

- Application delivery controllers

While India earlier relied largely on enterprise-owned on-premise data centers, the landscape has evolved dramatically. Modern data centers are increasingly:

- Cloud-centric

- Edge-enabled

- Colocation-driven

- Sustainability-focused

Currently, Mumbai, Delhi NCR, Bengaluru, and Chennai collectively account for over 60% of India’s data center sites and more than 75% of operational IT load, reflecting their strategic advantage in power, connectivity, and ecosystem partnerships.

Government initiatives promoting data localization, Digital India programs, and emerging cloud-first policies continue to accelerate market development.

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/29762/

Market Dynamics

- Rapid Digital Growth Fueling Capacity Expansion

India has become one of the world’s fastest-growing digital economies, with:

- 880+ million internet users

- Surging adoption of OTT platforms, online banking, e-commerce, and enterprise cloud migration

- Expanding AI and machine-learning workloads across industries

By 2024, India’s data centers spanned over 8 million sq. ft., with demand rapidly rising for additional power capacity and hyperscale infrastructure.

Mumbai remained the epicenter, emerging as the third-largest data center market in APAC in 2023, reflecting India’s strengthening digital foundation.

- Surge in Cloud, AI, and Edge Computing

The rise of 5G, connected devices, and real-time content consumption is pushing enterprises toward:

- Distributed cloud models

- Edge data centers

- Low-latency hyperscale facilities

In January 2024, Digital Realty launched its first Indian data center in Chennai with a 100 MW IT load capacity, illustrating strong global confidence in the Indian market.

- Growth of Sustainable Infrastructure

Global and domestic operators are prioritizing sustainability:

- Colt DCS announced hyperscale facilities in India with a pledge to reach net-zero carbon by 2045.

- Vertiv opened a new manufacturing plant focused on energy-efficient thermal management solutions.

- Major Indian data centers increasingly operate in IGBC-compliant green campuses.

Renewable energy adoption is becoming a competitive differentiator as operators commit to green data center ecosystems.

- Challenges: Infrastructure Limitations

India’s data center power demand is expected to reach 5 gigawatts within 6–7 years, creating pressure on:

- Grid power availability

- Renewable energy capacity

- Land acquisition

- Skilled workforce availability

- Network redundancy

Addressing these concerns is crucial for sustaining long-term growth.

Opportunities in the Indian Data Center Market

- Real Estate Expansion

Data centers have emerged as a major real-estate segment:

- Over 500 acres were acquired in 2022 for new facility development.

- Total data center space is poised to double from 10.3 million sq. ft. (2022) to 20 million sq. ft. by 2025.

This drives job creation in construction, engineering, and facility management.

- Domestic Manufacturing Boost

The Draft Data Centre Policy 2020 encourages:

- Local manufacturing of data center hardware

- Incentives for global OEMs to set up plants in India

- Increased domestic value addition

This reduces import dependency and strengthens India’s digital supply chain.

- Renewable Energy Investments

Growing demand for data centers aligns with India’s clean energy ambitions. Operators are increasingly investing in:

- Solar and wind farms

- Renewable-backed captive power

- Carbon-neutral facility designs

This opens avenues for green energy partnerships across states.

Segment Analysis

By Industry Vertical

- IT & Telecom led the market in 2023.

Telecom operators require extremely high network reliability and distributed architectures to deliver mobile broadband, cloud connectivity, and content delivery.

Other key segments include BFSI, government, retail, media, manufacturing, and healthcare.

By Component

- Electrical systems dominated the market, reflecting the importance of:

- Power distribution units

- UPS systems

- Backup generators

- Cooling and management systems

These components ensure uninterrupted data center operations—critical in a 24×7 digital economy.

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/29762/

Key Players in the Indian Data Center Market

Leading data center operators and solution providers include:

- Sify Technologies

- Web Werks

- CtrlS Datacenters Ltd

- ESDS Software Solution

- Yotta Infrastructure

- Netmagic Solutions

- AWS

- Gpx Global Systems

- NxtGen

- NTT Ltd

- Nxtra Data (Airtel)

- Reliance Jio

- STT GDC India

- Tata Communications

- Equinix

- RackBank Datacenters Pvt. Ltd.

- COLT DCS

- Vertiv

- AdaniConneX

These companies are rapidly expanding footprints through:

- Hyperscale facilities

- Edge data center deployments

- Green infrastructure

- Strategic joint ventures

- Multi-cloud and hybrid cloud offerings

Conclusion

The Indian Data Center Market is at the cusp of a growth revolution, fueled by digitalization, cloud-first strategies, and increasing investments from global and domestic players. While infrastructure and sustainability challenges persist, the sector presents enormous opportunities for real estate, energy, manufacturing, and technology stakeholders.

As India moves towards becoming a trillion-dollar digital economy, the demand for scalable, resilient, and energy-efficient data centers will continue to rise—positioning the country as one of the fastest-growing data hub destinations globally.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness