Italy Steel Tubes Market Report, Share, Trends & Analysis 2025-2033

Market Overview

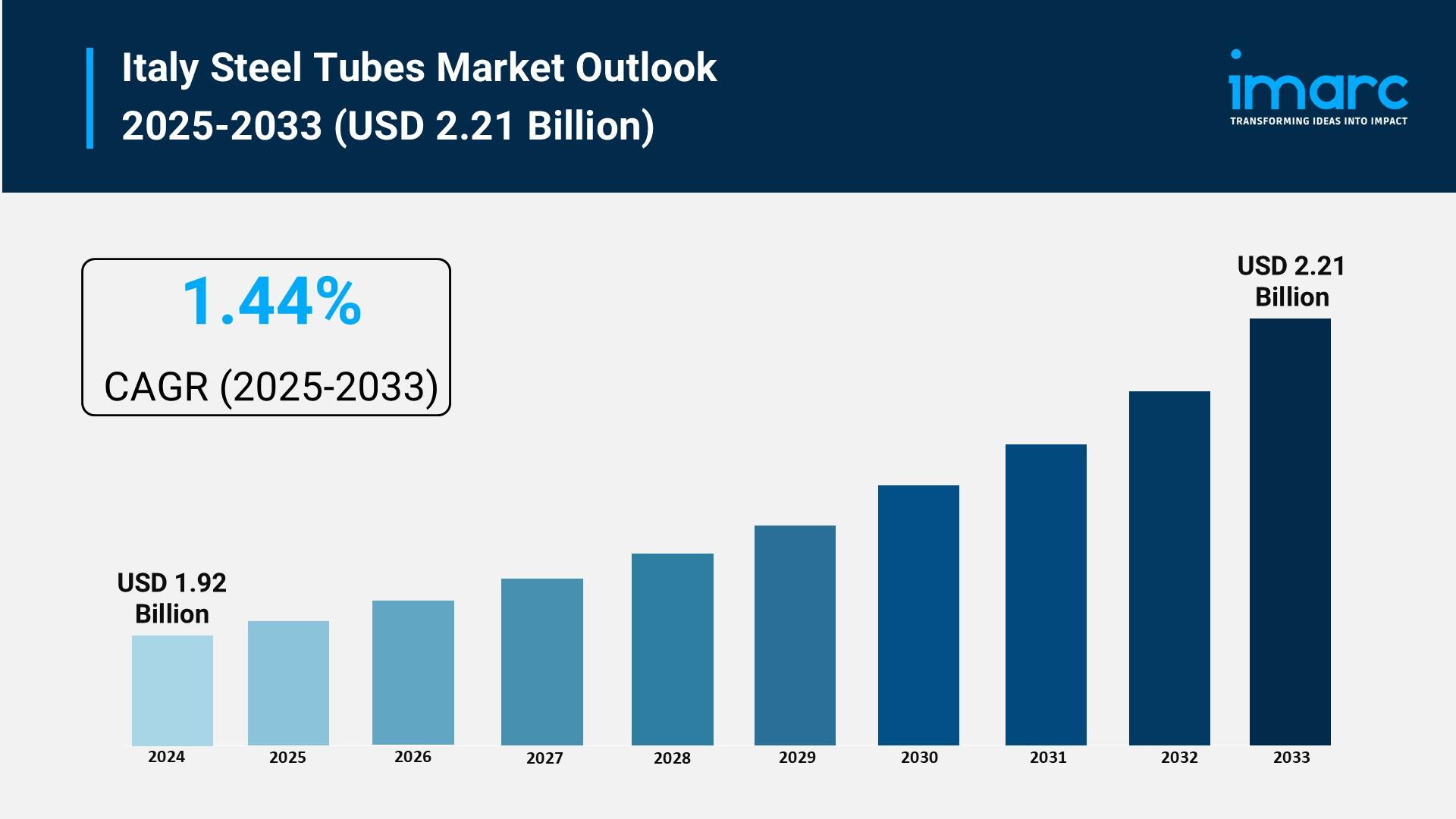

The Italy steel tubes market size was valued at USD 1.92 Billion in 2024 and is projected to reach USD 2.21 Billion by 2033. This growth, at a rate of 1.44% during 2025-2033, is driven by rising demand in construction, automotive, and energy sectors. Advancements in steel processing and emphasis on green infrastructure are shaping industry trends. Domestic production and export opportunities enhance market resilience, alongside strategic product diversification and partnerships.

How AI is Reshaping the Future of Italy Steel Tubes Market:

- AI-powered predictive analytics are enhancing supply chain optimization, leading to reduced lead times and improved inventory management in the steel tubes industry.

- Advanced AI-driven manufacturing processes enable higher precision and quality control, supporting compliance with stringent EU climate directives.

- AI integration facilitates sustainability by optimizing energy consumption and lowering emissions during steel tube production, aligning with Italy's green building policies.

- Machine learning algorithms help analyze market trends and customer preferences, aiding companies in tailoring product diversification and strategic partnerships.

- Automation and AI-based inspection technologies reduce production defects and enhance the reliability of seamless and welded steel tubes.

- Companies like Marcegaglia UK and Cogne Acciai Speciali are innovating their production lines, incorporating technologies that could include AI for enhanced operational efficiency.

Grab a sample PDF of this report: https://www.imarcgroup.com/italy-steel-tubes-market/requestsample

Market Growth Factors

One major driver of the Italy steel tubes market is the infrastructure renewal and production momentum, highlighted by a reported increase in Italy's crude steel production in early 2025. This recovery underpins the growing demand for steel tubes in energy transport, water systems, and urban development projects. Modernization efforts within regional recovery plans have led to consistent demand for tubes with specific structural and performance standards. Local producers benefit from stable domestic supply chains, reducing dependency on imports and logistical delays. This alignment between public investment and domestic production capacity fosters short-term market confidence, emphasizing supply consistency and lead time alongside pricing considerations.

The acceleration of the green transition is also propelling tube demand. Italy’s national steel industry's strong monthly output in April 2025 corresponds with increased construction and energy sector activities, driven by green building policies and clean energy goals. Environmental compliance is shaping procurement decisions, with manufacturers receiving more orders for products used in solar setups, energy-efficient buildings, and modular construction. Producers adapt processes to satisfy stricter emission and traceability standards, making domestically made tubes more attractive. This integration of sustainability into manufacturing and procurement is reshaping the market towards cleaner, responsive production aligned with EU climate directives.

Trade policy and regional supply dynamics also significantly impact the market. In mid-2024, EU safeguard measures extension affected the availability of crucial inputs like hot-rolled coils, essential for tube manufacturing. This regulatory environment limits access to non-European volumes, compelling manufacturers to rely more on regional sources. Consequently, lead times are adjusted, and supply chain strategies are restructured, influencing construction schedules, export logistics, and pricing visibility. While these measures protect EU producers, they introduce supply chain friction requiring careful navigation, stimulating innovation in sourcing and operational planning within the steel tubes sector.

Market Segmentation

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Development & News

- January 2025: Marcegaglia UK expanded its Oldbury facility by introducing electro-welded stainless-steel tubes, enhancing their product portfolio with grade 304 stainless steel compliant with EN10296-2 and ASTM A544 standards. This expansion supports diverse industrial needs across the UK and Europe and reinforces the group's commitment to quality and responsiveness.

- April 2025: Italy’s national steel industry reported its strongest output since the start of the year, reflecting renewed momentum in construction and energy sectors driven by green building policies and clean energy targets. This surge is supporting increased procurement of environmentally compliant steel tubes.

- November 2024: Cogne Acciai Speciali completed the acquisition of Germany’s Mannesmann Stainless Tubes, advancing its seamless tube production and vertical integration. This strategic move strengthens Cogne’s industrial capabilities and international presence, rebranding the acquired business as DMV.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness