Technical Textile Market Insights, Growth, Trends | Forecast - 2034

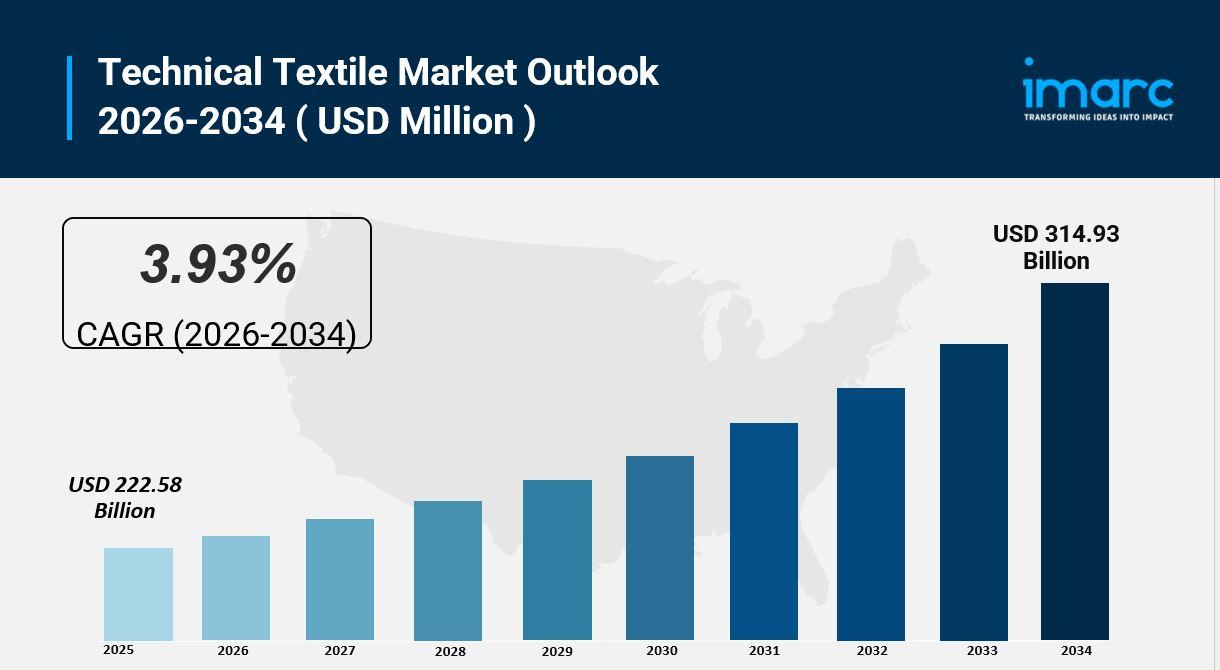

The global technical textile market size was valued at USD 222.58 Billion in 2025 and is projected to reach USD 314.93 Billion by 2034, growing at a CAGR of 3.93% during the forecast period 2026-2034. The market expansion is driven by rising demand from automotive, healthcare, and construction sectors, innovations in sustainable and smart textiles, and increased adoption of protective clothing and lightweight composites. The Asia Pacific region dominates the market with a 47% share.

The Technical Textile Market Size is growing rapidly as demand increases across automotive, construction, healthcare, agriculture, defense, and industrial sectors. Technical textiles are engineered materials designed for performance rather than aesthetics, offering properties such as high durability, thermal resistance, strength, and enhanced protection. These textiles play a critical role in applications like geotextiles, medical textiles, protective clothing, filtration, automotive components, and smart fabrics.

Market expansion is driven by rising infrastructure development, the growing need for advanced safety materials, and increasing adoption of high-performance fabrics in transportation and industrial processes. Technological advancements—including nanofibers, smart textiles, and biodegradable materials—are further reshaping the industry landscape.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Technical Textile Market Key Takeaways

- Current Market Size: USD 222.58 Billion in 2025

- CAGR: 3.93%

- Forecast Period: 2026-2034

- Asia Pacific dominates the market with a 47% share due to its robust manufacturing capabilities and growing industrial base.

- The market growth is fueled by rising demand for high-performance fabrics in automotive, healthcare, and construction industries.

- Increasing adoption of smart, functional, and sustainable textiles is significantly supporting market expansion.

- Government initiatives in countries like India, including the PLI Scheme extension, encourage innovation and manufacturing in the technical textiles segment.

- In the United States, technical textiles hold an 86.05% market share, driven by automotive, healthcare, and construction demand.

Get your free sample here: https://www.imarcgroup.com/technical-textile-market/requestsample

Market Growth Factors

The global technical textile market is experiencing growth driven by increasing industrialization and urbanization, which have boosted demand for functional textiles in automotive, construction, and healthcare sectors. The adoption of lightweight and high-performance materials enhances efficiency and safety, especially in automotive and aerospace applications. Advances in smart textiles, such as wearable electronics and protective clothing, open new avenues for medical, sports, and defense applications. In India, government campaigns like the 'Swadeshi Campaign' aim to increase domestic textile demand, potentially reaching USD 250 billion by 2030, supporting market expansion.

Environmental regulations are accelerating the shift towards sustainable and recyclable technical textiles, creating eco-friendly growth opportunities. Companies are incorporating environmentally friendly fibers, biodegradable polymers, and recycled fibers. Waterless dyeing and chemical-free treatments reduce environmental impacts, while sustainable applications in construction, packaging, and filtration contribute to circular economy goals. Collaborations such as Swedish recycler Syre partnering with U.S. retailers to supply recycled polyester reflect industry commitments to sustainability. These trends enhance functional and environmentally responsible textile manufacturing.

The automotive and transportation industries strongly drive the demand for technical textiles due to the need for lightweight, robust, and multifunctional materials to improve fuel efficiency, reduce emissions, and enhance passenger comfort. Technical textiles with flame-resistant, wear-resistant, heat-resistant, sound absorption, and vibration damping properties support vehicle performance and safety under harsh conditions. Expansion into railway, aerospace, and mass transit applications is accelerating, further propelling the market growth and innovation in transportation technologies.

Market Segmentation

Analysis by Material:

- Natural Fiber: Cotton, Wool, Others

- Synthetic Polymers/Fibers: Polyether Sulfone (PES), Polyamide (PA), Polyacrylonitrile (PAN), Polypropylene (PP), Polyester, Others

- Mineral Fiber: Asbestos, Glass Fiber, Ceramic Fiber

- Regenerated Fiber: Rayon, Acetate

- Metal Fiber

- Others

*Description:* Synthetic polymers and fibers dominate with 52% market share, valued for versatility, high strength-to-weight ratio, durability, chemical resistance, and adaptability across industrial, medical, and protective applications.

Analysis by Process:

- Woven

- Non-woven

- Others

*Description:* Woven process leads with 55% market share, involving interlacing yarns to create strong, dimensionally stable fabrics for applications like protective clothing, automotive textiles, geotextiles, and industrial filters.

Analysis by Application:

- MobilTech

- InduTech

- SporTech

- BuildTech

- HomeTech

- ClothTech

- MediTech

- AgroTech

- ProTech

- PackTech

- GeoTech

- OekoTech

*Description:* MobilTech accounts for 25% share, focusing on automotive and transportation textiles, including seat covers, airbags, interior panels, offering durability, lightweight, noise reduction, and supporting electric and lightweight vehicle demands.

Regional Insights

Asia-Pacific dominates the global technical textile market with a 47% share, driven by rapid industrialization, urbanization, and infrastructure growth in China, India, and other countries. Strong demand exists across automotive, construction, healthcare, and protective textiles sectors. Government support, skilled workforce presence, and increasing consumer awareness of advanced textiles in sportswear and medical applications further solidify the region's leadership and long-term market expansion.

Recent Developments & News

- In 2024, BASF launched loopamid®, the first polyamide 6 (PA6) fully derived from textile waste, adopted by Inditex in a jacket collection incorporating loopamid® lining, zippers, and buttons, advancing circularity.

- August 2024: UNIFI expanded its REPREVE® portfolio with new technical textile products, including white-dyeable filament yarn and ThermaLoop™ insulation, enhancing sustainable polyester performance for industrial and apparel uses.

Key Players

- 3M Company

- Asahi Kasei Advance Corporation (Asahi Kasei Corporation)

- Baltex

- Barry Global Inc.

- DuPont de Nemours Inc.

- Duvaltex Inc.

- Freudenberg & Co. KG

- Hindustan Mills Limited

- HUESKER Synthetic GmbH

- Huntsman Corporation

- Milliken & Company

- SKAPS Industries

- SRF Limited (Kama Holdings Ltd.)

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=8176&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness