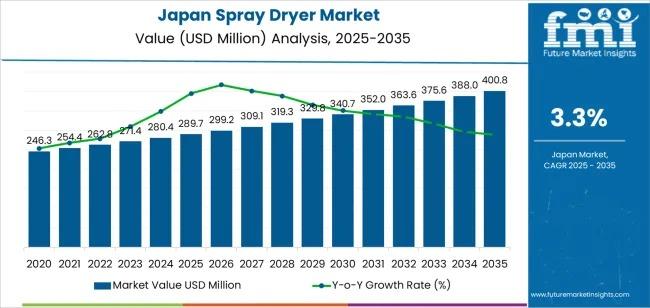

Japan Spray Dryer Market to Surpass USD 400.8 million by 2035

Japan’s industrial sectors are entering a period of technology-driven transformation, and one of the strongest benefactors is the Demand for Spray Dryer in Japan market. The sector is projected to grow from USD 289.7 million in 2025 to USD 400.8 million by 2035, supported by a 3.3% CAGR. Driven by rising adoption of powdered food ingredients, nutraceuticals, and pharmaceutical formulations, spray drying technology is becoming a cornerstone of Japan’s high-precision manufacturing landscape.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-28952

Market Drivers: Food Processing and Pharmaceuticals Lead Demand

The food and beverage industry remains the single largest contributor to demand, accounting for 47.2% of Spray Dryer usage in Japan. The sector relies heavily on spray drying for producing milk powder, instant beverages, coffee, flavorings, and functional ingredients—categories experiencing robust domestic and export-driven growth.

The pharmaceutical and nutraceutical industries are also intensifying their use of spray dryers to meet stringent quality standards for active ingredients, inhalable formulations, and encapsulated compounds. Growth in health-focused consumer products continues to stimulate investments in high-precision drying equipment.

Complementing this momentum is rapid technological advancement. Manufacturers are introducing improved atomizer systems, automated monitoring platforms, and energy-efficient drying chambers that lower operational costs and enhance particle uniformity. These innovations are driving wider adoption across both small-scale specialty producers and large industrial facilities.

Product and Application Breakdown: Atomizers Lead the Market

Atomizer spray dryers, which account for 33% of total demand, dominate due to their ability to produce uniform, fine powders—an essential requirement for dairy, beverage, nutraceutical, and pharmaceutical applications. Their flexibility in handling diverse feed types gives them a competitive edge in Japan’s quality-driven market.

By application, food and beverage ranks highest at 47.2%, followed by pharmaceuticals and chemicals, where precise powder characteristics are essential. Continuous spray dryers are increasingly favored for large-volume operations, while batch units remain important for R&D and specialty formulations.

Regional Insights: Kyushu & Okinawa and Kanto Show Strongest Growth

All major regions show steady expansion, though at varied intensities:

- Kyushu & Okinawa (4.1% CAGR) – highest growth, driven by strong food processing and pharmaceuticals.

- Kanto (3.8% CAGR) – a hub for innovation, industrial R&D, and advanced manufacturing.

- Kinki (3.3% CAGR) – anchored by Osaka and Kyoto’s diverse manufacturing ecosystem.

- Chubu (2.9% CAGR) – supported by automotive, chemical, and food industries.

- Tohoku (2.6% CAGR) – growing due to agricultural processing advancements.

- Rest of Japan (2.4% CAGR) – steady demand from small and mid-scale producers.

The growth distribution highlights Japan’s expanding need for efficient, scalable powder-processing technologies across both metropolitan and regional industries.

Technology Trends: Automation, Energy Efficiency, and Modular Designs

Japan is rapidly modernizing its production environments, pushing manufacturers to adopt spray drying systems that offer:

- Advanced atomizers for precise particle size control

- Closed-cycle dryers for heat-sensitive materials

- Automated digital control systems for real-time process optimization

- Modular designs tailored to industries with limited factory space

These innovations are particularly attractive in pharmaceuticals, where particle control and purity are critical, and in food processing, where consistency and throughput directly impact profitability.

Challenges: High Capital Costs and Space Constraints Slow Upgrade Cycles

Despite strong demand, several challenges moderate the pace of adoption:

- High upfront investment for advanced spray-drying systems

- Rising energy and maintenance costs

- Limited floor space in older Japanese manufacturing facilities

- Lengthy validation processes, especially in pharma and food sectors

These factors extend upgrade cycles, pushing companies to prioritize modular, energy-efficient, and easy-to-integrate systems.

Competitive Landscape: Engineering Excellence Drives Market Positioning

Leading suppliers in Japan include:

- Saka Engineering Systems Private Ltd.

- C.E. Rogers Company

- Acmefil Engineering Systems Pvt. Ltd.

- Changzhou Lemar Drying Engineering Co. Ltd.

- BUCHI Labortechnik AG

Saka Engineering holds a substantial share due to its engineering strength and ability to design systems compatible with Japan’s stringent process requirements. Customization, robust service networks, and process-consulting capabilities are differentiators among top competitors.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness