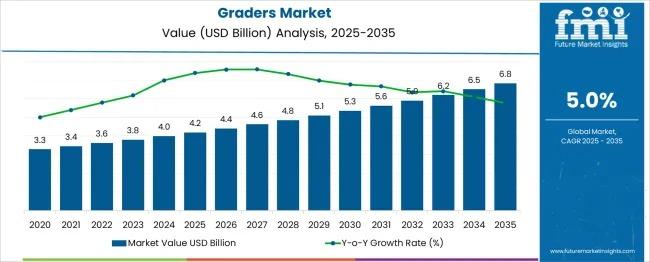

Graders Market to Surpass USD 6.8 billion by 2035

The global Graders Market is entering a decade defined by strong infrastructure expansion, technology integration, and rising demand for precision earthmoving equipment. Valued at USD 4.2 billion in 2025, the market is projected to reach USD 6.8 billion by 2035, expanding at a healthy 5.0% CAGR. This growth underscores the indispensable role graders play in infrastructure modernization, rural connectivity, mining operations, and large-scale construction projects worldwide.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-23500

Between 2025 and 2030, the graders market is expected to grow steadily at a rolling CAGR of nearly 4.0%, supported by road construction, municipal maintenance, and rising replacement demand for aging grader fleets. The latter half of the decade accelerates slightly to an estimated 6.0% CAGR from 2030 to 2035, driven by enhanced government spending on transportation corridors, smart city programs, and mining expansion across emerging economies.

Infrastructure Investments Continue to Propel Global Demand

Governments across Asia, Europe, and North America are prioritizing long-term infrastructure commitments, which include pavement rehabilitation, national highways, mining site preparation, rural development, and large-scale commercial builds. These sectors depend heavily on graders for accurate leveling, contouring, drainage preparation, and final surface finishing.

In fast-urbanizing economies like India and China, rapid roadway development and industrial expansion remain the strongest demand drivers. Meanwhile, developed markets such as the United States, Germany, and France are focusing on upgrading aging transport networks, boosting demand for mid-sized and high-precision graders with integrated automation.

Technology Adoption Enhances Productivity and Operator Efficiency

Automation continues to reshape the graders industry. GPS-enabled graders, telematics, grade-control systems, and operator-assist functions are becoming standard as contractors push for higher accuracy, reduced fuel waste, and minimized rework.

Manufacturers are integrating smart systems capable of analyzing terrain in real time, improving both grading performance and jobsite safety. These innovations reduce operator fatigue and improve project timelines, making next-generation graders a strategic asset for construction firms.

Medium Motor Graders & Articulated Frames Lead the Market

In 2025, medium motor graders represent 47% of market revenue, offering the optimal balance of versatility, operational efficiency, and cost. Their deployment spans municipal maintenance, rural construction, and infrastructure expansion in developing regions.

The articulated frame segment, holding 61% of market share, continues to dominate due to its maneuverability on uneven terrain and superior steering capabilities—making it the preferred choice for mining regions, challenging road environments, and large-scale infrastructure sites.

ICE-Powered Graders Maintain Strong Market Leadership

Internal combustion engine (ICE) graders remain the backbone of the industry, commanding 79% of global market share in 2025. Despite rising interest in electric machinery, ICE graders continue to be essential for remote mining operations, long-duty cycles, and areas where charging infrastructure remains limited. Advancements in fuel efficiency and emissions control further support this segment’s dominance.

Strong Performance Across Key Global Markets

The global competitive landscape is shaped by leaders such as Caterpillar Inc., Komatsu Ltd., CNH Industrial N.V., Deere & Company, and SANY Group. These companies maintain strong market presence through innovation, robust distribution networks, and fleet modernization initiatives.

Country-level growth rates highlight the market's diversity:

- China: 6.8% CAGR – supported by sustained construction megaprojects

- India: 6.3% CAGR – driven by national highway expansion and smart city programs

- Germany: 5.8% CAGR – advanced technology adoption and strict emission standards

- United Kingdom: 4.8% CAGR – urban redevelopment and digital construction practices

- USA: 4.3% CAGR – steady investments in infrastructure rehabilitation

As adoption of GPS and automation expands, rental companies and contractors are increasingly prioritizing digital-ready, low-emission graders to optimize fleet operations.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness