Smart Hospitals Market Size, Share, Growth, Trends and Forecast 2025-2033

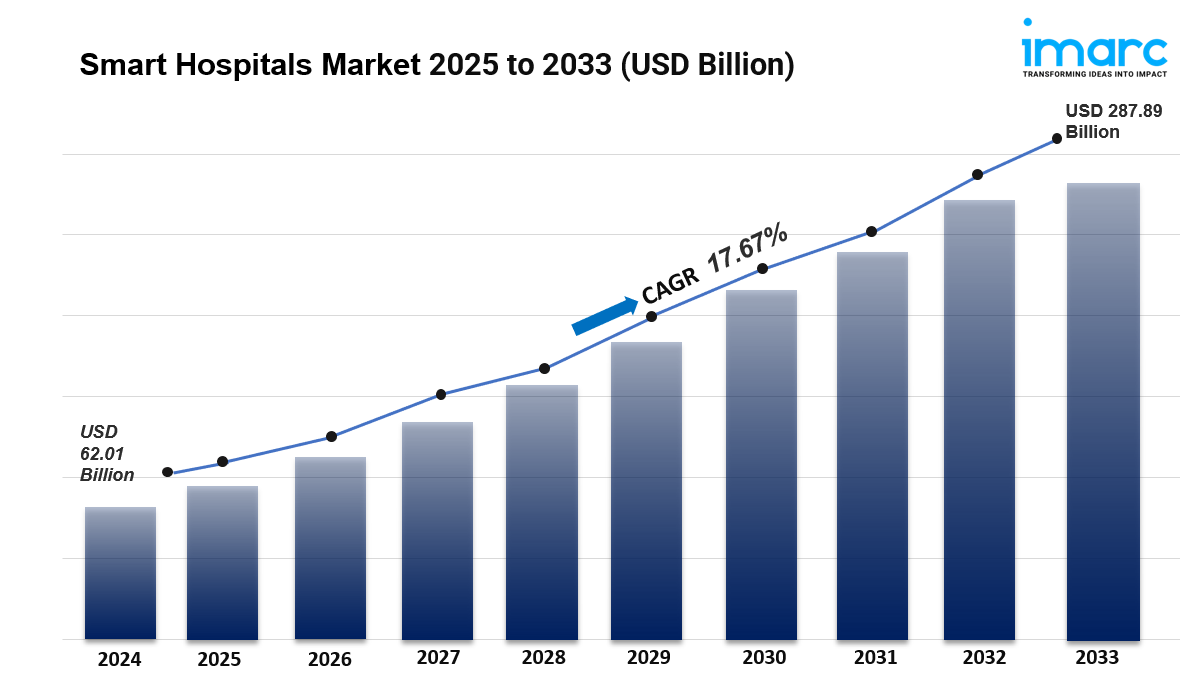

The global smart hospitals market size was valued at USD 62.01 Billion in 2024 and is projected to reach USD 287.89 Billion by 2033, growing at a CAGR of 17.67% during the forecast period of 2025-2033. North America is the leading region, accounting for around 35.8% of the market in 2024. Growth is driven by the rising adoption of AI, IoT, telemedicine, and big data analytics, along with government initiatives spurring digital transformation in healthcare.

The global Smart Hospitals Market Trends is expanding rapidly as healthcare systems adopt advanced digital technologies to enhance efficiency, patient care, and operational accuracy. Key drivers include the growing integration of IoT devices, AI-powered diagnostics, electronic health records, and automated workflows. Rising demand for remote monitoring, telemedicine, and data-driven decision-making further strengthens the overall Smart Hospitals Market Size. Additionally, increasing investments in healthcare infrastructure modernization and the shift toward personalized, connected care environments are accelerating market growth worldwide.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Smart Hospitals Market Key Takeaways

- Current Market Size (2024): USD 62.01 Billion

- CAGR (2025-2033): 17.67%

- Forecast Period: 2025-2033

- North America dominates with over 35.8% market share in 2024.

- Increasing demand for telehealth and remote patient monitoring fuels market expansion.

- Advancements in AI, IoT, cloud computing, and big data analytics enhance healthcare delivery.

- Government investments and policies promote digital healthcare and smart hospital adoption.

- Focus on patient-centric care and healthcare efficiency is transforming service models.

Request a Sample Report: https://www.imarcgroup.com/smart-hospitals-market/requestsample

Market Growth Factors

The smart hospitals market is propelled by rapid technological advancements such as IoT devices, telehealth systems, electronic health records (EHR), and AI analytics, which collectively transform healthcare delivery by improving diagnostic precision and treatment effectiveness. The surge in telehealth visits among Medicaid (28.3%), Medicare (26.8%), and low-income groups (26.4%) underscores this trend. These digital health solutions enable efficient and proactive patient care, encouraging widespread market adoption.

Growing demand for remote patient monitoring and telehealth services significantly drives market growth. In 2024, the remote patient monitoring market size was approximately USD 1.7 Billion. The COVID-19 pandemic accelerated the need for remote healthcare access, boosting telehealth solutions' demand. Smart hospitals incorporate wearable devices for continuous vital sign monitoring and virtual consultation platforms, reducing physical visits and hospital stays, thus lowering costs and increasing patient convenience.

Government initiatives worldwide are catalyzing smart hospital adoption by fostering digital transformation ecosystems through large funding, regulatory incentives, and public-private partnerships. Investments in R&D focus on innovations like robotic surgeries and AI-based diagnostics. Grants and subsidies facilitate small healthcare providers' tech adoption, and national programs support telemedicine and IoT integration. These policies reinforce healthcare digitalization and infrastructure modernization, sustaining long-term market growth.

Market Segmentation

Analysis by Component:

- Hardware

- Stationary Medical Devices

- Implanted Medical Devices

- Wearable External Medical Devices

- Others

- Software

- Services

- Professional Services

- Managed Services

Services encompass installation, system integration, maintenance, cloud management, cybersecurity, data analytics, and consulting. They enable technology adoption, workflow redesign, and optimize investments in smart hospital infrastructures, ensuring sustainability and operational efficiency.

Analysis by Product:

- mHealth

- Telemedicine

- Smart Pills

- Electronic Health Record

- Others

Telemedicine is the largest segment in 2024, with approximately 35.8% market share. It revolutionizes care delivery by providing remote access, reducing hospital load and operational costs, and increasing feasibility thanks to faster internet and mobile connectivity. It supports chronic disease management and post-discharge follow-ups.

Analysis by Service Offered:

- General Services

- Specialty

- Super Specialty

General services dominate due to their broad applicability, including cleaning, catering, security, and administrative support, all evolving with automation and data analytics for enhanced efficiency, safety, and patient satisfaction.

Analysis by Connectivity:

- Wireless

- Wi-Fi

- Radio Frequency Identification (RFID)

- Bluetooth

- Zigbee

- Near Field Communication (NFC)

- Others

- Wired

Wireless connectivity leads due to flexibility, scalability, and support for various devices, enabling seamless real-time communication and data exchange. Advanced wireless technologies like Wi-Fi 6 and 5G facilitate remote surgeries, diagnostics, and large-scale data processing necessary for smart hospital operations.

Analysis by Technology:

- Artificial Intelligence

- Internet of Things

- Cloud Computing

- Big Data

- Others

AI enhances diagnostics and predictive analytics, improving treatment personalization and reducing errors. IoT ensures real-time patient monitoring and operational automation. Cloud computing provides scalable and secure data management, supporting integration and disaster recovery. Big data analytics offers actionable insights, optimizing resource use and care delivery.

Analysis by Application:

- Remote Medicine Management

- Electronic Health Record & Clinical Workflow

- Outpatient Vigilance

- Medical Connected Imaging

- Medical Assistance

- Others

Electronic Health Record (EHR) and Clinical Workflow solutions form the largest application segment (approx. 19.2% in 2024). EHR consolidates patient data for immediate access, minimizing errors and enhancing care efficiency. Integration with advanced technologies enables predictive insights and regulatory compliance, supporting continuity of care through interoperability.

Regional Insights

North America is the dominant region with approximately 35.8% market share in 2024. The region benefits from advanced healthcare infrastructure, significant investment in healthcare IT, and government initiatives promoting digitization and interoperability. This supports the adoption of smart hospital solutions that improve patient outcomes, operational efficiency, and affordable care models.

Recent Developments & News

- December 2024: Indian Medical Association launched the "IMA AMR Smart Hospital" certification to address antimicrobial resistance, certifying four hospitals.

- November 2024: Alliance for Smart Healthcare Excellence introduced the Smart Hospital Maturity Model (SHMM), assessing readiness of over 170 hospitals.

- November 2024: Sancheti Advanced Orthocare Hospital, Pune, launched India's first AI-powered "Smart Ward" using Dozee's Remote Monitoring and Early Warning System.

- October 2024: South Korea's Ministry of Health announced AI-driven emergency projects under ARPA-H, including regional patient transfers with $830 million funding.

- April 2024: GE HealthCare, LG Electronics, and Microsoft Korea signed an MOU to develop smart hospitals using AI and cloud technologies.

- April 2024: Healthgrate initiated smart hospital launches across India to address overcrowding.

Key Players

- Adheretech Inc.

- Capsule Technologies, Inc. (Francisco Partners)

- Cerner Corporation

- GE Healthcare Inc. (General Electric Company)

- Intel Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- Medtronic, Inc. (Medtronic Public Limited Company)

- Microsoft Corporation

- SAP SE

- Siemens Healthineers AG (Siemens Aktiengesellschaft)

- STANLEY Healthcare (Stanley Black & Decker Inc.)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3965&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness