Italy Family Offices Market Size & Trends Forecast 2025-2033

Market Overview

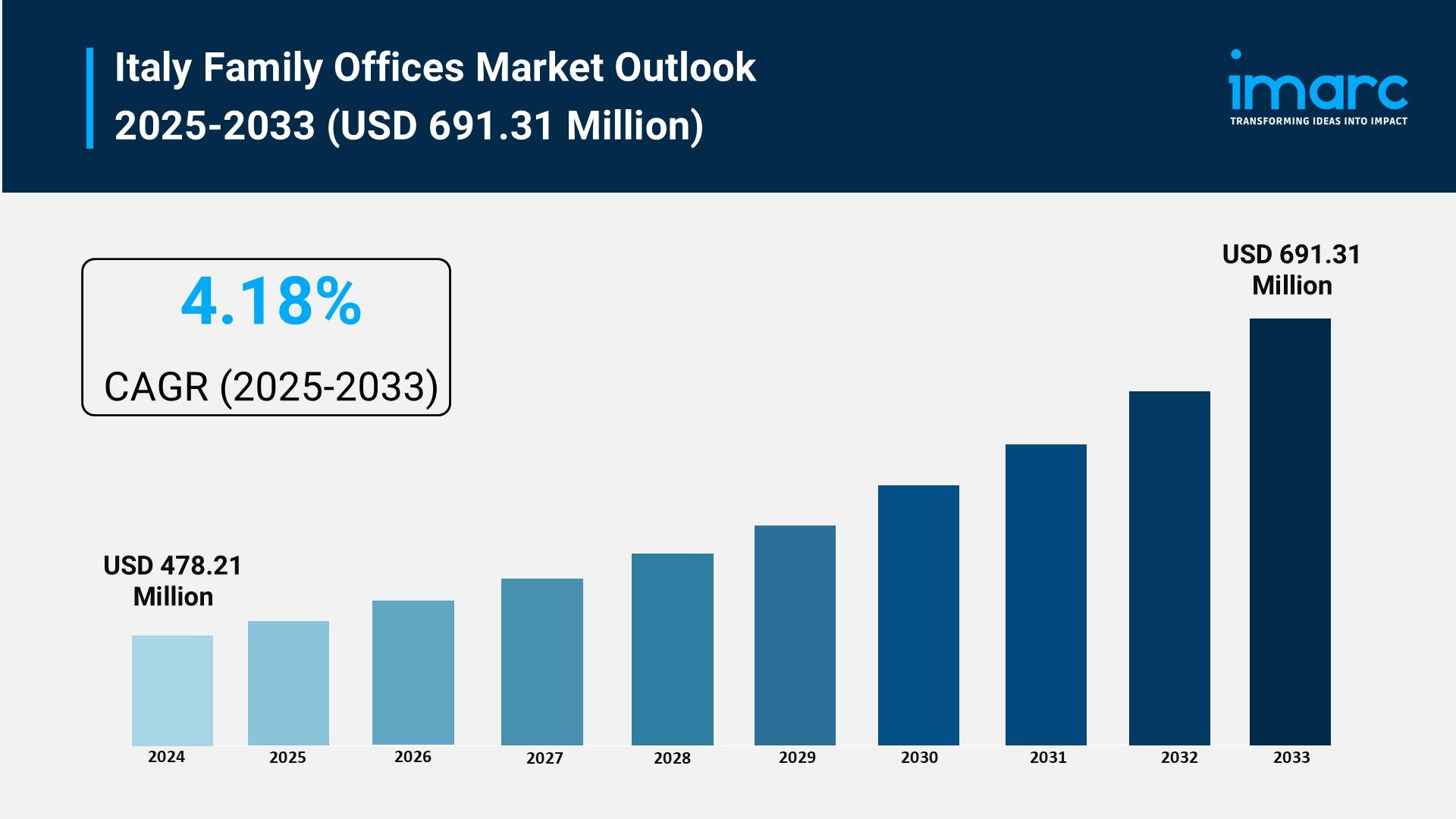

The Italy Family Offices Market size reached a size of USD 478.21 Million in 2024. It is expected to expand to USD 691.31 Million by 2033, growing steadily driven by advanced wealth management systems custom-tailored to high-net-worth individuals. The forecast period spans from 2025 to 2033, during which the market grows at a CAGR of 4.18%. Emphasis on sustainability, intergenerational wealth transfer, and governance underpins the sector's evolution, alongside increasing technology adoption and portfolio diversification supporting resilience.

How AI is Reshaping the Future of Italy Family Offices Market

- AI-driven portfolio management tools optimize asset allocation by analyzing complex data sets to support diversified investments like private equity, real estate, and infrastructure.

- Advanced AI systems enhance risk assessment and compliance monitoring, helping family offices meet regulatory demands while maintaining bespoke wealth management strategies.

- AI automation boosts operational efficiencies across governance, succession planning, and reporting, smoothing intergenerational wealth transfers.

- Machine learning models support impact investing by quantifying Environmental, Social, and Governance (ESG) outcomes, reinforcing sustainability integration in investment decisions.

- AI-enabled predictive analytics assist Italian family offices in identifying emerging market opportunities aligned with Italy’s economic strengths, such as luxury property and innovative mid-market enterprises.

- Collaboration between AI platforms and dedicated wealth management units, exemplified by firms like Mediobanca Premier, improves advisory capabilities tailored to wealthy families.

Grab a sample PDF of this report: https://www.imarcgroup.com/italy-family-offices-market/requestsample

Market Growth Factors

The Italy family offices market is significantly influenced by the increasing interest in alternatives such as private equity, real estate, and infrastructure assets. These investments help family offices insulate wealth from market volatility while capitalizing on sectors where Italy exhibits economic strengths, including luxury and heritage property segments and mid-market enterprises. The integration of sustainability-linked initiatives balances financial returns with societal impact, indicative of Italian family offices’ adaptive asset allocation to enhance resilience and facilitate multigenerational wealth transfer.

A core growth factor is the focus on intergenerational wealth transfer, which is paramount in Italy due to its rich tradition of business and cultural heritage. Family offices serve as institutional frameworks to ensure governance, preserving family values alongside financial capital. Customized estate planning, trusts, and involvement of younger generations—including interest in digital assets and impact investing—reflect evolving stewardship models. This formal governance focus helps protect assets and fosters stakeholder cohesiveness, underscoring one of the market’s pivotal trends for continuity.

The integration of Environmental, Social, and Governance (ESG) principles into investment strategies is a key driver. Italian family offices increasingly invest in green infrastructure, renewable energy, and socially responsible ventures, aligning their portfolios with global shifts towards sustainability. This trend is uniquely sensitive to Italy’s cultural and environmental context, emphasizing social responsibility and cultural preservation. Impact investing not only shapes wealth management practices but also transforms family legacies to demonstrate measurable social and environmental results.

Market Segmentation

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- January 2025: Mediobanca launched Mediobanca Premier, a specialized wealth management unit dedicated to serving wealthy Italian families. This initiative, part of their "One Brand–One Culture" strategy, enhances advisory services in response to increasing demand for organized wealth management solutions.

- March 2025: Italy’s government collaborated with financial education institutions to promote sustainability awareness among family offices. This partnership fosters increased ESG investments, aligning wealth management with Italy's environmental and cultural priorities.

- August 2025: Industry reports indicated notable growth in family office establishments in the luxury and heritage real estate sectors, reflecting expanding diversification toward alternative assets and long-term value creation in Italian wealth portfolios.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness