Banking Encryption Software Market Trends & Future Outlook, 2032 | UnivDatos

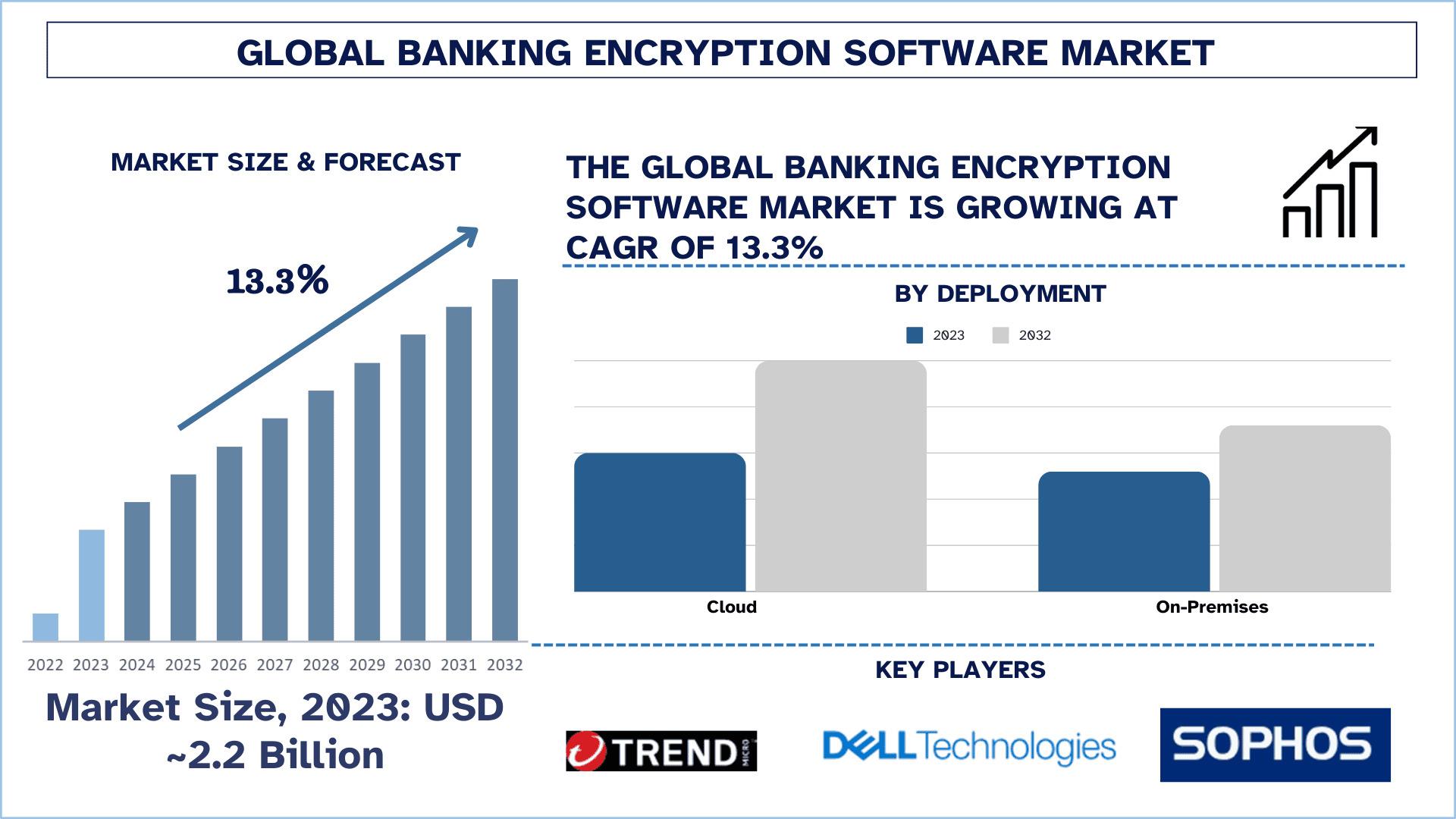

According to the UnivDatos, growing cybersecurity threats, increase in online transactions, rising adoption of zero-trust security models, shift to digital banking, and the emergence of quantum computing drive the banking encryption software market. As per their “Banking Encryption Software Market” report, the global market was valued at USD 2.2 Billion in 2023, growing at a CAGR of about 13.3% during the forecast period from 2024 - 2032 to reach USD Billion by 2032.

The criminological implications of the increasing digitization of banking also pose challenges to the effective security of banking information. Banking encryption software has been upgraded as a strong pillar in offering a deep shield to banking operations, customer data, and compliance requirements. Given the fact that there is an increase in the number of cyber threats and with the added incidence of data breaches, banks around the globe are now using high levels of encryption measures to protect data in their systems. As part of this article, the latest trends within banking encryption software, the major adoption cases in the industry, and their market growth aspects will be examined.

Increasing Popularity for Encryption Products

The banking business is experiencing an increased rate of growth in the transactions being done online hence requiring advanced tools such as encryption software. There has been an increased number of cyber threats which include ransomware, phishing, and insider attacks, meaning banks have no option but to embrace data protection. According to records by the World Bank, 2023 was a year of break-in incidences directed to the customers’ database, indicating the importance of new encryption programs. However, the implementation of regulations such as GDPR, PCI DSS, and other regional cybersecurity legislation has emerged as persuaders for market take-off.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/banking-encryption-software-market?popup=report-enquiry

The role of regional dynamics in growth

North America

In the North American region, non-GPLA countries and high risk of cyber security along with regulations like GLBA and CCPA are pushing high demand for encryption software. Currently, American banking institutions are incorporating the encryption tools initiated by artificial intelligence and zero-trust frameworks.

The California Consumer Privacy Act (CCPA) is having an impact on the security professionals, auditors, managers and boards responsible for ensuring its effective implementation. The act, which governs the disclosure of data and the sharing of California residents’ personal information, became effective 1 January 2020. Of particular concern is the CCPA’s requirement that enterprises demonstrate use of the proper level of encryption to mitigate the risk of a data breach.

Further, this program must assess and cross-reference other related internal and regulatory controls, such as International Organization for Standardization (ISO)/International Electrotechnical Commission (IEC) 27001, ISO/IEC 27017, Gramm-Leach-Bliley Act (GLBA), Payment Card Industry Data Security Standard (PCI DSS).

Asia-Pacific

Digital Banking has been eradicated in the Asia-Pacific region very fast, where India and many other countries have made strict laws regarding cybersecurity. Financial institutions in this region are implementing regional-based encryption to support regulation requirements & the increasing amount of Internet transactions.

Europe

Europe continues pointing to the example of data protection; the GDPR, for instance, expects banks to enforce high levels of encryption. The region is observing increasing adoption of post-quantum cryptography as a result of future-proofing efforts.

The Regulation also recognizes these risks when processing personal data and places the responsibility on the controller and the processor in Art. 32(1) of the General Data Protection Regulation to implement appropriate technical and organisational measures to secure personal data.

Primary Trends and Developments in Banking Encryption Software

AI-Powered Encryption: AI is making an impact in encryption by offering the opportunity to analyze the possibilities of encrypting data and the ability to detect threats on its own, helping banks get more streamlined at finding and eliminating weak spots.

Cloud-Based Security: As banks move more services to the cloud, secure-multi cloud is becoming the communications model of choice with end-to-end encryption.

Post-Quantum Cryptography: The advent of quantum computing brings risks to traditional encryption paradigms Whether intentional or traditional, new risks for banks present themselves from this sort of future quantum computing.

Blockchain Integration: A way in which they are incorporating blockchain technology is for the ability to hold transactions with greater security, the storage of which is incorruptible and in tandem with traditional encryption practices.

Focus on Data Privacy: More stringent measures in encryption are being adopted to meet the strong privacy expectations of choice customers and to offset stringently emphatic privacy laws.

Adoption Strategies by Banks

Banks have not remained limited to using one layer of encryption to address modern security threats. Such measures include disk encryption, network encryption, and database encryption where data relating to customers is concerned. Moreover, institutions are partnering with cybersecurity industry leaders so that they can reap from the advanced form of encryption technologies.

Clouds as particular solutions have been introduced as being capable of providing banks with increased levels of encryption, while at the same time also lowering costs. SMEs in banking are also using affordable encryption service models to improve security without evoking capital intensity.

Click here to view the Report Description & TOC: https://univdatos.com/reports/banking-encryption-software-market

Challenges in Adoption

However, several factors act as barriers to the growth of the banking encryption software market even when there is a fast uptake. One challenge associated with Cipher relates to the high costs of implementing the solution, followed by difficulty in implementing Cipher where the existing systems are not compatible with encryption systems. The third challenge is also linked to human resources where there are inadequate skills required to enforce Cipher complexes security systems. Also, different cyber threats emerged over the years, and the cryptographic protection of data demands frequent enhancements, which is costly.

The Future of Banking Encryption Software

From the case, the future of banking encryption software can be seen in improving upon the different facets of the present encryption technologies to overcome newer forms of threats. The world of cryptocurrency and cybersecurity is forecasted to undergo a big shift after post-quantum encryption, blockchain integration, and artificial intelligence tools. Banks will incorporate more encryption as a preventive measure to protect customer information and meet growing and evolving standards.

Also, future technologies such as IoT and edge computing, integrated with encryption will provide new frontiers to secure financial systems. Since financial institutions focus on security and customer trust, the banking encryption software market will see unparalleled growth in the future.

Conclusion

Banking Encryption Software is not a device that can be regarded merely as a software tool but is indeed a requirement in an era where digital banking is becoming the norm. These are the reasons why the use and deployment of enhanced security schemes can no longer be taken for granted for banks as they may affect one’s capacity to uphold the necessary standards, much less provide customers with the security they deserve. Today, the market is still expanding because of the development of technology and the heightened level of cybersecurity risks; hence, banking institutions need to adopt new encryption approaches. This approach will be proactive in building a secure, resilient, and trustworthy future of the financial system.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness