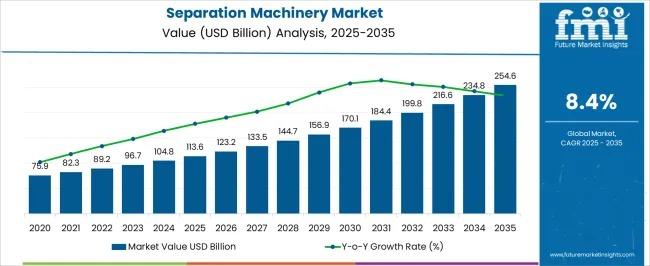

Separation Machinery Market to Surpass USD 254.6 billion by 2035

The global Separation Machinery Market is entering a high-growth decade, with projections indicating a rise from USD 113.6 billion in 2025 to USD 254.6 billion by 2035, according to recent industry analysis. The market, which expanded from USD 75.9 billion in 2020, is benefiting from rapid advances in automation, rising environmental regulations, and surging demand across chemical processing, food & beverage, pharmaceuticals, and water treatment ecosystems.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23761

Growth during 2020–2025 reflects consistent industrial expansion, with market value rising annually from USD 82.3 billion in 2021 to USD 96.7 billion in 2023. This steady trajectory highlights industries’ increasing preference for high-performance, energy-efficient separation technologies capable of enhancing throughput, ensuring purity, and reducing operational downtime.

Market to Accelerate Faster from 2026 with Digital Integration and Environmental Compliance

Between 2026 and 2030, the market is forecast to jump from USD 113.6 billion to USD 156.9 billion, driven by the integration of automation, predictive maintenance, and digital monitoring systems. As emerging economies expand industrial infrastructure, modular and scalable separation systems are becoming critical for managing large-volume processing with precision.

From 2031 to 2035, global demand intensifies, pushing the market to USD 254.6 billion, fueled by stricter environmental compliance, increased investments in wastewater treatment, and growth in biopharmaceutical and biotechnology production requiring ultra-high-purity separation.

Leading Segments: Industrial Centrifuges & Industrial Processing Hold Dominant Shares

Industrial centrifuges—projected to represent 27.4% of 2025 market revenue—lead the product landscape. Their ability to manage high volumes, diverse feedstock, and continuous operation positions them as a preferred choice for petrochemical, pharmaceutical, and food industries. Innovations in vibration control, energy recovery, and contamination-free operation further strengthen demand.

The industrial processing segment is set to capture 31.8% of the 2025 market, supported by requirements for consistent separation performance, fluid stability, and compliance with increasingly stringent global quality standards.

In speed-based segmentation, medium-speed machinery (1000–5000 RPM) leads with 39.5% share in 2025, offering optimal balance of throughput, efficiency, and suitability for sensitive compounds.

Why the Market is Growing: Key Drivers & Trends

- Automation and Smart Technologies

Real-time monitoring, IoT-enabled equipment, and predictive maintenance capabilities are reshaping industrial separation, reducing downtime and improving system longevity. - Environmental Regulations

Stricter wastewater management, emissions control, and waste reduction norms across Europe, North America, and APAC are driving adoption of advanced filtration, membrane, and centrifuge solutions. - Expansion in High-Growth Sectors

Biotechnology, pharmaceuticals, renewable energy, and advanced materials processing require precision separation for purity, safety, and compliance—fueling sustained investment. - Modular & Scalable Designs

Industries across Asia-Pacific and the Middle East are adopting plug-and-play systems that support capacity expansions and flexible operations.

Country-Level Growth Highlights

China (CAGR: 11.3%)

Accelerated by massive industrialization, water treatment investments, and high-volume manufacturing demand.

India (CAGR: 10.5%)

Growth driven by infrastructure upgrades, food and pharma expansion, and government investment in sustainable technologies.

Germany (CAGR: 9.7%)

High adoption of filtration and membrane technologies due to strict environmental laws and advanced industrial capabilities.

USA (CAGR: 7.1%)

Steady demand from oil & gas, food processing, and pharmaceuticals, supported by rising focus on energy efficiency.

Competitive Landscape

The market features strong participation from Alfa Laval, GEA Group, ANDRITZ, CECO Environmental, Rotex, SWECO, Mitsubishi Kakoki Kaisha, Parkson Corporation, and Russell Finex. Strategies include automation integration, performance optimization, cost-efficient customizations, and sustainability-focused system design.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness