Global Accounts Receivable Automation Market Outlook 2025-2033: Growth Trends, Opportunities, and Forecast Analysis

Market Overview

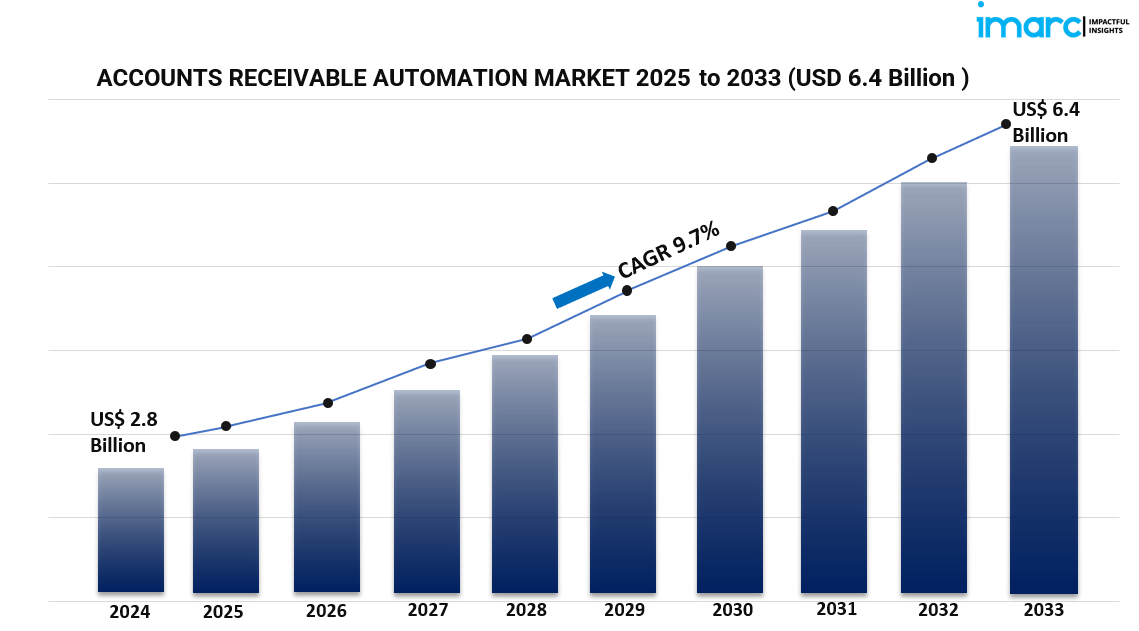

The global Accounts Receivable Automation Market was valued at USD 2.8 Billion in 2024 and is forecast to reach USD 6.4 Billion by 2033. The market is expected to grow at a CAGR of 9.7% during 2025-2033. Growth is driven by demand for streamlined financial processes, enhanced cash flow management, digital transformation, cloud technology advancements, and increasing adoption of AI-powered automation solutions across industries.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Accounts Receivable Automation Market Key Takeaways

• Current Market Size: USD 2.8 Billion in 2024

• CAGR: 9.7% during 2025-2033

• Forecast Period: 2025-2033

• North America dominates the market due to strong digital transformation and regulatory compliance demands.

• Increasing mergers and collaborations among key players drive market expansion.

• Growing usage of online banking apps and acceptance among SMEs boosts market growth.

• Rising adoption of cloud-based and AI-powered solutions enhances operational efficiency and error reduction.

• BFSI vertical leads the market owing to complex financial operations and high transaction volumes.

Request for sample copy of this report: https://www.imarcgroup.com/accounts-receivable-automation-market/requestsample

Market Growth Factors

The market is primarily driven by the rising need for streamlined financial processes and improved cash flow management. Organizations adopt accounts receivable automation to reduce manual errors, accelerate payment cycles, and optimize working capital. These systems enable faster invoice processing, improved tracking, and enhanced visibility across financial workflows.

Advancements in digital transformation—especially through cloud computing and artificial intelligence—further propel demand. Cloud-based systems offer scalability and remote accessibility, making them appealing to enterprises of all sizes. AI integration enhances forecasting accuracy, credit risk assessment, and predictive analytics, enabling smarter financial decision-making.

Growing concerns about regulatory compliance and fraud risk mitigation encourage companies to invest in automated systems. Additionally, increasing partnerships and mergers among major vendors and expanding online banking applications contribute significantly to market expansion.

Market Segmentation

By Component:

• Solution

• Services

By Deployment:

• On-premises

• Cloud-based

By Organization Size:

• Large Enterprises

• Small and Medium-sized Enterprises

By Vertical:

• Consumer Goods and Retail

• BFSI

• Manufacturing

• IT and Telecom

• Healthcare

• Energy and Utilities

• Others

By Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America dominates the market due to stringent regulatory compliance requirements and high adoption of advanced financial technologies. The region’s robust digital infrastructure supports rapid uptake of cloud and AI-powered systems. The U.S. leads with strong cloud adoption among SMEs and increased use of AI for predictive payment collection, further driving regional growth.

Recent Developments & News

• August 2024: Flywire acquired Invoiced to expand its global B2B payment network by integrating a leading SaaS platform for accounts receivable.

• July 2024: U.S. Bank launched an accounts receivable platform to accelerate cash flow, reduce costs, and improve payment experiences.

• April 2024: HighRadius introduced a GenAI-powered Accounts Payable Automation solution featuring Supplier Connect.

• March 2024: Celonis launched the Sailfin Accounts Receivable app suite in partnership with Sailfin Technologies.

• January 2024: Nuvei integrated payments and accounts receivable automation into Microsoft Dynamics 365 Business Central.

Key Players

• BlackLine Inc.

• Bottomline Technologies Inc.

• Comarch SA

• Esker SA

• HighRadius Corporation

• Invoiced Inc.

• Oracle Corporation

• Sage Group plc

• SAP SE

• ScienceSoft USA Corporation

• VersaPay Corporation

• Yaypay Inc. (Quadient)

• Zoho Corporation Private Ltd.

Request for customization of this report: https://www.imarcgroup.com/request?type=report&id=5084&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness