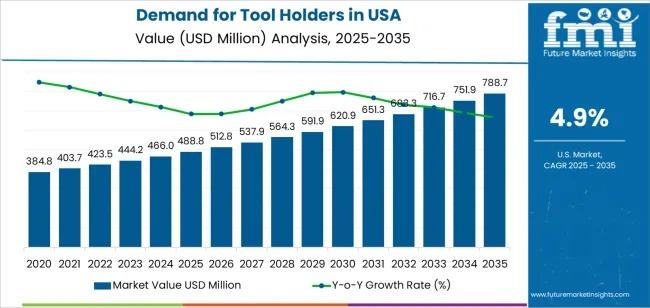

USA Tool Holders Market to Surpass USD 788.7 million by 2035

The demand for tool holders in USA is entering a new phase of expansion as manufacturers intensify their shift toward high-precision, automated, and digitally integrated machining. According to recent market assessments, the industry is set to grow from USD 488.8 million in 2025 to USD 788.7 million by 2035, advancing at a robust 4.9% CAGR. As detailed in the latest market study, the rising appetite for high-quality tool-holding systems is closely linked to adoption trends across CNC machining, automated production, and next-generation manufacturing technologies.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-28690

Driven by several structural shifts, this decade marks a transformative period for machining technologies across the United States. Industries such as automotive, aerospace, heavy engineering, and electronics are demanding higher accuracy and reliability in their machining operations—areas where modern tool holders deliver measurable performance benefits. By 2030, the market is projected to add USD 76.1 million in new demand, accounting for a quarter of the decade’s growth as factories modernize and expand.

Tool holders, though often overlooked in the broader tooling ecosystem, play an essential role in achieving precision and productivity. Their ability to ensure tool stability, reduce vibration, uphold tight tolerances, and support high spindle speeds makes them indispensable in advanced CNC environments. As machining tasks become more complex—especially in EV components, lightweight alloys, aerospace structures, and high-tolerance metal parts—the performance expectations from tool-holding systems are rising significantly.

Key Market Forces Fueling Growth

The accelerating adoption of automation is among the strongest demand drivers. U.S. factories are increasingly deploying robotic cells, multi-axis machining centers, and automated handling systems, all requiring tool holders capable of consistent, repeatable accuracy. A parallel trend is the move toward predictive and preventive maintenance through sensor-embedded smart tool holders, which help reduce downtime, enhance tool life, and improve process stability.

Additionally, advancements in tool-holder materials—such as high-strength alloys, precision-ground tapers, and advanced coatings—are enabling machining operations at higher speeds and tighter tolerances. These innovations are especially valuable in sectors requiring extremely precise machining, such as electric vehicle components, defense manufacturing, and high-performance aerospace assemblies.

While growth prospects remain strong, the market faces several challenges. Upgrading to premium tool-holder systems demands capital investment, which may be difficult for smaller job shops. Retrofitting older machinery to accommodate advanced tool holders also remains a barrier. Finally, global supply-chain constraints and volatility in alloy steel prices can disrupt availability and pricing.

Segmental and Regional Highlights

The BT flange taper segment leads the U.S. market with 52% share, largely due to its high precision, rigidity, and suitability for CNC systems. Automotive remains the largest end-use segment, holding 32% of total demand. This dominance is reinforced by rising production complexity, the need for precision in powertrain and EV parts, and investments in automated machining lines.

Regionally, the West leads with a 5.7% CAGR, driven by strong aerospace, automotive, and technology manufacturing clusters. The South follows at 5.1%, supported by rapid industrial expansion in Texas, Georgia, and Florida. The Northeast (4.5%) and Midwest (4.0%) also remain vital landscapes for machining operations.

Competitive Landscape

The competitive environment in the U.S. tool-holder industry remains strong, with innovation-focused manufacturers securing significant market positions. Guhring KG leads the market with a 30.3% share, supported by Seco Tools AB, Emuge-Franken, NT Tool Corporation, and Mapal Group. Their ongoing investments in high-precision systems, vibration-damping holders, quick-change solutions, and digital integration are shaping the industry's future.

Strategic Outlook

As U.S. manufacturing continues to embrace reshoring, precision engineering, and high-automation workflows, demand for advanced tool-holding solutions will remain resilient. Manufacturers are expected to prioritize durability, accuracy, compatibility with high-speed machining, and interoperability with modern CNC systems. The next decade will see expanding use of sensor-enabled smart holders, quick-change systems, and highly specialized tooling formats tailored to new materials and machining complexities.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness