Brazil Used Cooking Oil Market Analysis 2025–2033: Biodiesel Demand, Collection Networks, Regional Trends and Long-Term Forecast

Brazil Used Cooking Oil Market Overview

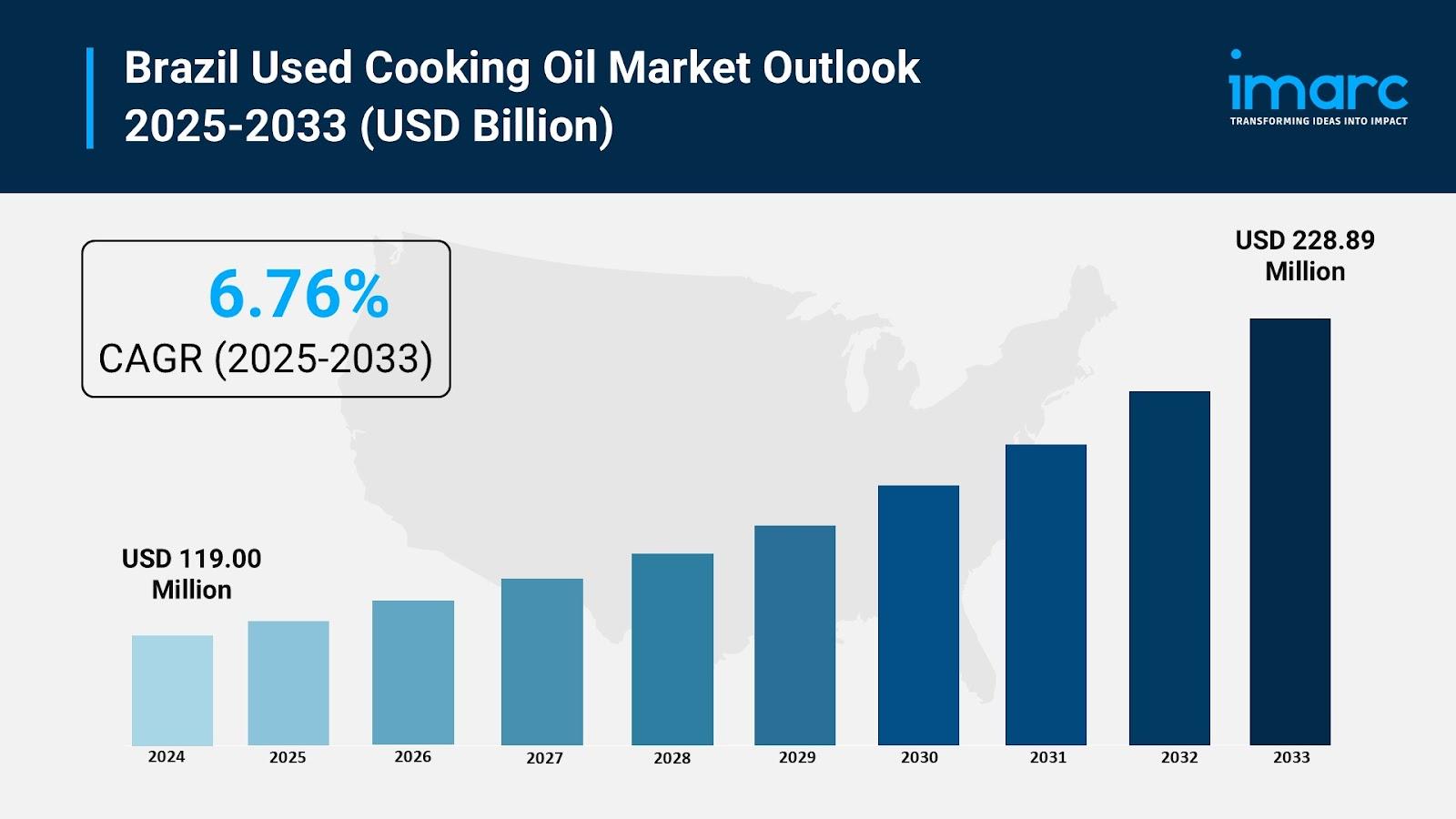

The Brazil Used Cooking Oil Market reached USD 119.00 Million in 2024 and is projected to reach USD 228.89 Million by 2033, growing at a CAGR of 6.76% during 2025–2033. Market expansion is strongly supported by rising demand for sustainable aviation fuel (SAF) produced from used cooking oil, alongside increasing tourism activities that boost feedstock availability across hotels, restaurants, and foodservice establishments. Brazil’s extensive renewable energy capabilities and leadership in biofuels further enhance the conversion of waste oil into clean energy solutions. Strengthening international aviation regulations that push higher SAF blending mandates continue accelerating the market’s long-term growth outlook.

Study Assumption Years

Base Year: 2024

Historical Years: 2019–2024

Forecast Period: 2025–2033

Brazil Used Cooking Oil Market Key Takeaways

- Market Size (2024): USD 119.00 Million

- CAGR (2025–2033): 6.76%

- Aviation sector demand for SAF is a major growth catalyst

- 6.65 Million international tourists in 2024 increased used cooking oil generation

- Brazil’s renewable energy sector valued at USD 16.3 Billion in 2024

- International aviation regulations advancing SAF blending requirements

- Technological advancements ensure SAF meets aviation-grade standards

Brazil Used Cooking Oil Market Growth Factors

The Brazil Used Cooking Oil Market is primarily driven by soaring demand for sustainable aviation fuel (SAF). As the aviation industry intensifies efforts to reduce greenhouse gas emissions, used cooking oil has emerged as a key low-carbon feedstock due to its sustainability and compatibility with advanced refining technologies. Brazil’s long-standing expertise in biofuels enhances its capability to convert waste oil into SAF, supporting circular economy principles. International aviation policies targeting carbon neutrality and promoting higher SAF blending mandates further strengthen market demand beyond traditional biodiesel applications.

Growing tourism activity is another major factor contributing to increased used cooking oil availability. Brazil recorded 6.65 Million international tourists in 2024, a 12.6% rise from 2023, particularly across coastal destinations and metropolitan hubs with high foodservice density. This seasonal and sustained rise in tourists significantly boosts cooking oil consumption in restaurants, hotels, and catering services, ensuring abundant feedstock supply. Hotels and foodservice operators increasingly partner with regulated collectors to comply with environmental standards and reduce waste, supplying feedstock for biodiesel, soaps, and chemical applications.

Technological innovations in refining processes also enhance market scalability. Modern hydrotreatment and upgrading technologies ensure SAF derived from used cooking oil meets stringent aviation-quality requirements, including thermal stability and low freeze-point criteria. These advancements minimize dependency on fossil fuels while addressing waste disposal concerns. Additionally, investments in waste management infrastructure within tourism-heavy regions have improved collection efficiency. Combined, these elements contribute to a strong and sustainable market trajectory through 2033.

Sample Request Link: https://www.imarcgroup.com/brazil-used-cooking-oil-market/requestsample

Brazil Used Cooking Oil Market Segmentation:

Source Insights

- Food Processing Industry

- HoReCa

- Household

- Others

Application Insights

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

Regional Insights

Brazil’s used cooking oil market is segmented across Southeast, South, Northeast, North, and Central-West. The source does not provide specific regional dominance, market share, or CAGR data. Therefore, regional performance details are not provided in the source, though all major regions contribute to overall collection and processing activities depending on tourism density and industrial presence.

Recent Developments & News

- In May 2025, fuel distributor Vibra began supplying sustainable aviation fuel (SAF) at Tom Jobim International Airport (GIG) in Rio de Janeiro, becoming the first company in Brazil to offer SAF produced from used cooking oil.

- This development marks a significant milestone for Brazil’s renewable aviation sector, supporting low-carbon travel initiatives.

Request Customization https://www.imarcgroup.com/request?type=report&id=41422&flag=E

About Us

IMARC Group is a global management consulting firm providing market intelligence, feasibility studies, factory setup assistance, regulatory guidance, and competitive benchmarking.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel (India): +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness