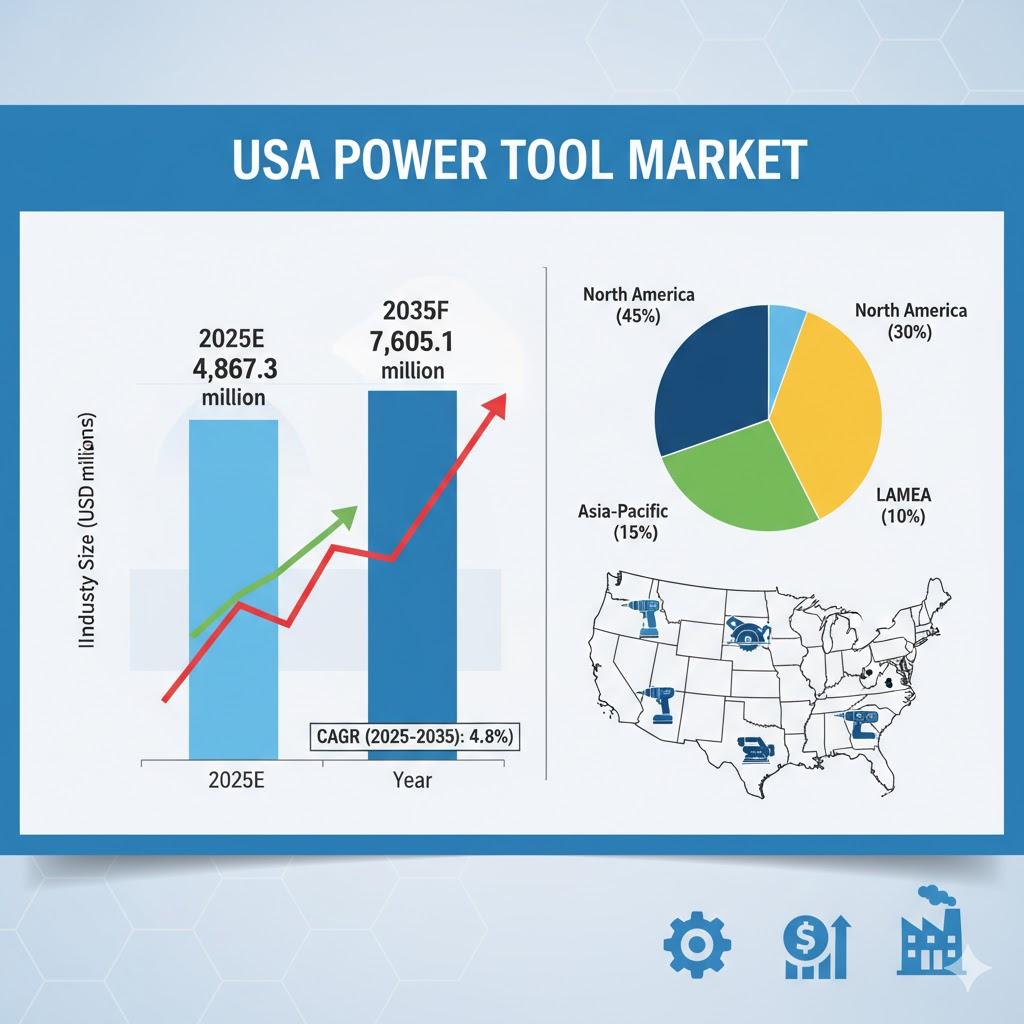

USA Power Tool Market to Surpass USD 7,605.1 million by 2035

The USA Power Tool Market is entering a decade of accelerated growth, supported by sustained construction activity, increased industrial automation, and a rising shift toward cordless solutions. According to recent industry estimates, the market valued at USD 4,867.3 million in 2025 is projected to reach USD 7,605.1 million by 2035, expanding at a 4.8% CAGR. Growth drivers include lithium-ion battery innovation, heightened demand for ergonomic tools, and the widespread adoption of advanced IoT-enabled power solutions across professional and consumer applications.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-21688

A strong uptick in prefabrication, modular construction, and automation is reshaping the operational environment for both contractors and manufacturers. Brushless motor technology, known for longer life cycles and superior energy efficiency, is becoming standard in heavy-duty sectors, including automotive, aerospace, and industrial manufacturing. Meanwhile, DIY culture and the home renovation boom continue to strengthen the consumer segment, expanding the market’s demographic reach.

Growth Drivers: Cordless Innovation, Smart Tools & Infrastructure Spending

Cordless power tools remain the fastest-growing product category, fueled by advancements in lithium-ion battery chemistry that deliver longer runtimes, rapid charging, and improved safety. Smart power tools—equipped with IoT, Bluetooth monitoring, and AI-based diagnostics—are rapidly gaining traction for asset management, predictive maintenance, and operator safety functions.

Massive investments in national infrastructure—including highways, bridges, renewable energy installations, and urban development—continue to be a cornerstone of market expansion. These projects require high-performance drills, impact wrenches, grinders, and cutting tools capable of meeting demanding jobsite conditions.

Industrial sectors including metal fabrication, automotive assembly, and equipment repair rely heavily on durable, precision-oriented power tools to streamline operational efficiency. Rising reshoring efforts and smart factory adoption are creating new long-term opportunities for manufacturers offering high-accuracy, connected tools.

Regional Outlook: Momentum Across Key U.S. Regions

Northeast USA

Driven by booming commercial real estate, home renovation, and urban infrastructure projects. Major cities like New York, Philadelphia, and Boston accelerate demand for cordless tools suited for dense construction environments.

Southeast USA

Cities such as Atlanta, Charlotte, and Miami are powering growth through year-round construction activity. The automotive manufacturing presence in Alabama and South Carolina further supports demand for precision tools.

Midwest USA

Michigan, Ohio, and Illinois form a powerhouse manufacturing cluster. Automotive assembly lines and agricultural equipment maintenance play a major role, while residential development supports consumer tool demand.

Southwest USA

Texas, Arizona, and New Mexico benefit from high levels of commercial construction, industrial expansion, and major oil & gas operations requiring durable and explosion-proof tools.

West USA

California, Washington, and Oregon lead innovation-driven demand for energy-efficient and environmentally compliant tools, particularly in technology, aerospace, and seismic retrofitting projects.

Market Challenges and Opportunities

Challenges:

- High costs associated with advanced cordless and smart tools

- Compliance with stringent OSHA and environmental regulations

- Competition from lower-priced imports

- High R&D expenditure for battery technology and sustainability mandates

Opportunities:

- Rapid expansion of cordless power tools

- Rising adoption of IoT-enabled smart tools

- Government-funded infrastructure upgrades

- Growth in EV-related manufacturing and precision tool requirements

- Surge in DIY home improvement and residential renovation

State-Level Insights (CAGR 2025–2035)

- Texas: 5.4%

- Florida: 5.1%

- California: 5.0%

- Illinois: 4.5%

- Pennsylvania: 4.3%

These state markets reflect a combination of population growth, industrial diversification, infrastructure upgrades, and strong demand from construction professionals and homeowners alike.

Key Segment Performance

- Drilling tools continue to dominate due to their versatility across professional and consumer applications.

- Impact wrenches are seeing rapid adoption within automotive, industrial, and metal fabrication sectors.

- Construction remains the largest end-use segment, supported by federal infrastructure spending.

- Manufacturing demand is strengthened by automation, robotics, and the need for high-precision tools in assembly processes.

Competitive Landscape

Major players such as Stanley Black & Decker, Bosch, Makita, Milwaukee Tool, and Hilti continue to lead through R&D investments in cordless platforms, higher-capacity batteries, and ergonomically advanced designs. The rapid rise of e-commerce and D2C channels is reshaping distribution, while private-label and value brands intensify competitive pricing.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness