South Korea Insulation Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Insulation Market Size, Share, Trends and Forecast by Material Type, Function, Form, End Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Insulation Market Overview

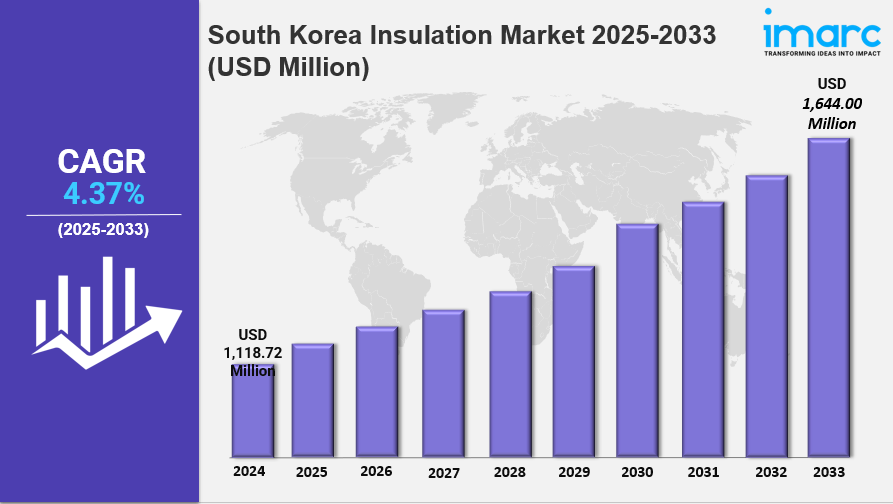

The South Korea insulation market size reached USD 1,118.72 Million in 2024 and is projected to reach USD 1,644.00 Million by 2033. The market is expected to grow at a CAGR of 4.37% during the forecast period 2025-2033. Growing demand for energy-efficient buildings, stringent government regulations on sustainable construction, and increasing awareness of insulation benefits are key drivers. Urbanization and industrialization further support market expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Insulation Market Key Takeaways

- Current Market Size: USD 1,118.72 Million in 2024

- CAGR: 4.37% during 2025-2033

- Forecast Period: 2025-2033

- The South Korean government has enforced strict energy efficiency regulations and building codes, increasing demand for advanced insulation solutions.

- Technological advancements include development of aerogels, vacuum insulation panels, and smart insulation, improving thermal performance and space efficiency.

- Urbanization and industrialization contribute to market growth by expanding construction activities.

- Regulatory actions such as the suspension of EPS insulating sandwich panel standards for fire safety highlight increasing focus on safety and compliance.

- Competitive landscape includes detailed analysis of key player positioning and strategies.

Sample Request Link: https://www.imarcgroup.com/south-korea-insulation-market/requestsample

Market Growth Factors

The South Korea insulation market is increasingly driven by stringent energy efficiency regulations and building codes implemented by the government. These measures compel new constructions and renovations to integrate advanced insulation materials to reduce energy consumption and carbon emissions, supporting national sustainability goals. For example, in March 2024, the Ministry of Land, Infrastructure and Transport suspended national standards for expanded polystyrene insulating sandwich panels due to fire safety concerns. Such regulatory initiatives ensure continual demand for compliant, high-performance thermal insulation solutions across residential, commercial, and industrial sectors.

Technological innovation significantly propels market growth as manufacturers develop advanced materials like aerogels, vacuum insulation panels (VIPs), and smart insulation solutions that enhance thermal insulation in thinner profiles. These innovations cater especially to space-constrained urban environments and modular construction preferences. The advancements improve durability, efficiency, and installation ease. For instance, Hanwha Solutions developed high-purity insulation materials for high-voltage and submarine cables using proprietary XLPE technology, enhancing cable efficiency and heat resistance, as reported in March 2024.

Urbanization and industrialization trends in South Korea boost insulation demand by expanding construction activities in both residential and non-residential sectors. Increased awareness of energy conservation benefits fuels adoption of insulation products. Government incentives and sustainability-focused construction practices further catalyze market expansion. The rise of energy-efficient buildings and appliances, combined with rising sustainability consciousness, drives consistent demand growth, supporting the forecasted 4.37% CAGR during 2025-2033.

Market Segmentation

Material Type Insights:

- Polystyrene: Includes insulation materials made from expanded or extruded polystyrene, widely used for thermal insulation.

- Mineral Wool: Comprises insulation materials made from natural or synthetic minerals, offering fire resistance and thermal properties.

- Glass Wool: Consists of fibrous glass insulation known for thermal resistance and sound absorption.

- Polyurethane: Contains insulation foam materials with high thermal insulation efficiency.

- Calcium Silicate: Includes rigid insulation materials suitable for high-temperature applications.

- Others: Covers additional insulation materials not categorized in above segments.

Function Insights:

- Thermal: Insulation materials designed primarily for reducing heat transfer.

- Acoustic: Materials aimed at soundproofing and noise reduction.

- Electric: Insulation materials providing electrical insulation properties.

- Others: Any other functions not classified above.

Form Insights:

- Blanket: Flexible insulation forms typically used in building applications.

- Foam: Spray or rigid foam insulation materials for thermal resistance.

- Board: Rigid insulation boards utilized in various construction settings.

- Pipe: Insulation designed for piping and tubular systems.

- Others: Other forms of insulation materials not fitting the specified categories.

End Use Industry Insights:

- Non-Residential: Insulation applications in commercial and institutional buildings.

- Residential: Insulation used in homes and apartment buildings.

- Industrial and Plant Equipment: Insulation for industrial machinery and plant equipment.

- HVAC Equipment: Insulation of heating, ventilation, and air conditioning systems.

- Appliances: Insulation used in consumer and industrial appliances.

- Transport Equipment: Insulation in vehicles and transportation infrastructure.

- Others: Additional end use industries employing insulation products.

Regional Insights

The report segments the South Korea insulation market into major regions: Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others. Among these, the Seoul Capital Area is the dominant region driving significant market activity due to its high urbanization and concentration of commercial and residential construction projects. Specific statistics such as regional market share or CAGR are not provided in the source.

Recent Developments & News

In March 2024, South Korea's Ministry of Land, Infrastructure and Transport suspended the national standard for expanded polystyrene (EPS) insulating sandwich panels citing fire safety concerns, highlighting regulatory focus on product safety. Additionally, Hanwha Solutions developed high-purity insulation materials for extra-high voltage (400kV) and submarine cables using proprietary XLPE technology, marking South Korea's first domestic innovation in this segment. These developments demonstrate ongoing technological progress and regulatory changes impacting the market.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness