United States Data Center Liquid Cooling Market Size, Share, In-Depth Analysis, Opportunity and Forecast 2025-2033

IMARC Group has recently released a new research study titled “United States Data Center Liquid Cooling Market Size, Share, Trends and Forecast by Component, Data Center Type, End Use, Application, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

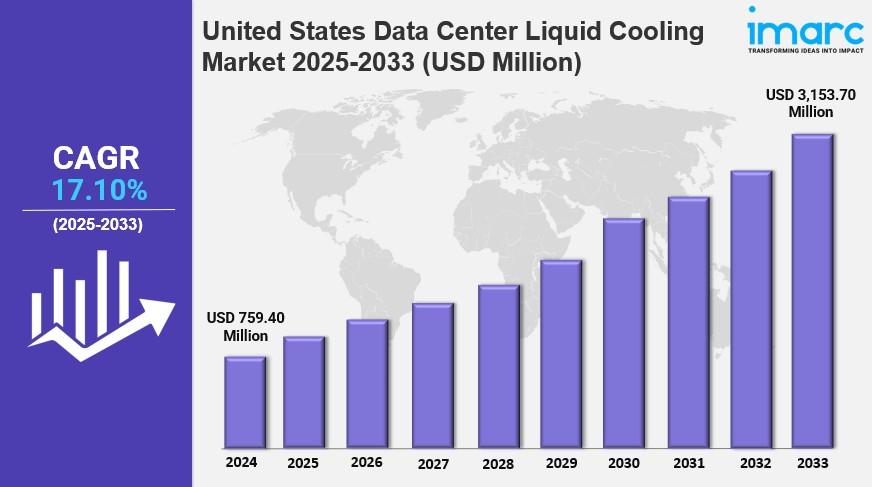

The United States data center liquid cooling market size was valued at USD 759.40 Million in 2024 and is projected to reach USD 3,153.70 Million by 2033, exhibiting a CAGR of 17.10% during the forecast period of 2025-2033. This growth is driven by rising demand for data processing and storage, energy efficiency initiatives, and the increasing need for advanced cooling solutions due to high-performance computing and AI workloads.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

United States Data Center Liquid Cooling Market Key Takeaways

● Current Market Size in 2024: USD 759.40 Million

● CAGR (2025-2033): 17.10%

● Forecast Period: 2025-2033

● Increasing adoption is driven by the rise of high-performance computing (HPC), AI, and big data analytics that demand efficient thermal management.

● Expansion of hyperscale and edge data centers boosts demand for liquid cooling due to higher rack densities and energy efficiency requirements.

● Liquid cooling solutions support sustainability goals by reducing energy consumption and power usage effectiveness (PUE) in data centers.

● The market sees strong growth in both component solutions and specialized services related to design, installation, and maintenance.

● Regions such as the Northeast, Midwest, South, and West each exhibit unique drivers pushing the demand for liquid cooling systems in data centers.

Sample Request Link: https://www.imarcgroup.com/united-states-data-center-liquid-cooling-market/requestsample

Market Growth Factors

The United States data center liquid cooling market demand is rising as growing adoption of HPC systems and AI-driven workloads accelerates the need for efficient, high-performance cooling solutions. Enterprises' increasing adoption of ML, AI, and big data analytics for data processing is creating heavy data center workloads that produce more heat than air-cooling can dissipate in total. Liquid cooling solutions like direct-to-chip and immersion cooling are increasingly used in AI and advanced computing environments. This maximizes server performance. This eliminates thermal throttling. This maintains system uptime. Liquid cooling partnerships that are high-profile and innovative solutions such as Accelsius's NeuGuard program that launched in March 2025 are important in addressing the cooling demands associated with AI and advanced computing.

Hyperscale and edge data centers are other major drivers of efficiency increases. Cloud computing, Internet of Things (IoT), 5G networks and content delivery networks have increased the demand for higher rack densities and better cooling. Liquid cooling technologies have been adopted by many hyperscalers such as Google, Microsoft and Meta to scale their data centers for AI and cloud. Edge data centers, which are smaller and often have limited space and power, benefit from dense, energy efficient liquid cooling solutions. Other collaborative efforts also present the growing trend for sustainable, scalable data centers, such as SEGUENTE and Sabey Data Centers.

Energy becomes efficient and sustains market development because data centers use much energy, and they consume a large portion of energy for cooling. Liquid cooling improves power usage effectiveness. Liquid cooling draws heat away from equipment more effectively. This is increasingly needed in order to meet corporate environmental, social, and governance (ESG) goals and regulatory targets. Volatile energy prices with environmental regulations encourage operators to adopt energy-efficient and low-carbon solutions. However, people are investing substantially, as shown by the February 2025 partnership between ZutaCore and Carrier Global Corporation, to create advanced, integrated liquid cooling solutions that meet this energy and sustainability challenge.

To get more information on this market Request Sample

Market Segmentation

Analysis by Component:

● Solution

● Direct Liquid Cooling

● Indirect Liquid Cooling

● Services

● Design and Consulting

● Installation and Deployment

● Support and Maintenance

Data Center Type:

● Large Data Centers

● Small and Medium-sized Data Centers

● Enterprise Data Centers

End Use:

● Cloud Providers

● Colocation Providers

● Enterprises

● Hyperscale Data Centers

Applications:

● BFSI

● IT and Telecom

● Media and Entertainment

● Healthcare

● Government and Defense

● Retail

● Research and Academic

● Others

Regional Insights

The United States liquid cooling market is broadly supported across four regions: Northeast, Midwest, South, and West, each with distinctive dynamics. The Northeast prioritizes sustainable cooling due to strict environmental regulations and aging infrastructure. The Midwest benefits from affordable land and climate, encouraging green data center growth. The South's warm climate accelerates liquid cooling adoption to reduce energy costs. The West, home to tech giants, focuses on sustainable, energy-efficient systems amid regulatory pressures and high electricity costs. No precise market shares or CAGR per region are provided in the source.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20765&flag=C

Recent Developments & News

● May 2025: Chemours and DataVolt formed a strategic partnership to advance liquid cooling solutions for AI and high-density computing, emphasizing efficiency and sustainability using Chemours' Opteon dielectric fluids.

● February 2025: Vertiv launched its Liquid Cooling Services portfolio in the US, offering installation, fluid management, emergency support, and lifecycle maintenance for HPC and AI systems.

● December 2024: AWS introduced data center innovations aiming for up to 6x higher rack power density through modular power, liquid cooling, and optimized rack designs.

● October 2024: Wesco acquired Ascent LLC for USD 185 million to enhance its data center solutions portfolio, including liquid cooling services.

● October 2024: Vertiv unveiled new products, CoolPhase CDU and CoolChip Fluid Network, expanding liquid cooling solutions tailored for AI workloads.

● October 2024: JetCool and Flex partnered to provide liquid cooling-ready servers using JetCool's micro-convective cooling technology for scalable AI and high-density compute.

Key Players

● Schneider Electric

● Vertiv

● LiquidStack

● Submer

● CoolIT Systems

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness